While making profits is the goal of trading, it has to be tempered with prudent risk management to enable profits to matter. The dark side of trading that often gets overlooked is the defensive posture that needs to accompany a strong offense. What good is a $1,000 profit after taking a (-$3,000) loss? The cliché “The best defense is a good offense” may apply in sports, but in the world of trading, defensive risk management enables you to live to fight another day. It buys you the time to find and capitalize on opportunities and helps to ensure longevity as a trader.

What is Risk?

Risk can be quantified as the amount you stand to lose on a trade. Knowing your downside risk is just as essential are knowing your profit targets. When you’re on a winning streak you are often most susceptible to risk as the line between confidence and arrogance gets blurred.

Types of Risk in Trading

There are two types of risk when trading and its critical to be consciously aware of these.

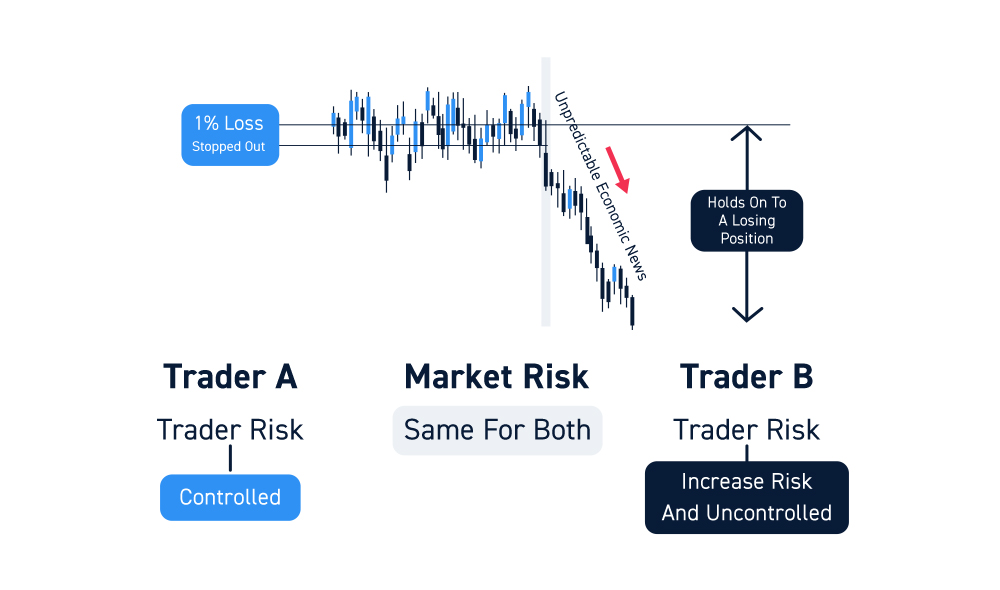

Market Risk is what the market does. This risk can impact individual stocks, sectors, or the entire market.

Trader Risk is completely in the hands of the trader based on planning, management and reaction. This type of risk comes from how traders react to market risk.

The biggest differentiation between “market risk” and “trader risk” is how they can be controlled. Market risk is uncontrollable – every trader is at the mercy of the markets. Trader risk is controllable, as traders can react to the market however they choose.

For example, assume the market starts dropping on completely unpredictable economic news (market risk). One trader, may stop out at a 1% loss while another may stubbornly hold onto the losing position. The market risk was the same, but the trader risk was increased for the trader who took a more liberal approach to risk management.

The Importance of Risk Management

Risk management has to be the top priority for traders. Proper risk management helps to ensure that you don’t find yourself trying to dig your way out of a big hole in the first place. Failing to manage risk is comparable to have a leaking faucet that gets worse with time until the pipes burst. Lack of risk management is one of the key weaknesses that the market will ruthlessly exploit. Remember, you can’t control market risk, but you must control trader risk. There are two material impacts of risk management.

Risk Management Directly Impacts Net Profitability

Consciously decreasing your average loss by (-$100) has the same net effect as increasing your average profits by +$100. This may seem like common sense, but when you’re trading in the “eye of the storm”, it can easily be overlooked.

Have you ever had days where you fought your way back from a deep red morning to happily end the day with just a +$10 profit? In hindsight, by administering tighter risk management, you could have avoided falling into a deep hole in the first place.

It also sets a bad precedent to consistently start the day deep in the hole only to struggle back to even by the end of the day. Prudent risk management also means identifying those particular set-ups and sidestepping the landmines altogether to pursue better opportunities.

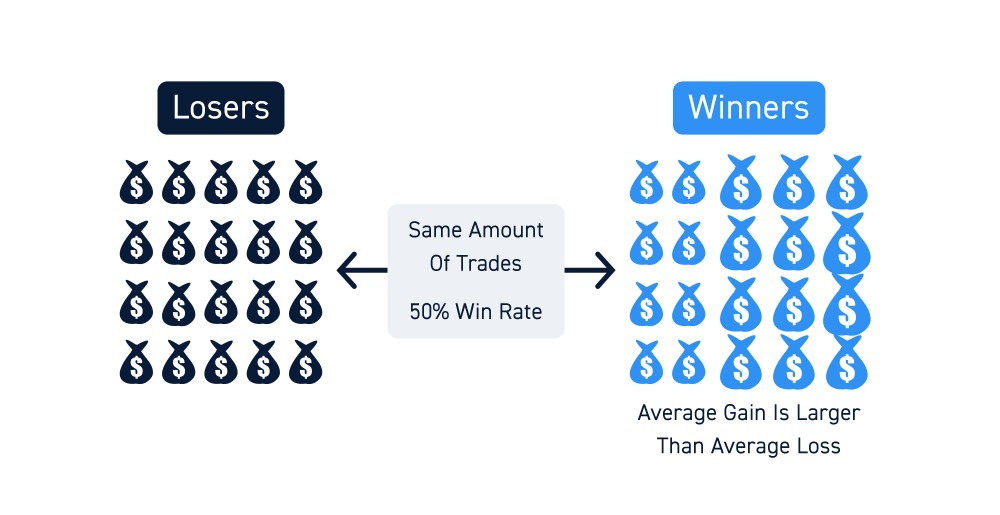

Risk Management Provides the Padding to Afford to Be Wrong More Often

Prudent risk management is a fail-safe that limits your losses so that you can afford to be wrong more often until you find the best set-up to trade. Keep in mind, a 50% win rate can be profitable if your average gain is 2X-3X your average loss.

In boxing, the jab is the most common punch. It expends the least amount of energy to set-up the power shot. Trading can follow the same mechanics, utilizing light tester size positions and adding to winners while cutting losers quickly. Even if you stop out half the time, the winners more than make up for the losers in this scenario.

Risk Management Rules

Risk management takes conscious effort, especially in the beginning. It is always a work in progress but gets more familiar with repetition. Start by consciously following some basic rules.

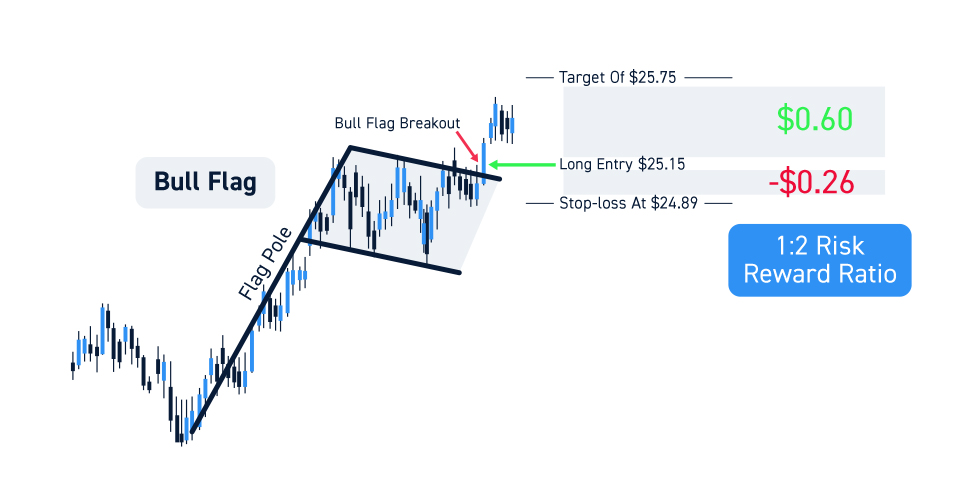

Determine Your Risk Beforehand

When you analyze trade set-ups, always factor the stop-loss into the equation. If you’re playing a breakout set-up, then determine what triggers the stop loss and quantify it by price amount or dollar amount.

For example, long XYZ stock at $25.15 on a bull flag breakout with a target of $25.75 and a stop-loss at $24.89 equates to a +$0.60 potential profit versus a (-$0.26) potential stop loss. On 1,000 shares you are risking (-$290) to make +$600, a 1:2 risk reward ratio. By planning ahead and setting your stop-losses ahead of time, the shock of losing can be alleviated enabling you to react prudently.

Control Risk with Position Sizing

The size of your trade directly impacts your risk. If every share carries $1 of risk, a 1000-share position carries twice as much risk as a 500-share position.

By taking smaller positions, you immediately trim your risk. As you get familiar with high-probability set-ups, you can increase your sizing based on the strength of the underlying pattern.

Using the boxing analogy, throwing small sized jabs until a strong set-up calls for a larger position power shot. However, you must have the discipline to take the stop-loss if the set-up breaks down. If you’ve pre-determined that (-$200) is your stop loss on a long position at $11 for a $13 target and a stop-loss at $10, then you and still maintain a 1:2 risk to reward ratio.

Cut Losses

Having a plan and executing the plan can seem world’s apart when trading real cash. Be disciplined enough to cut your losses as planned without second thought. This is why you plan ahead so that you don’t have to overthink when you’re in the trade. Risk management game plans are useless if they aren’t executed without hesitation. Use hard stops.

Set Your Max Risk

This is the most important risk management rule. Set your max loss per-trade, per-day and per-week. It can be dollar-based or percentage-based. Once this level is hit, you must absolutely stop out and reassess. This is the fail-safe that must be adhered to prevent blowing out your account and ensuring longevity as a trader.

The reality is that some trading days will be your Kryptonite where it seems you can’t make a winning trade to save your life. Recognize these days exist and have the discipline to walk away until conditions improve, especially when you hit your max-loss limit on the day. Live to fight another day. Consider the dollar loss as tuition and remember that it can always be worse. Trading is about pressing your strengths and pulling back on weaknesses. Some days will align with your strengths and some days will test your weaknesses. Proper risk management means planning ahead of time and cutting losses quickly when you recognize “Kryptonite” conditions.