Traders make their bones speculating on price action and relying on their ability to execute good fills in a timely manner. Trading requires the prudent interpretation of price history to anticipate where prices can go from here and what to do when they get there. Successfully navigating both liquidity and volatility is key to reaching one’s trading goals. Volatility originates from the heavy demand either from buyers or sellers. Liquidity is the supply of shares available during the periods of demand on either side.

Day Trading Goals

A trader without goals is like a boat without a rudder. Day trading is arguably risk-averse by nature since positions are closed out quickly and not taken overnight. The goals of day trading are centered around the constant mitigation of risk. Risk is composed of two key components, the size of positions and the holding time. Prudently adjusting these two components is key to successful risk management. Larger sizes should be inversely proportionate with smaller holding times and vice versa smaller size positions can have longer holding times.

The ultimate goal is zero risk which equates to zero shares or closing out all positions. This is especially important during lulls and periods of noise. Don’t get stuck in boring positions and periods of uncertainty, only strike when volatility starts to emerge. When in doubt, get or stay out. Liquidity enables you to enter and exit positions quickly and economically without having to chase. Volatility allows for quicker and larger price action moves and to allow for profit opportunities.

Let’s take a closer look.

The Importance of Liquidity

Liquidity refers to the available supply of shares at the moment. A stock that is “thin” means it has thin liquidity or is considered to be illiquid. This means any surge or buying or selling can see bids and asks scatter forcing traders to chase entries and exits. A stock that has “thick” liquidity allows for easier entry and exits due to the abundant supply of available shares. Stocks with thicker liquidity tend to have less volatility due to the availability of shares to meet the demand from both buyers and sellers. Thicker liquidity stocks are easier to enter and exit economically. Beginning traders should always start with the thick liquidity stocks.

How to Determine if a Stock is Liquid or Illiquid

Liquidity can be gauged initially by the bid/ask spreads. A liquid stock is a ‘thick’ (thickly) trading stock. An illiquid stock refers to a ‘thin’ (thinly) traded stock. Illiquid stocks have a lot of slippage due to the wider spreads. Thicker stocks have tighter spreads down to 0.01 (one-penny) between the bid and ask most of the times (IE: 25.38 x 25.39). Liquidity can be measured also by the average daily volume of a stock and the bid/ask spreads. As stock prices get more expensive, they tend to become thinner. A stock that trades above $100 per share trades much thinner than a stock that trades at $25 per share. This is not to say all high-priced stocks are thin, but they tend to have thinner liquidity in general as shares rise in price. Logically, when prices move higher, the urge to sell drops and demand rises.

Why Liquidity Matters

Any fund manager will admit that liquidity overrides price. Despite what the paper value of a one-million share position may reflect, actually selling those shares would make a material impact on the share prices. For example, a one-million share position at $25 on a thin stock may take weeks to sell without making too much of a material impact not just from the inability of the market to absorb the shares but also trying to mask the transparency of the intent to sell.

If traders get wind of a large seller, they will naturally step in front trying to short-sell which will further sell off the shares. Therefore a $25 million position held may actually be a $22 position after closing out, due to the inevitable market impact. A thicker liquidity stock may only drop the average selling price to $24.50 due to the massive supply of buyers. Large volume also indicates thicker liquidity especially if it’s a multiple of the average daily trading volume. Bottom line, liquidity enables you to quickly and efficiency enter and exit positions without chasing or making a market impact.

The Importance of Volatility

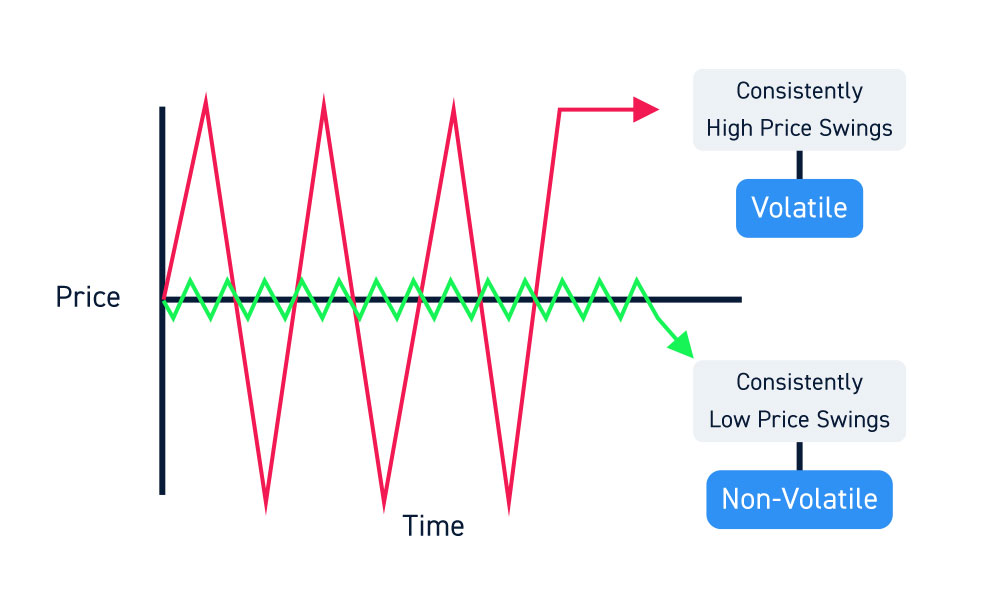

Volatility is a gauge of the range and velocity of price action. High volatility refers to stocks experience large and fast price swings. Low volatility refers to stocks moving within a small or tight price range with muted price moves. Day trading is the game of speculating on price action. Traders naturally migrate to higher volatility stocks since they tend to have more participants, more volume and more opportunities to capitalize on the price fluctuations.

How to Determine if a Stock is Volatile

Volatile stocks have wide price swings relative to their price. Stocks can have high volatility days due to news, earnings or rumors on any given day. In general, stocks that have wide intra day price ranges are deemed volatile. This is not necessarily something determined just by the percentage alone, but actual dollar price moves. For example, a $300 stock may have just a 4% average trading range (ATR) but that’s a daily price range swing of $12, which makes it volatile for traders.

Why Volatility Matters

Volatility is synonymous with price range and the velocity of price moves. Volatility prices the opportunity to capitalize on price action. The larger a price range is, the more opportunity there is to scalp out profits.

Of course, volatility is a double-edged sword since there are also more opportunities to lose money as well if the trader is not trading with a solid game plan and methodology. Profit potential is larger and more frequent with higher volatility. Every day there are lists of morning price gappers and dumpers, which is a good starting point to find potentially high volatility stocks to trade. The highest volatility stocks will usually have double or even triple digit price swings for the day. These are also the most dangerous stocks to trade and only seasoned pros should attempt them. Newbies should stick to stocks they are familiar with and work on consistency before raising the bar with higher volatility stocks.

Volatility Risks

To reemphasize the point, volatility is a double-edged sword. While quick profits are appealing to any day trader, the losses can materialize even faster. Volatility amplifies gains and losses. Therefore, if you can’t trade medium volatility stocks, you can get smoked hard on high volatility stocks.

Speed is the factor that can crush unprepared traders. The wins and losses move at warp speed and requires planning many steps ahead to be prepared to take prudent action in anticipation of a move. Newbies can be shocked and stumble right into the “deer in the headlights” freeze where they short circuit due to the sheer velocity of the losses turning them into bag holders and hopers. Don’t let this happen to you.

Always start with the low volatility stocks and gradually move up within your comfort zone. When price action is accelerated, it makes traders more emotional with feelings ranging from exhilaration to anger to depression and nausea from turning profits into deep losses as they freeze up. Slippage and bad fills are the norm with high volatility stocks so it’s crucial to factor these in and mitigate the risk with smaller size positions. Balancing different types of volatility in your day trading helps to contrast the volatility so you can train to make adjustments and stay aware of the risks.