For active trading purposes, margin accounts are a necessity for traders. These accounts provide the leverage and buying power needed to facilitate and complete trades. They enable traders to continue to make consecutive round trip trades without having to wait for buying power to replenish after the two-day clearing period on closed trades. Margin is also required for short selling stocks.

What is Margin?

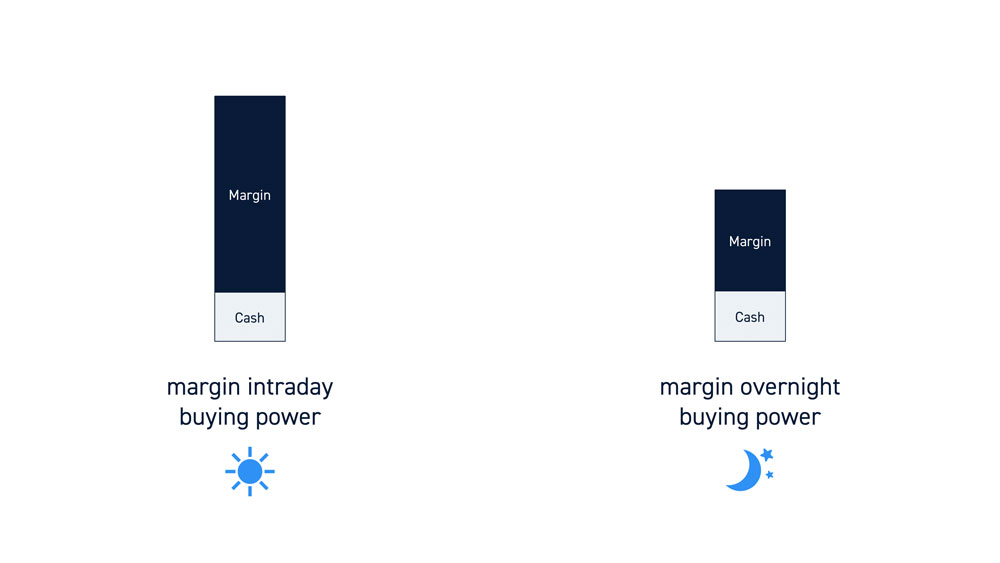

Margin is a loan against the capital in your trading account. When using margin, the brokerage is loaning you the additional funds needed above your capital level to complete the trade. The amount of margin extended is subjective to the underlying stocks being trading. Margin enables four-to-one (4:1) intraday buying power and two-to-one (2:1) overnight buying power, though buying power ratios may be lower on certain securities such as leveraged ETFs low-priced securities.

Margin Accounts Versus Cash Accounts

Buying Power

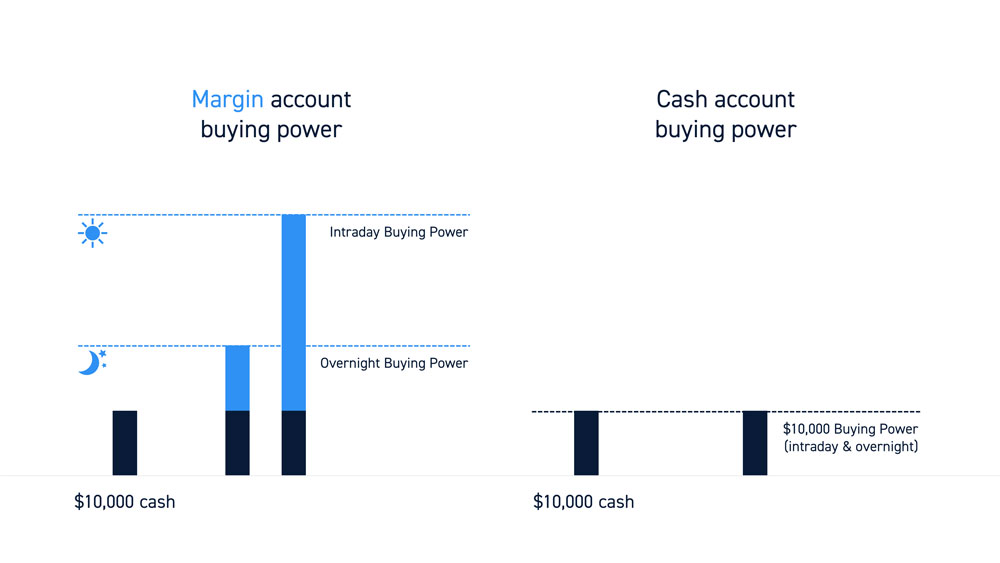

Buying power is the amount of capital you can allocate to trades. If you have $50,000 buying power, you can purchase $50,000 worth of stock.

With a cash account, trades are limited to the amount of cash in the account. The cash amount is the buying power, and you need to have enough buying power to open a position. If you have $25,000 cash, you have $25,000 buying power which will allow you to purchase up to $25,000 worth of stock.

With margin accounts, you can leverage your capital and increase your buying power. $25,000 cash may yield $100,000 intraday buying power and $50,000 overnight buying power.

Trade Settlement Periods

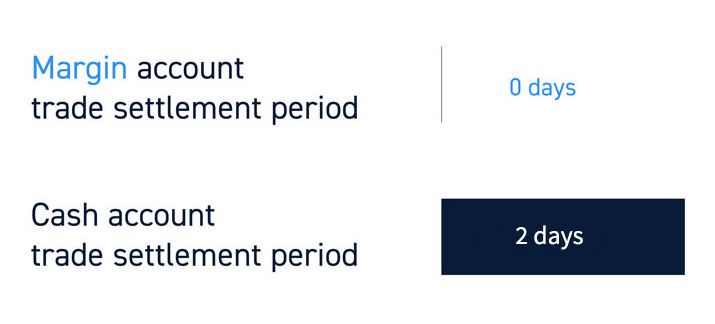

With cash accounts, the proceeds need to “settle” before they can be reused. Once a position is partially or completely closed, it will take two days (T+2) before the cash can be used again to make another trade. The two-day period is required for a trade to clear and settle to replenish buying power. Trading with unsettled funds can lead to account restrictions and is ill-advised.

With margin accounts, you do not need to wait for a trade to settle before reusing the capital. This is essential for traders because it allows them to use capital without any delays.

Short Selling

Cash accounts are not allowed to short sell stock.

Since short selling involves “borrowing” stock, you are required to have a margin account if you’d like to place short trades.

What Traders Need to Know About Margin Trading

Margin can be a trader’s best friend or worst enemy. The additional leverage can feel empowering, but traders must realize it is borrowed money that needs to be paid back. The margin interest is a non-issue if closing out positions intraday. However, swing traders should be aware of the risks involved if taking trades overnight. The risk exposure is why margin ratios are halved for overnight positions.

Here are a few considerations for margin traders.

Know Your Margin Rate

Just like a bank loan, brokers charge interest for the portion of margin used for the duration of the holding period. The margin interest rate is often determined by your broker’s clearing firm. Intraday traders don’t have to worry about margin interest if positions are closed out before the session ends.

It’s still prudent to be aware of the margin interest rate to compare fees. Swing traders and investors should absolutely be mindful of the margin interest rate since they may be utilizing margin for a longer period of time. It’s also important to know when your broker will be extracting the margin interest from your account.

Be Careful Not to Over-Leverage

The added buying power should be treated with caution as it’s easier than you think to overleverage a position. The maximum intraday margin is the four-to-one; however, some volatile stocks may get adjusted margin ratios intraday.

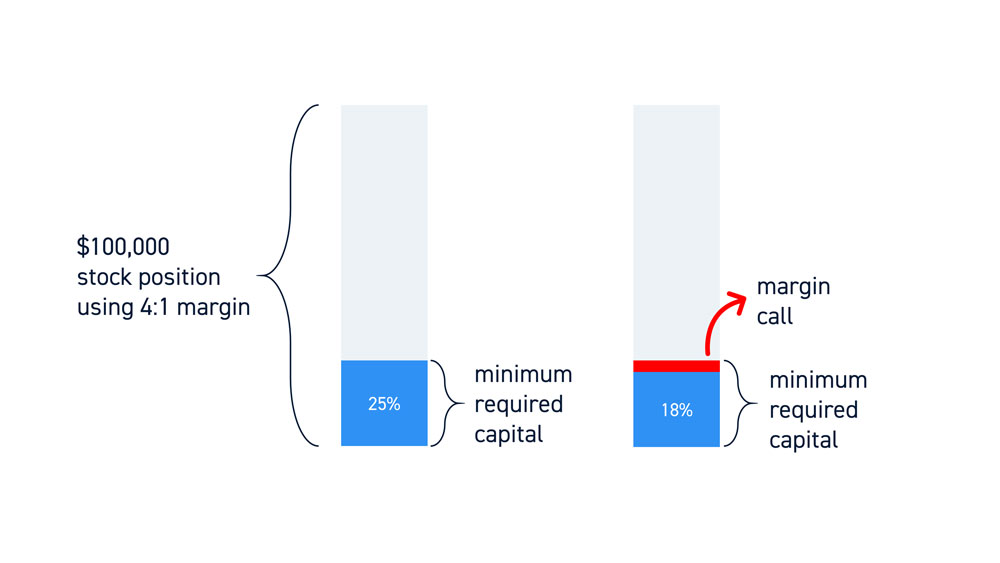

It’s crucial to be aware of the maintenance margin for any positions you take. The maintenance margin is the amount of capital you need to maintain the position. A 25% maintenance margin on a $100,000 stock position using 4:1 margin means there must be at least $25,000 in capital to maintain the position.

For this reason, it’s imperative not to ever use all the margin in an account at any given time. The more you leverage, the smaller the move in the underlying stock before a margin call can trigger. With that in mind, it’s a good rule of thumb not to use all your margin. Always be aware of remaining margin and leave a buffer.

Margin Calls

A margin call occurs when an account falls below the maintenance margin threshold.

If a margin call is triggered, immediate action is needed to get the account back above the maintenance margin threshold. This can be done by closing out pieces of the position or depositing more cash into the account.

An intraday margin call can also trigger forced liquidation, which means the broker will automatically close out the positions needed to bring the account status back to normal. Be careful trading stocks with extreme volatility, especially on the short side. More volatile stocks can trigger higher maintenance margin requirements intraday triggering forced liquidations unbeknownst to the trader.

Use Margin as a Tool

Margin should be used as a tool to optimize your trading. The ability to make trades without having to wait two days to reuse capital is often taken for granted. Continuity is conducive to maintaining a trader’s “flow”.

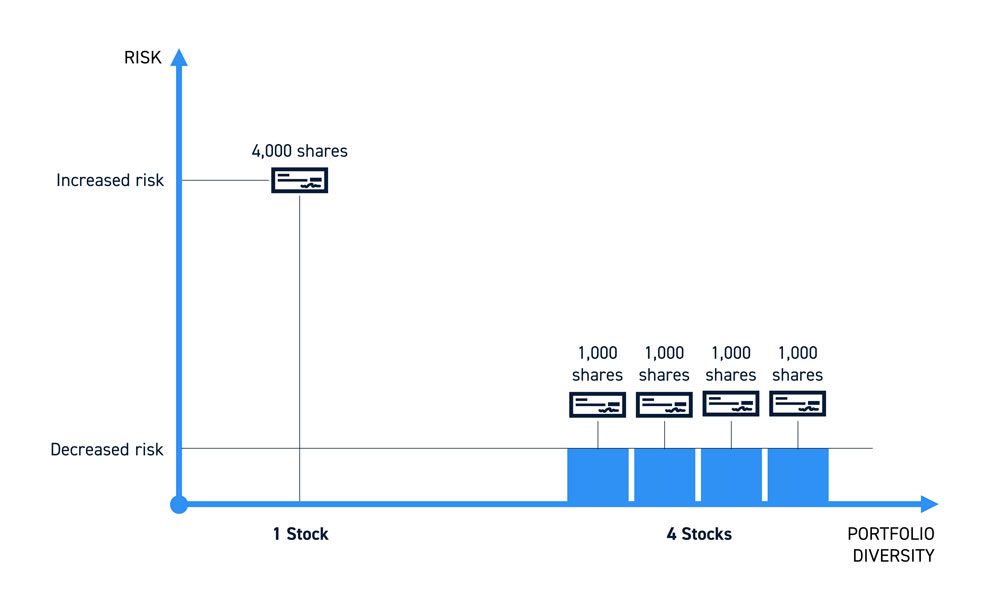

The additional leverage also enables traders to utilize more strategies to diversify positions and hedge risk. Of course, it’s not prudent to use all the margin at any given time.

When used properly, margin enables traders to attain more upside with less capital to optimize returns. With less cash tied it, it can be utilized or invested elsewhere. It should be noted this also means the opposite is true. The downside risk is greater with the use of margin. Of course, traders should remember not to trade with capital they cannot afford to lose, especially borrowed capital.