In trading, your stock buying power is your ammo. Regardless of how strong your skill sets are, lack of ammo leaves you without an offense or a defense. Knowledge of your changing intraday buying power is crucial to assessing your risk thresholds and preventing self-inflicted wounds (IE: getting caught in a short squeeze). Knowing how much stock you can buy is determined by your buying power, and failing to monitor it can lead to big problems.

What is Buying Power?

Your buying power is the money you have available to purchase securities.

In a cash account, your buying power is your settled cash.

In a margin account, you do not have to wait for cash to settle, and your cash may be leveraged to increase your buying power.

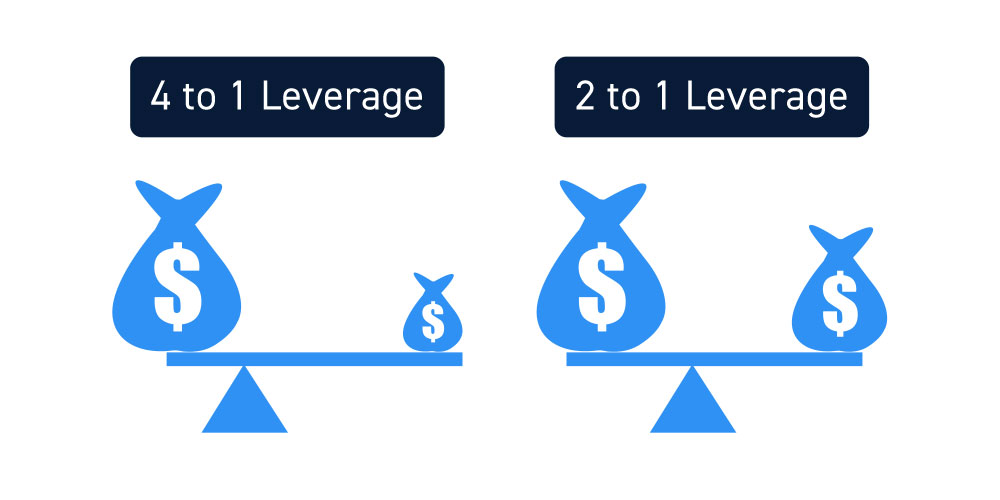

The standard buying power for a day-trading margin account is 4 to 1 (4:1) intraday and 2 to 1 (2:1) overnight. If you have $30,000 cash in a margin account, then you should be able to buy $120,000 worth of stock intraday or hold $60,000 overnight. If you have less than $25,000 in equity value in your account, you will not be eligible for day-trading margin.

Where Can I Find My Buying Power?

Every broker differs, but they all should show your buying power located in the account information in the platform.

If your broker has a standalone platform download or a mobile app, it should display in the account information or on the trading page. Direct market access (DMA) brokers are more sensitive and accommodating to providing real-time buying power information right in the platform.

How is Buying Power Determined?

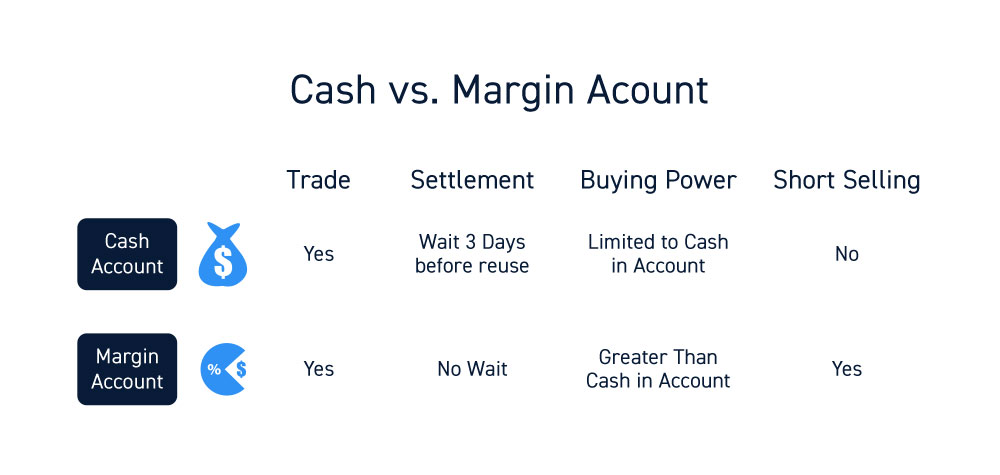

There are two types of trading accounts, cash and margin.

A cash account lets you make trades but requires up to a three-day settlement period after you close a position to be able to re-use the proceeds for another trade. It also limits your buying power to the cash amount available to trade. Also, short selling is prohibited since it requires margin to borrow shares. If you have less than $25,000 in the account, then you are not eligible for day-trading margin and will be limited to just three round trip intraday trades on a rolling five-business day period.

A margin account enables trading with leverage and allows you to use the proceeds of a trade immediately after you close a position without waiting for the settlement. The brokerage actually covers the amount until settlement is completed in a background. A day-trading margin account provides leverage of 4:1 intraday and 2:1 overnight buying power on stock trades. For example, if you wanted to purchase 1,000 shares of a $40 stock in a margin account, it would require 25% cash or $10,000 cash. For a cash account, it would require the full $40,000. Margin accounts also allow for short selling stocks that are available for borrow. Keep in mind that margin accounts enable borrowing the cash to make trades, this comes with interest fees and margin requirements that can differ between stocks. Riskier stocks tend to have higher margin requirements, which reduces your buying power.

How Does Leverage Work?

Leverage refers to how much cash you can borrow in your margin account for trades. Day trade margin accounts generally offer 4:1 intraday buying power and 2:1 overnight buying power on most widely traded stocks. This means you can put 25% of the costs down intraday and 50% of the costs down to hold positions overnight.

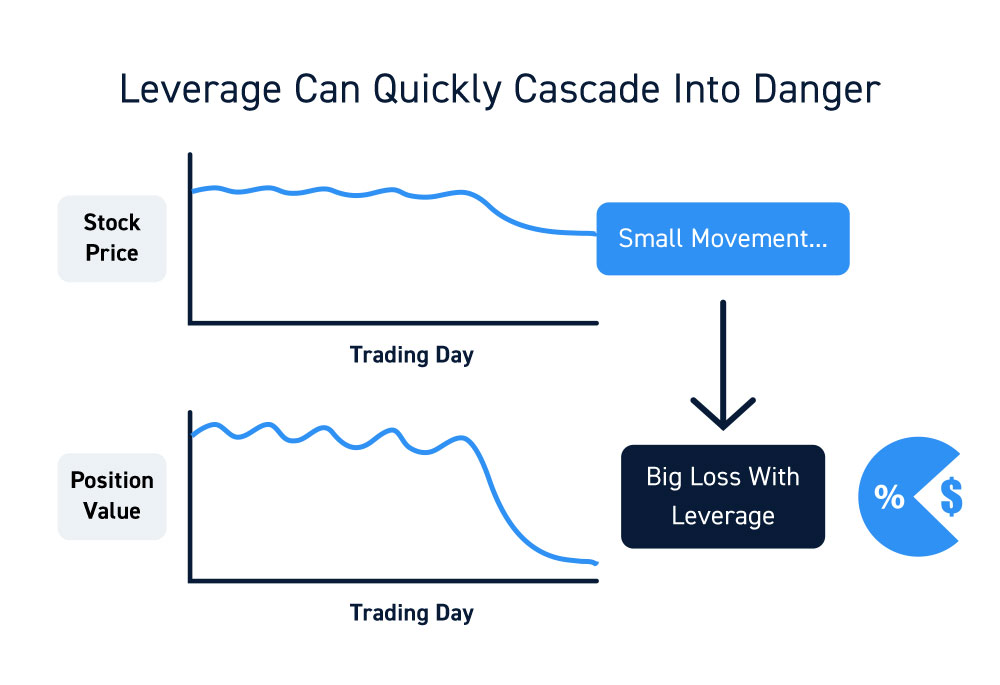

It’s never a good idea to use all your leverage since a slight move in the wrong direction can trigger a margin call. The reason overnight leverage is 2:1 is due to the inherent risk of events that can cause a price gap against you in the morning.

Use Margin Leverage as a Tool

The added buying power can be empowering, but the blade cuts both ways. Leverage enables traders to buy more shares to maximize gains. However, if the trade turns against the trader, the losses can rack up just as fast. Leverage requires disciplined trade management, which often means cutting losses quickly before they get out of hand or trigger a margin call, which in a worst-case scenario can mean an immediate liquidation of your positions by the broker. Broker-initiated liquidations are at the discretion of the broker and can lead to a total loss of all your cash and assets in your account if the losses in your leveraged positions are significant.

It’s crucial to be selective and frugal with leverage. Use it as a tool when needed but quickly sheathe the sword afterwards.

It’s also important to be aware of your remaining buying power when you are scaling into a position. Most brokers will have triggers in place to warn you if you are exceeding margin, or flat out reject orders when you don’t have enough buying power to add more share. However, if you are already in a heavy position and it moves against you, it can cascade into negative situations with severe consequences. Control the tool, don’t let it control you.

What Happens If You Don’t Have Enough Buying Power?

If you don’t have enough buying power to place a trade, you can’t place the trade (simple as that). For example, if you want to buy $10,000 worth of stock but you only have $5,000 buying power, the trade will generally not go through.

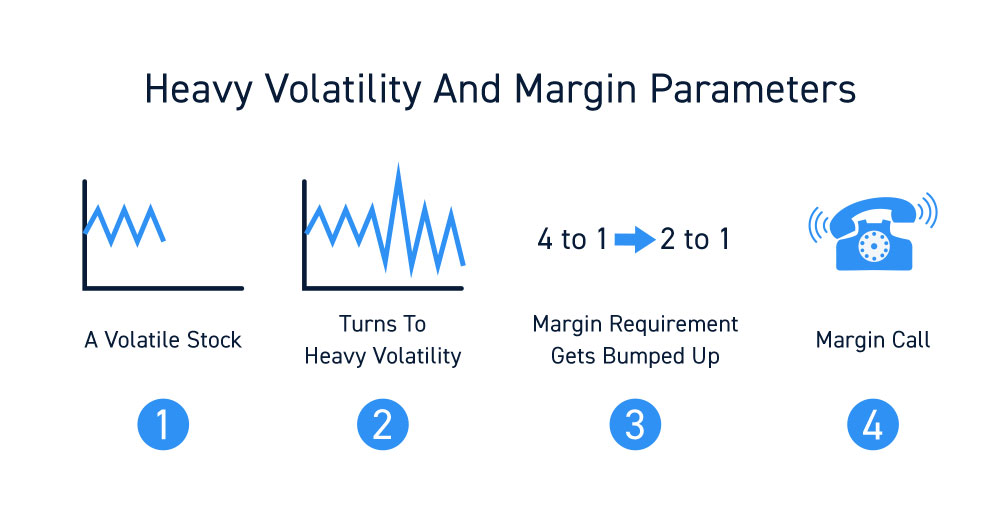

Buying power can change depending on the stock’s margin parameters which is at the discretion of your brokerage. Be aware that brokers have to constantly assess volatility risk throughout the day. If a stock or market exhibits extremely heavy volatility, the broker may bump up the margin requirement from 25% (4:1) to 50% (2:1) during the day. As the middleman that facilitates the trades between counterparties, the broker is on the line for potential losses if a trader doesn’t have the proper capital to handle the price swings and can initiate action to protect itself (liquidation of your positions or restriction on your ability to enter new positions) if you are over-leveraged or your account is overly-concentrated in a highly volatile position.

How Do Margin Calls Work?

This can happen if the price of a long position falls or a short position squeezes. This is a key reason to never use all your margin. There should be enough margin left to handle volatility in a stock’s price. However, it can also happen if the broker changes the margin requirements for stocks you may be holding. If a stock is deemed too risky or too volatile, the broker has the discretion to adjust margin requirements even if you have already purchased it under previous margin requirements.

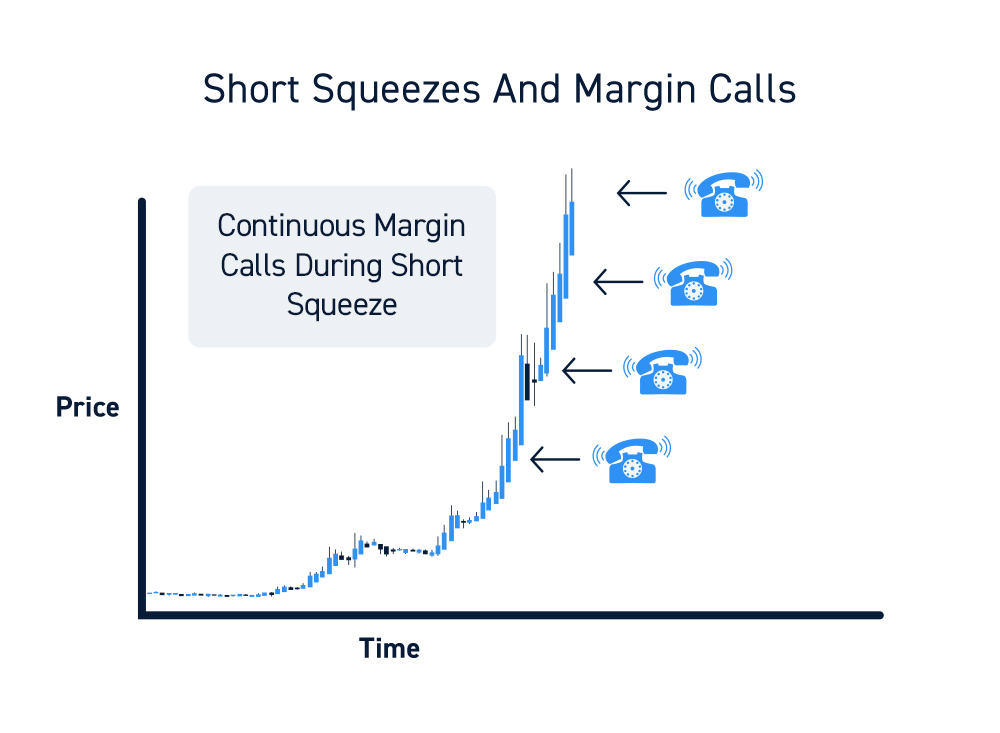

What If You Receive a Margin Call?

If you received a margin call, you can either deposit more money into the account or close out all or part of the position so that falls back under the maintenance margin. In worst case scenarios, an unmet margin call can trigger a forced liquidation where the broker automatically sells off parts, or all, of your positions. This can be detrimental in short squeeze situations where you are short a stock that is squeezing higher. A forced liquidation adds more fuel to the fire as the broker buys shares to cover in the open market which can add more buying pressure causing the stock to squeeze even higher. This is why it’s important to monitor your buying power throughout the day, not just the price of your stock positions.

Final Thoughts

Your buying power is your trading fuel and you should always pay attention to the fuel gauge. Consider your buying power before making any trade, and consider the margin maintenance requirements to make sure you have enough funds to trade without receiving a margin call.