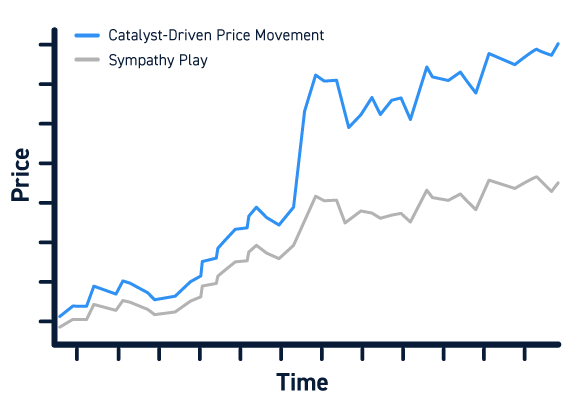

Whenever a publicly traded company releases big news that drives the share price up or down, it’s common for the company’s competitors in the same industry to see significant stock price movements as well. These ‘sympathetic’ movements offer a chance for traders to trade stock news beyond just a single company.

In this guide, we’ll explain how sympathy plays work and how you can trade them.

What is a Sympathy Play in Stocks?

A sympathy play is a trading strategy that involves trading a stock after a competing company releases significant news.

In order to understand how sympathy plays work, it’s important to understand why sympathetic moves happen in stocks. Say for example that Ford beats earnings expectations this quarter because of strong consumer demand for cars. Ford’s share price rises thanks to the beat. But investors also look at competitors like GM, which may have benefited from the same strong demand and is likely to beat earnings estimates as well.

Investors then price in new, higher expectations for GM’s earnings, pushing up the price of GM stock even though Ford is the company that made an announcement. Traders can act on this sympathy movement by riding the upward momentum – or by betting that GM will underperform and trading with the expectation of a reversal.

The act of trading these news-driven, sympathetic price movements is called a sympathy play.

What Leads to a Sympathy Play?

Sympathy plays can be driven by a variety of different catalysts. Surprise earnings reports from one company in a sector, as in the example above, are one of the most common drivers of sympathy plays. Earnings reports and corporate guidance can drive both bullish and bearish sympathy movements.

Mergers and acquisitions can also set the stage for sympathy plays. When consolidation happens in the airline industry, for example, investors may begin predicting the next big acquisition and price the companies they think will be involved accordingly.

Sympathy plays can also happen across sectors when two companies have a business relationship. For example, if one company is a supplier for another, then stronger-than-expected sales for one of those companies is a good indicator that the other will also report above-average sales.

Sometimes, the reason for a sympathy play is less obvious. A single stock may have an exceptional day even in the absence of a big announcement. Even though investors may not know exactly what’s going on, they see a hot stock and invest in its competitors on the assumption that corporate insiders or institutional investors have more information about a sector than they do.

How to Trade Sympathy Plays

While sympathy plays may seem like an easy trading strategy, it can be difficult to recognize sympathetic movements in action and even more difficult to time a sympathy play correctly.

Recognizing Sympathy Plays

The first step in approaching sympathy plays is to recognize that a price movement is sympathetic. This requires keeping an eye on market news for big announcements. These announcements need to not only have a significant impact on the company at the center of the news, but also have relevance for the company’s competitors or sector.

In addition, it’s important to understand the nature of the news. If it points to a real catalyst that’s likely to help or harm a company’s competitors, then it’s possible the entire sector could see a sustained multi-day price movement. On the other hand, if the news is fleeting and doesn’t point to deeper trends, then sympathetic price movements that result from it might be short-lived.

Identify Candidates in Advance

Many sympathy plays unfold quickly, so it helps to be prepared. You can identify candidate stocks for sympathy plays in advance by identifying correlations between companies. Simply listing companies in the same sector is a good place to start, but you can also research past price movements around earnings announcements to see which companies tend to rise and fall together.

Ideally, you’ll have lists of sympathetic stocks across multiple sectors. Then, when there’s a big announcement, you’ll know exactly what stocks to monitor for a potential sympathy play.

Scan for Sympathy Plays

You can also use stock scanning tools to identify sympathy plays as they unfold. Once you identify news that could drive a sympathy play, set up a scan within that market sector. Volume and price change filters can then help you determine which stocks, if any, have started moving.

Plan Your Trades

Once you find a sympathy play, you have to decide how you want to trade it. You can either join in on the sympathy movement and ride the momentum, or you can trade with the expectation of a reversal. Fully understanding the context and implications of the news driving a sympathy play is key to deciding how you may trade it.

In any case, it’s important to be cautious when trading sympathy plays. Sympathetic movements can be highly volatile and can depend heavily on traders’ emotions, especially when they first take off.

Conclusion

Big news from a publicly traded company can often drive sympathetic movements in the stock prices of its competitors. Sympathy plays look to take advantage of these price movements by riding the momentum or betting that the movement won’t be sustained. In order to trade sympathy plays successfully, traders need to recognize these plays quickly and understand the broader implications of the news or event that’s driving the price movements.