Short squeezes can introduce a lot of volatility into stocks and send share prices sharply higher. These squeezes offer opportunities for trading, but they often require different strategies and more caution than traditional breakouts.

In this article, we’ll take a closer look at trading short squeezes and explain how traders can recognize a short squeeze in action.

What is a Short Squeeze?

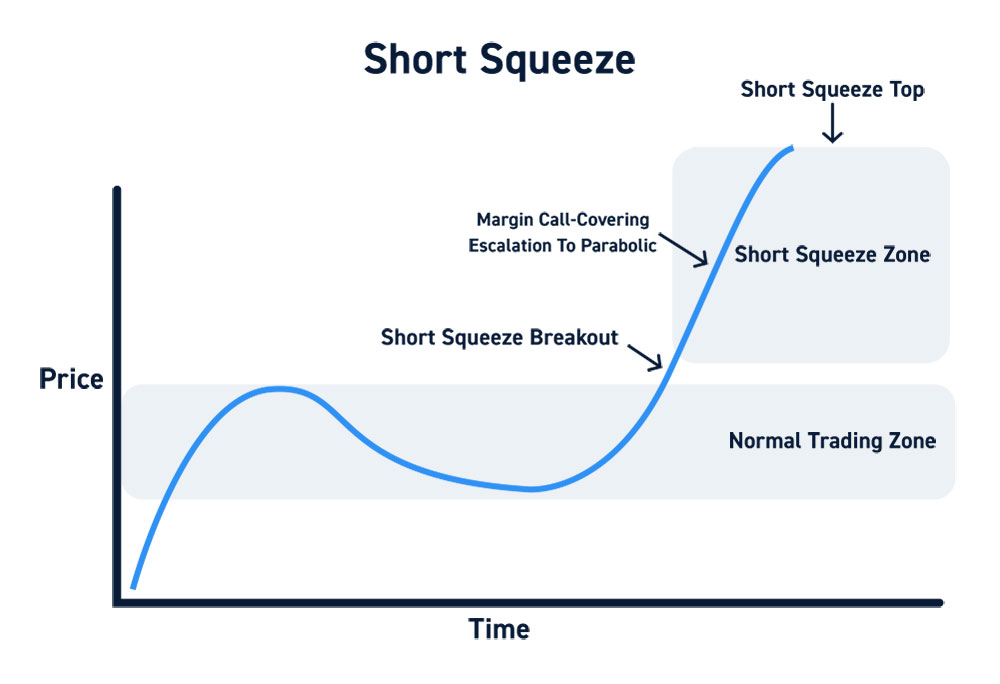

A short squeeze occurs when the price of a stock rises sharply, forcing short sellers to buy shares to exit their positions. In buying shares to cover their short positions, short sellers end up pushing the stock price even higher. Bullish traders see this buying activity and jump in as well, adding further upward pressure to the share price. In this way, a relatively small bullish movement can trigger in a cascade of buying activity.

Short squeezes typically happen only when the short interest in a stock is very high. It takes a lot of short sellers buying shares to push the price of a stock strongly upward. Short squeezes are usually short-lived and end when short sellers have fully exited their positions or stop buying shares to cut their losses.

Short Squeezes vs. Breakouts

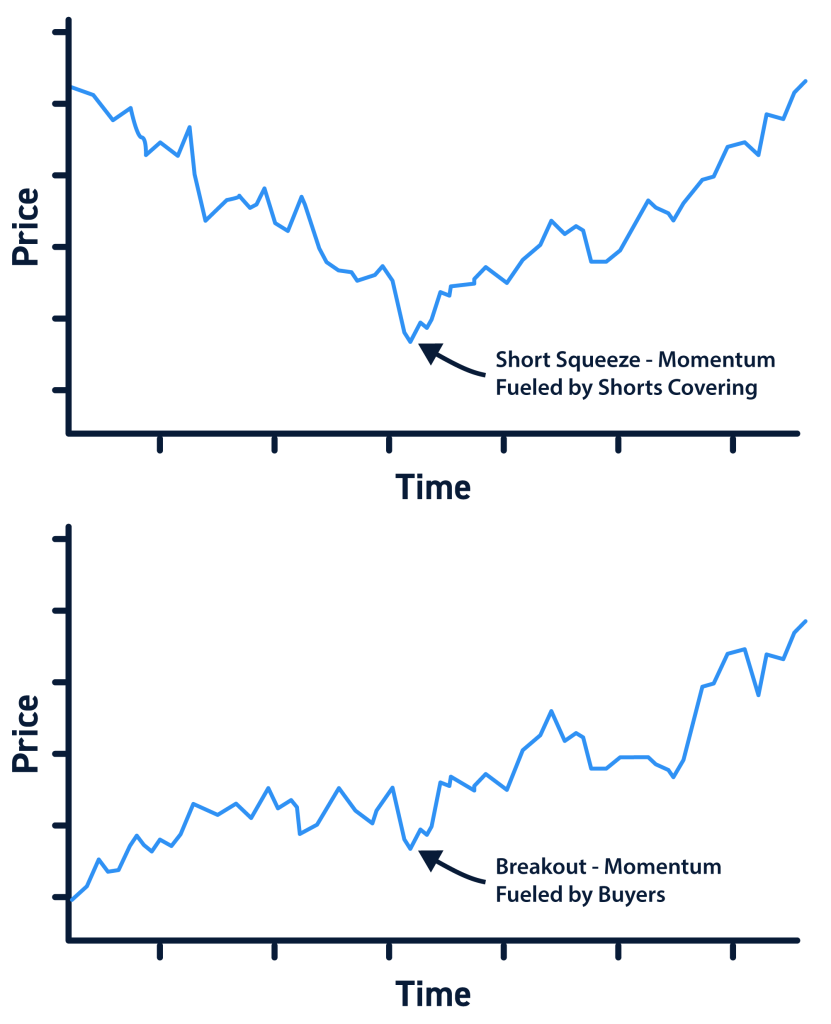

Short squeezes and breakouts both involve strong bullish movements in the price of a stock. However, the underlying dynamics are very different.

In a short squeeze, a stock’s upward movement is driven by short sellers buying shares to exit their positions and bullish traders piling in. The trading activity is usually highly volatile and somewhat frantic since the fuel behind the price movement – open short positions – will run out at some point. Short squeezes often end in a sharp peak, after which prices usually drop to near or slightly above the level at which the short squeeze began.

In a breakout, a stock’s price moves above an area of resistance and then moves to a sustained higher price level. Breakouts are usually supported by strong bullish trading volume and do not primarily involve short sellers buying shares. Breakouts may see a price peak form, but the stock’s price typically stays above the prior resistance line following a successful breakout.

Note that a short squeeze can be the catalyst for a breakout or vice versa. During a short squeeze, a stock may break above a resistance level and sustain a price above that level. Alternatively, a breakout could trigger buying activity that alarms short sellers and causes them to exit their positions, initiating a short squeeze.

Why Traders Need to Be Aware of Short Squeezes

Traders need to be aware of short squeezes because their dynamics can be very different from traditional breakouts.

Short squeezes can be extremely volatile, with buying pressure pushing a stock’s price far above its last support level. Traders who have bullish positions around a short squeeze for too long could find themselves riding a downward crash back to areas of support. Long traders need to be aware of what is moving a stock’s price and consider how long that movement may last.

Short sellers also need to be cautious around short squeezes. What might look like a better price to short a stock could end up being the beginning of a sharp upward movement. If short sellers jump in, they could end up being forced to quickly exit their positions for a loss.

How to Recognize a Short Squeeze

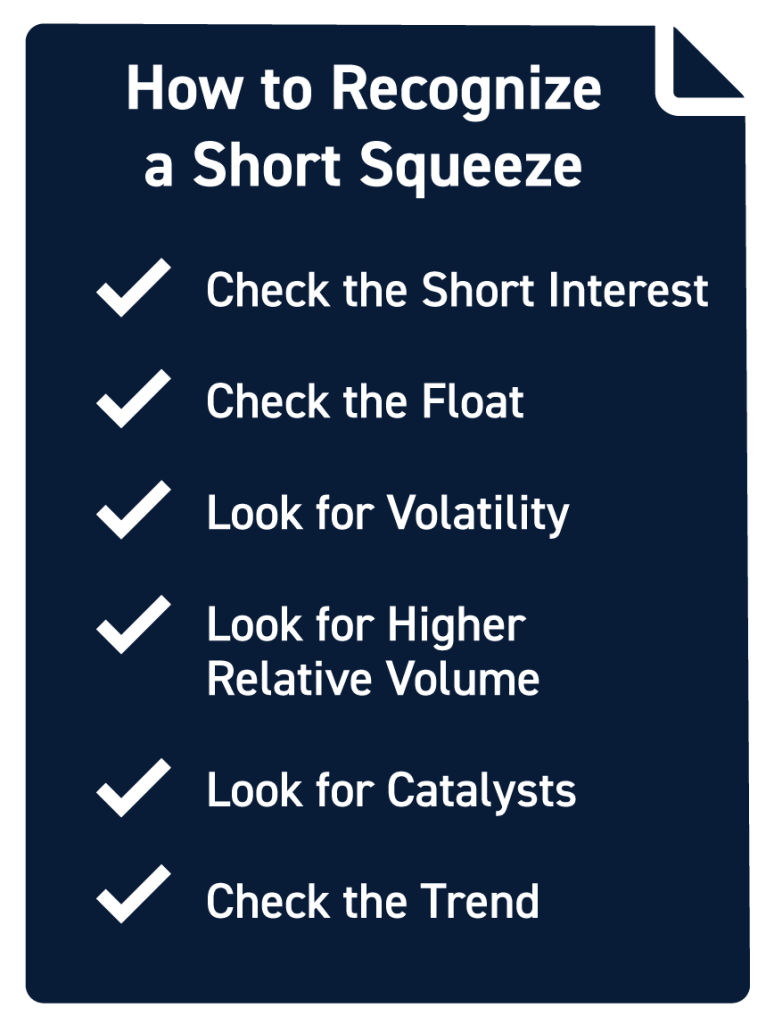

There are several ways that traders can recognize a short squeeze in action.

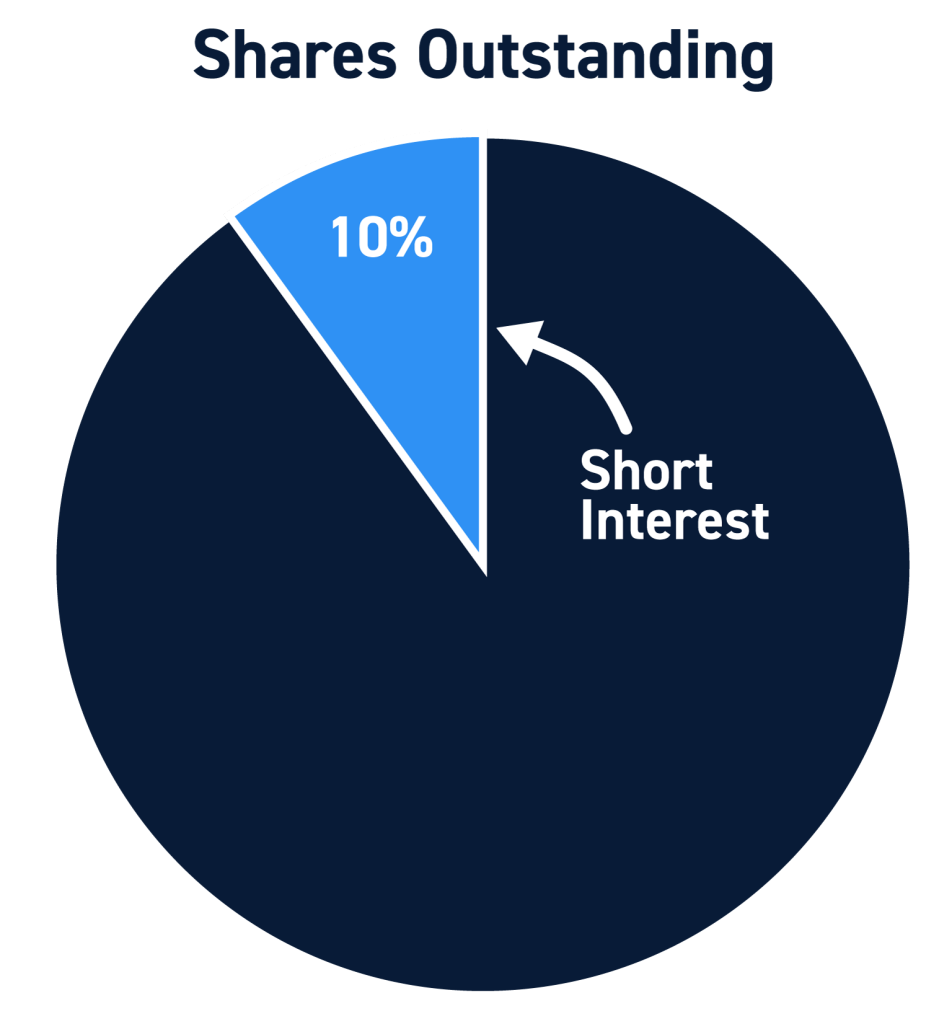

Check the Short Interest

A stock must have high short interest in order to experience a short squeeze. The best way to identify short squeeze candidates is to look at the number of shares short relative to a stock’s average daily trading volume. This is known as the days to cover ratio. Stocks with days to cover ratios of 5 or more may be susceptible to short squeezes.

Check the Float

Stocks with low floats are also more susceptible to short squeezes. Low float stocks have fewer shares available for public trading, so short sellers will generally have a harder time covering their positions. Low float stocks are also typically more volatile than stocks with high float, which can help trigger a short squeeze.

Look for Volatility

Unusually high volatility could be a sign that a short squeeze is about to happen. Higher volatility may be due to short sellers starting to exit their positions in a hurry. High volatility could also induce a short squeeze if short sellers see that a stock has a very high days to cover ratio.

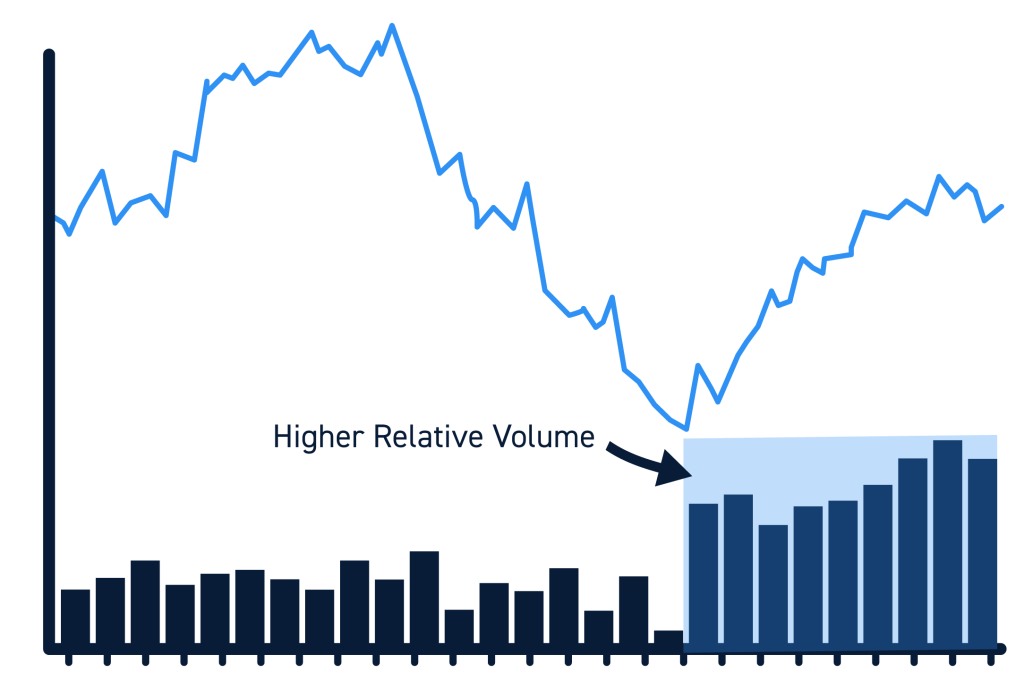

Look for Higher Relative Volume

Unusually high trading volume can be a sign that short sellers are buying shares to cover their short positions. As bullish traders try to trade around the squeeze, trading volume will rise even higher. However, bear in mind that high trading volume is also associated with bullish breakouts.

Look for Catalysts

It’s important for traders to think about why a stock’s price is moving. If there’s a legitimate catalyst, such as a positive earnings report or industry-wide news, that may be the cause behind a sharp bullish price movement rather than a short squeeze.

On the other hand, a bullish catalyst can be the spark for a short squeeze. If short sellers’ bets were based on a company announcing bad news and it announces decent news instead, short sellers could head for the exits and trigger a squeeze.

Check the Trend

Short squeezes can happen during either uptrends or downtrends. However, a squeeze in a downtrend is less likely to occur because short sellers are less likely to experience margin calls (if they are holding unrealized profits in their short positions). Short sellers who hold unrealized profits may also be less incentivized to exit their positions if a stock is in the midst of a prolonged downtrend.

That said, if a stock starts squeezing after a longer-term downtrend, a short squeeze may ensue. Short sellers who were previously comfortable with their positions may be inclined to cover as the stock turns against them.

Conclusion

Short squeezes can present unique opportunities for trading, but they can be highly volatile and require caution. The first step to trading short squeezes is to recognize when one is happening. Traders should consider a stock’s short interest, float, volume, and any catalysts to determine whether a short squeeze is developing.