Introduction

For traders who trade on margin, understanding your buying power is essential to staying on the right side of margin requirements. Buying power controls how much money you can deploy at any time. Importantly, buying power changes between market hours and overnight hours.

In this guide, we’ll explain what buying power is, how it works, and why buying power matters for traders.

What is “Buying Power”?

Buying power is the amount of money that a trader has available to deploy at any given moment. Buying power may not be the same as the amount of settled cash in your account, particularly if you have a margin trading account. It can include unsettled funds that are available for trading and margin from your brokerage.

Buying power matters because it controls how much money traders can actually use to make trades. You can never exceed your buying power, so you can think of it as an upper limit on the total size of new positions you can open.

Buying power will increase as you liquidate positions. However, depending on your account type and the transactions involved, it could take several days to see an increase in your buying power. So, traders need to plan around this when considering how much money they can dedicate to trades.

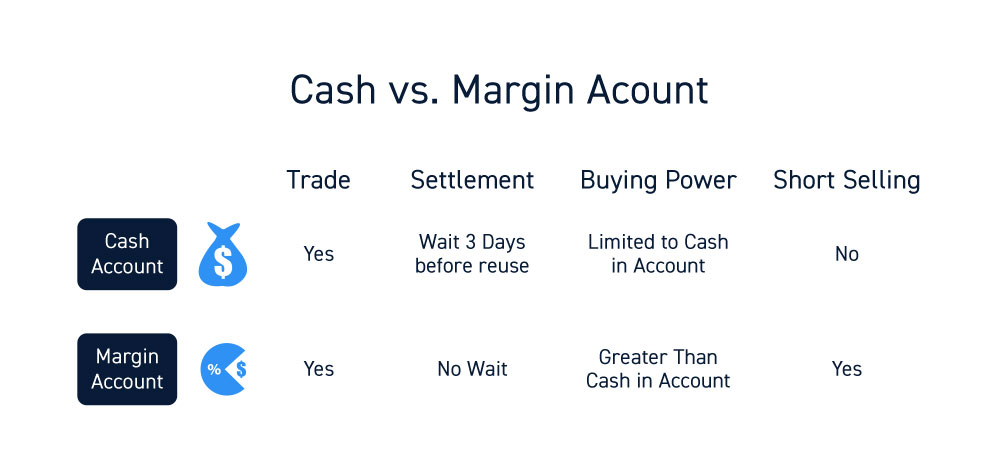

Buying Power in a Cash Account

Brokerage cash accounts do not have access to margin. In a cash account, your buying power is usually equivalent to the settled funds in your account.

However, many brokerages also include unsettled funds in your buying power. This means that if you sell a stock, the proceeds from that sale will be immediately available to use for trading and will be added to your buying power. Most stock trades take two days to settle, so your buying power can be greater than your settled funds for two days after a sale.

Note that if you’re trading with unsettled funds, it’s important to avoid trading violations. The most common violation is a good faith violation, in which a trader uses unsettled funds to buy another stock, then sells that stock before the original funds settle.

For example, say you sell $5,000 of Apple stock on Monday and then immediately buy $5,000 worth of Microsoft stock. The next day, you sell the Microsoft stock. This would be a good faith violation because the $5,000 proceeds from your sale of Apple stock still have not settled. If you incur three good faith violations in a 12-month period, your account will be restricted to only trading with settled funds for 90 days.

Buying Power in Margin Accounts

In margin accounts, traders have the ability to trade with leverage using margin from their brokerage. As a result, your buying power may be several times the amount of settled and unsettled cash in your account.

Most brokers offer 4x buying power during market hours (known as intraday margin) and 2x buying power outside of market hours (known as overnight margin). That means that if you have $50,000 in cash in your margin account, you can trade with up to $200,000 during market hours. However, you can only hold up to $100,000 in positions overnight.

It’s important that traders recognize that their margin buying power changes after market close. Traders who have positions valued at more than twice the cash in their account must close out some positions before market close in order to remain within the limits of their overnight buying power.

Why Traders Need to Be Aware of Their Buying Power

There are several important reasons that traders need to understand and be aware of their buying power.

Margin Requirements May Change

The margin requirements for your trading account can change depending on a stock’s risk. You may be able to trade Apple shares with 4x leverage, but your broker may only offer 2x leverage for trading a highly volatile small cap stock. In this case, your effective buying power for Apple shares will be twice as high as your buying power for the small cap stock.

Importantly, margin requirements for a stock can change at any time if the stock’s risk profile increases or decreases. Traders need to be aware of their buying power and understand the amount of leverage that can be used based on their marginable cash and securities.

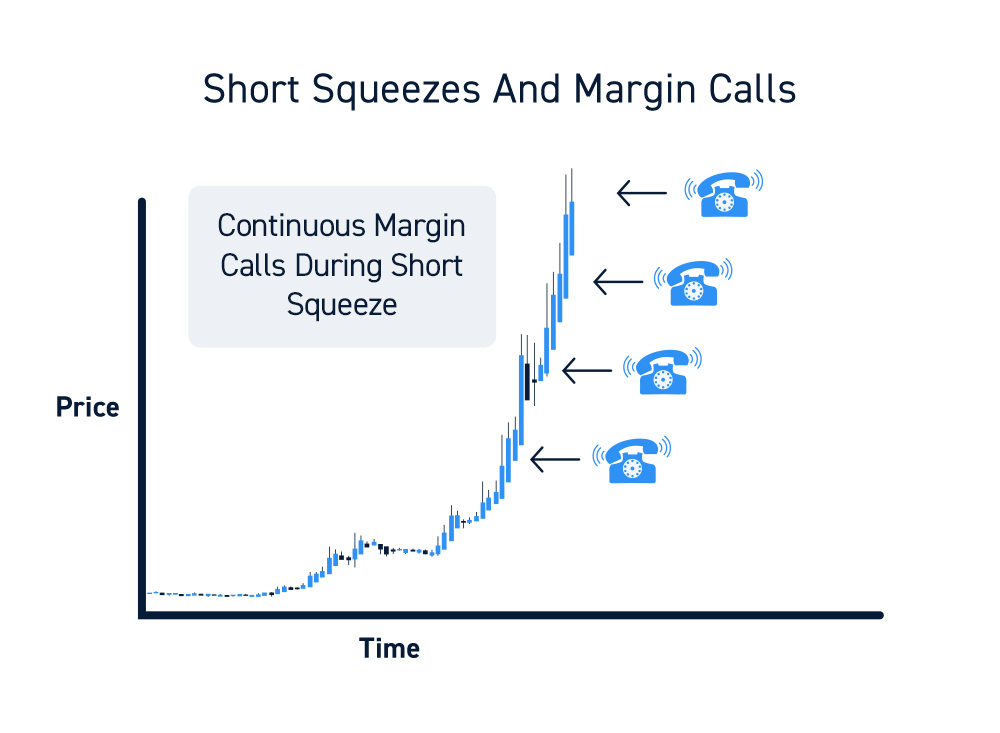

Avoid Margin Calls

Keeping track of your buying power is also important for avoiding margin calls, which can force you to exit a position prematurely. Margin calls can occur when the value of a leveraged position falls and your buying power decreases accordingly. If you no longer have enough cash or marginable securities in your account to cover your margin requirements, you’ll receive a margin call. Margin calls can also occur due to a change in margin requirements.

The best way to avoid margin calls is to avoid using all of your available buying power. That way, you have a buffer available in the event that your buying power drops.

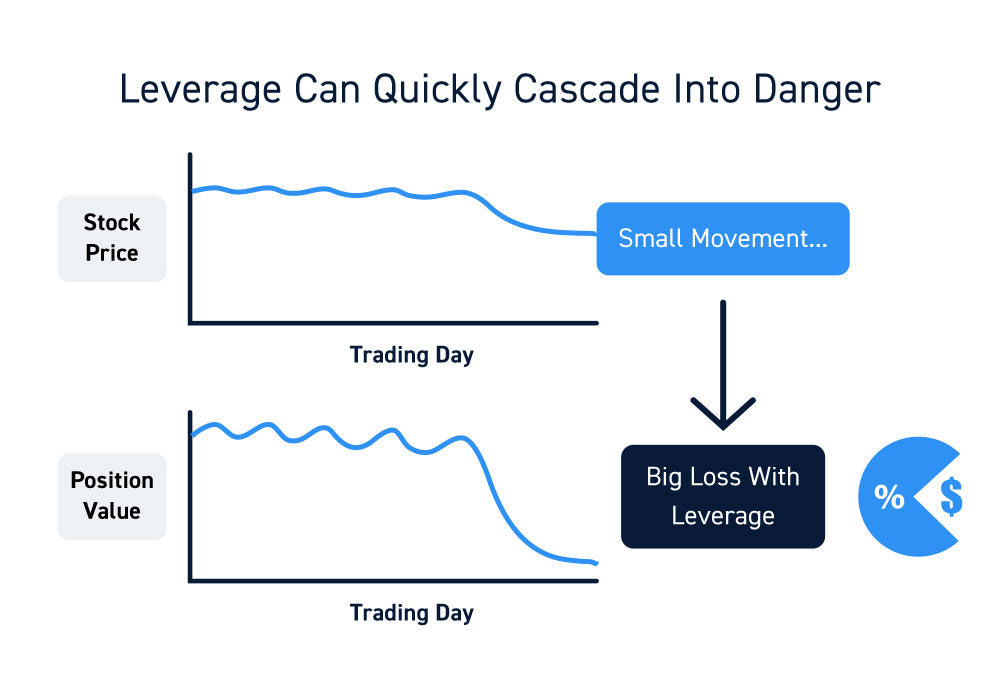

Avoid the Downsides of Leverage

One of the major downsides of leverage is that it amplifies your losses as well as your gains. If you use margin up to your available buying power, you expose yourself to potentially large losses if a trade doesn’t go your way. You could also face a margin call, forcing you to lock in your losses.

By being aware of your buying power, you can be more cautious about your position sizes and the amount of leverage you apply to each trade.

Close Positions in Time

If you use margin in excess of twice your account’s cash value during intraday trading, you need to be prepared to close positions before market close. Once the market closes, your overnight buying power will drop to 2x your account’s cash value.

This means that you need to plan ahead and begin closing out positions early. You don’t want to end up having to liquidate positions at inopportune times as the market is about to close.

Conclusion

Buying power is a measure of how much money traders can use to open positions. While buying power is limited to settled and unsettled cash in cash accounts, it also includes available margin in margin accounts. Importantly, overnight margin is less than intraday margin at most brokerages. Traders should always be aware of how much buying power they have and plan proactively to avoid a margin call.