Every trader knows that losses are part of the game. However, there are good losses and bad losses. It’s easy to have a case of Schadenfreude whenever taking a stop loss. If the stock collapses much lower after you stop out, you feel better. If the stock immediately rallies higher after you stop out, you’re kicking yourself. Sound familiar? It should, because that’s how the Mr. Market wants you to react. Don’t fall for it.

Losses in Trading

Losses are part of trading. To buffer the psychological pain and stress that accompanies losses, a new mindset must be adopted.

Trading is a business and every business has expenses that must be taken out of the revenues to derive a profit. Consider losses as a business expense.

You can’t operate a business without expenses. Naturally, you want to minimize those expenses to grow larger profits, but expenses are inevitable in any business. The best traders learn from losses, levering that experience to make them “wiser” for the next time a similar situation develops. This is how losses become learning opportunities to improve your skill set moving forward.

Good Losses vs. Bad Losses

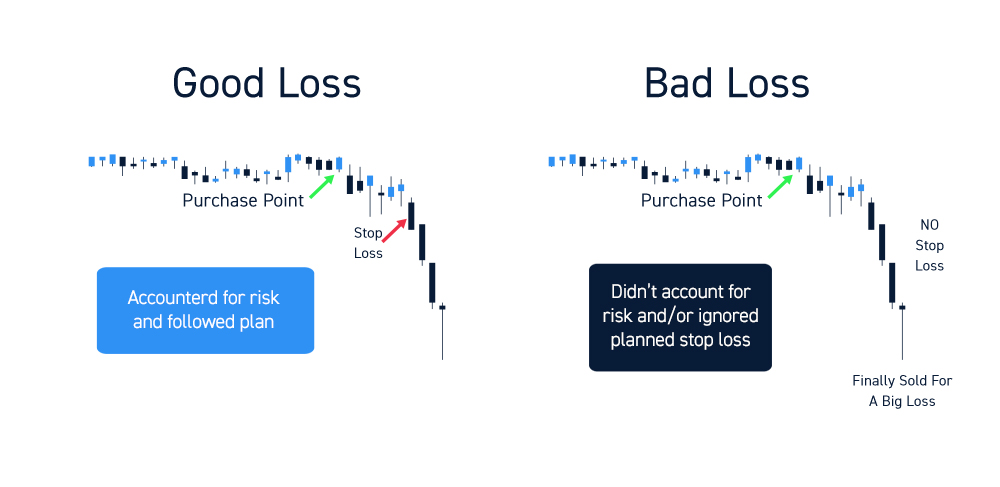

Not all losses are equal. There are good losses and bad losses. This distinction is independent from the amount of the loss, but the circumstances of it.

Good losses are those that are taken in a timely manner as planned, according to your trading plan. In other words, you already anticipated what can go right and what can go wrong with the trade and took prudent action by taking the stop-loss as the trade wasn’t playing out according to plan. This is a good loss because you were prepared for it and reacted.

Bad losses are those that are taken out of fear, panic and/or panic as you stray from your trading plan or didn’t even have one to begin with. This may be as a result of impulse trading driven by fear-of-missing-out (FOMO). Jumping impulsively into a trade and weathering initial pullbacks until the pain was too much and stopping out in panic. Sound familiar? It happens to everyone at some point. Everyone has bad losses. The key is to recognize and learn from them. In fact, bad losses can be some of the most valuable lessons because they are the most painful types of losses. Pain is a great teacher, if you listen.

The #1 Rule: Learn From Losses

The greatest traders and fund managers have learned the hard way what not to do enough times to do things right moving forward. Painful losses can be utilized as reminders of what not to repeat. If you touch a hot stove once, you quickly learn not to touch it again.

The key is learning from losses and not repeating them often. Here are some lessons you can apply.

Every Loss Presents a Lesson

When you take a loss, it’s human nature to grade the loss based on what happened to the stock after you got out. This is natural and part of the learning process. Realistically, the quality of your loss will depend on what the stock does afterwards, right? No.

The takeaway from any loss involves analyzing whether you had a good loss or a bad loss. A good loss was planned and anticipated and triggered, for which you executed as per your plan. A bad loss is one where there was either no plan, or you strayed from the plan and stopped out because you just couldn’t take the pain anymore (IE: holding on much longer beyond the stop-loss level hoping and praying for the stock to recover).

Get in the Habit of Learning From Losses

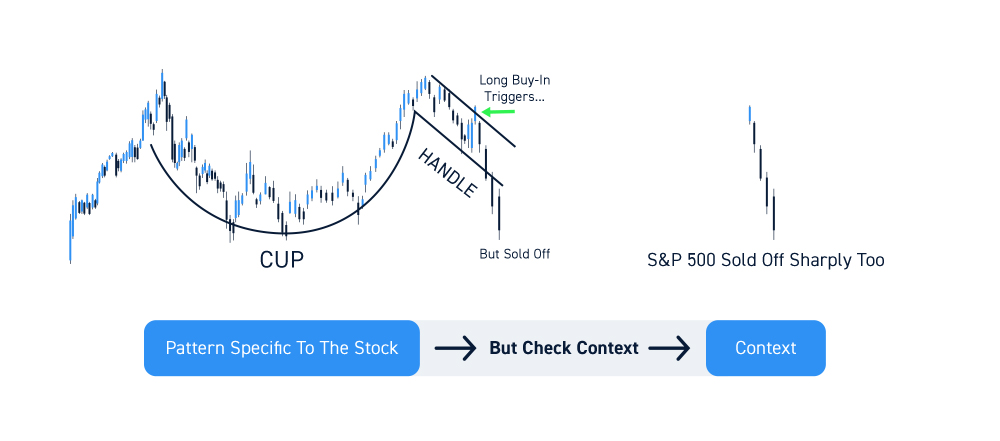

If you took a good loss, then focus on the set-up and what went wrong with the triggers to learn for the next time. Factor in the context, not just the pattern specific to the stock. For example, if you took a long trade on a cup-and-handle trigger but the stock sold-off, then check the S&P 500 to see if the futures sold off sharply.

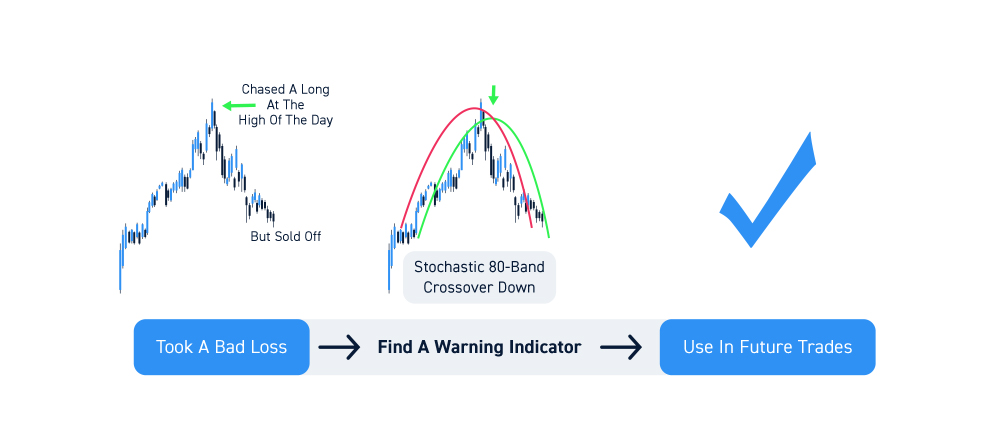

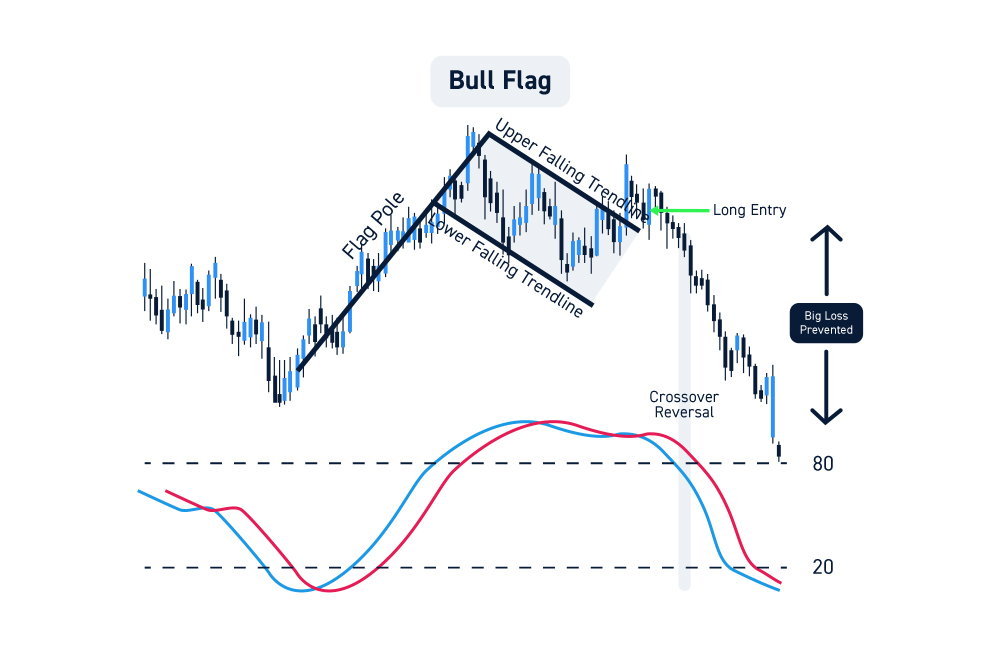

If you took a bad loss, find the price level where you should have taken your stop and what clues were present at that time. For example, if you chased a long entry at the high of the day but the stock dropped sharply, then identify the momentum indicator trigger that could have warned you of the impending collapse (IE: stochastic 80-band crossover down). Implement that in your future trades.

Recovering From a Loss

First of all, the fact that you took a loss is a sign that you can recover. It may take some time if it’s a bad loss, but you can heal and improve by consciously implementing the following steps.

Take a Step Back and Breathe

Most importantly, give yourself closure from the trading platform. Physically get up and take a break. Don’t feed the urge to jump right back into the action. This is how you can go into “tilt” mode. You need separation from the screen to calm down and catch your equilibrium. Remember that everyone takes losses and it isn’t the end of the world. The fact that you took a loss implies that you are still somewhat in control.

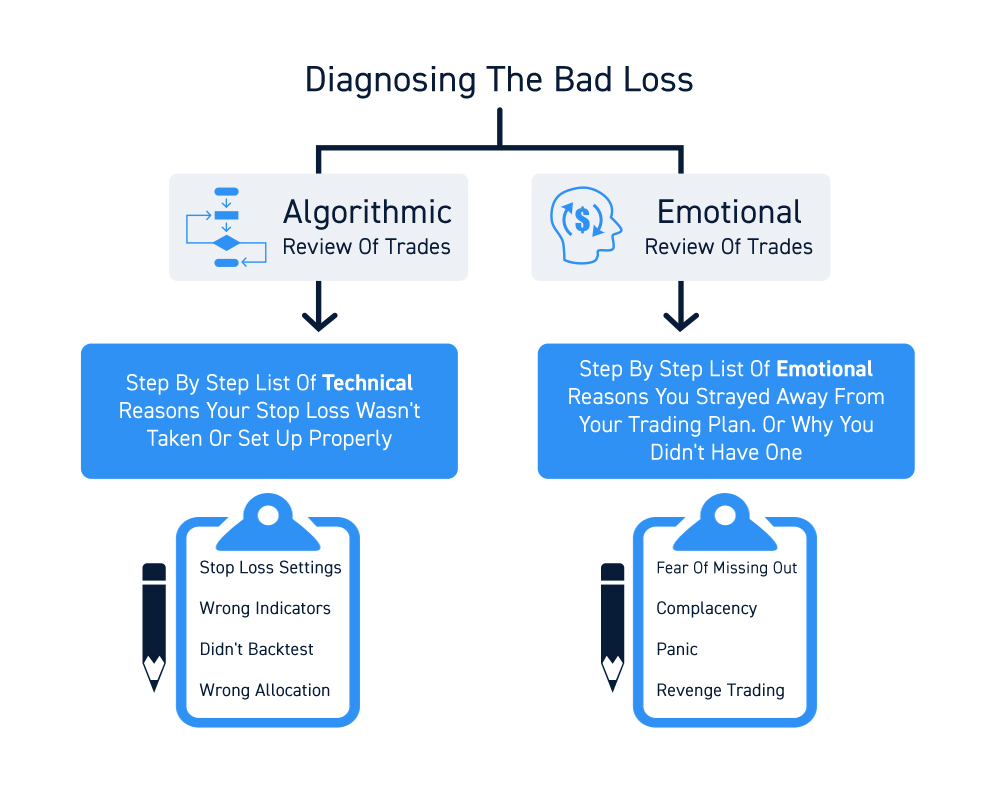

Diagnose the Issue

This is where to get clinical. Review the trade as if you were a researcher in a lab. Diagnose where you should have taken the stop-loss and what caused you to stray from the plan. Do this both from a technical trading set-up perspective as if you were an algorithm and from the emotional perspective noting what made you go from complacency, to stubbornness and then sheer panic. What key technical factors did you overlook or ignore? Be brutally honest.

Refine Your Trading Strategy

Once you’ve identified the issues with your strategy and your emotions, it’s time to refine them.

For pattern set-up issues, derive what the initial clues were that the pattern was not playing out. What were the early signs? What were the indicator signs? What was the earliest stop-loss that could have been taken?

For example, you took a long trade on a bull flag pattern above the upper falling trendline. The stock spiked briefly but fell back under the upper trendline and proceeded to collapse below the lower flag trendline. The stochastic indicated a crossover reversal off the 80-band as momentum shifted back to the downside, rather than crossing up through the 80-band. In this scenario, you can refine the strategy by keeping a tight stop-loss on the upper flag trendline or waiting for a pullback after the upper trendline break so for a stochastic 20-band bounce entry.

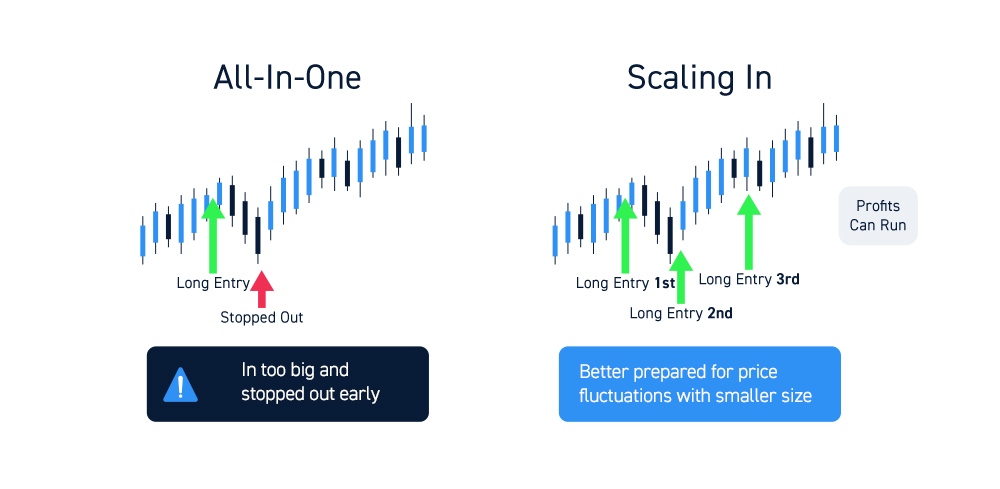

For emotional and psychological issues, identify where you felt comfortably in control of the trade and when you started to feel an abundance of stress. Did you feel stress and anxiety taking the trade as soon as you entered? If so, this may be a position size situation as you were playing too heavy of a position and chasing overbought entries looking to sell higher, then froze when the pattern rejected.

Perhaps, you “knew” the pattern was failing but “wished” that it would still play out even after shares collapsed through the lower trendline. Perhaps, every time the stock looked to collapse, it bounced back up to lower highs and just enough to make you complacent in the hopes that the next bounce would be the breakout.

To refine these situations, consider a scaling method of entry and exit. Rather than chasing all-in on one entry, get into the habit of placing bids around certain price levels to attain shares on a “wholesale” level and implementing stop-losses incrementally when the pattern starts to display potential failure. My minimizing the “blow” it takes some of the fear out of taking losses.

Ease Back into the Markets

Once you’ve identified the maladies and refined your strategies, it’s time to put the lessons to work slowly. Don’t rush right back into the markets and don’t even attempt to make back the losses quickly. Use lighter shares or even a simulator to test the refinements. Every little win is a victory on your way back.

Most importantly, cut your trading size. Trading size can wreck your trading plan on so many levels. Start small and take little wins before gradually raising your size back up. Always have a stop-loss set in stone for the trade and a max-loss for the day. If you trigger them, then go right back to reassessing and refining your strategy.

View trading losses as simply a “pause” in your trading. The pause that buys you time to gather your thoughts, reassess and adjust your trading game plan and most importantly stop the bleeding. Sun Tzu wrote, “A skilled fighter places himself in a position where defeat is impossible, yet never misses the opportunity to defeat the enemy.” In trading, the undefeatable position is being in cash.

Remember, that dealing with trading losses is always a work in progress and part of the business of trading. The key is to keep them manageable. The bottom line is to take that personal experience and devise refinements to your strategy moving forward. This is how you can turn losses into lessons moving forward as you evolve as a trader.