Your trading platform serves as both weapon and armor when engaged on the battlefield known as the stock market. The best defense is not necessarily a good offense as millions of customers discovered when their zero-commission fintech trading apps went down, locked up, and froze during the historical volatility of February 2020. Trying to reach customer support through e-mail only access underscored the structural deficiencies with these popular apps. As the saying, “You get what you pay for” reverberated throughout social and mainstream media.

What Is A Trading Platform?

A trading platform is a software that enables brokerage clients to place, execute, and manage trades. That’s what’s on the surface. Below the surface is a stable foundation that seamlessly operates low latency robust data with uninterrupted operational functionality. Prompt multi-channel customer support composed of experienced trading platform specialists accessible by phone, chat/messenger, and e-mail. A complete trading platform goes beyond just the software that’s provided by the brokerage but also the customer support that accompanies it. Platform functionality and support accessibility are inseparable.

Trading Platform vs. Trading Apps

Don’t mistake a robust full trading platform with live expert customer support to a no-frills simple-looking trading app on your smartphone. When markets experience big volatility, a true trading platform must remain stable with no downtime due to the solid network and programmed infrastructure.

An app-based “trading platform” often cannot sustain heavy periods of volatility without suffering disruptions, usually at the worst times. While passive investors with no inclination to monitor daily activity may get by with trading apps, active traders can’t take the risk of system failures. Serious traders need reliability and confidence, knowing that their armor will continue to deflect and shield against outages.

Furthermore, trading apps offer basic functionality; they do not offer the tools traders need to perform optimally.

Important Trading Platforms Features

The stability and prompt expert customer service is the defensive component of a solid trading platform that protects you from structural and mechanical disruptions. The offensive component is measured by the features it provides, enabling traders to spot opportunities, react, and execute promptly with very little wasted movements. Tools that enhance a trader’s decision-making process (i.e., interpret price action) and bolster their agility to react with conviction is the hallmark of high caliber trading platforms. Some of these essential features include:

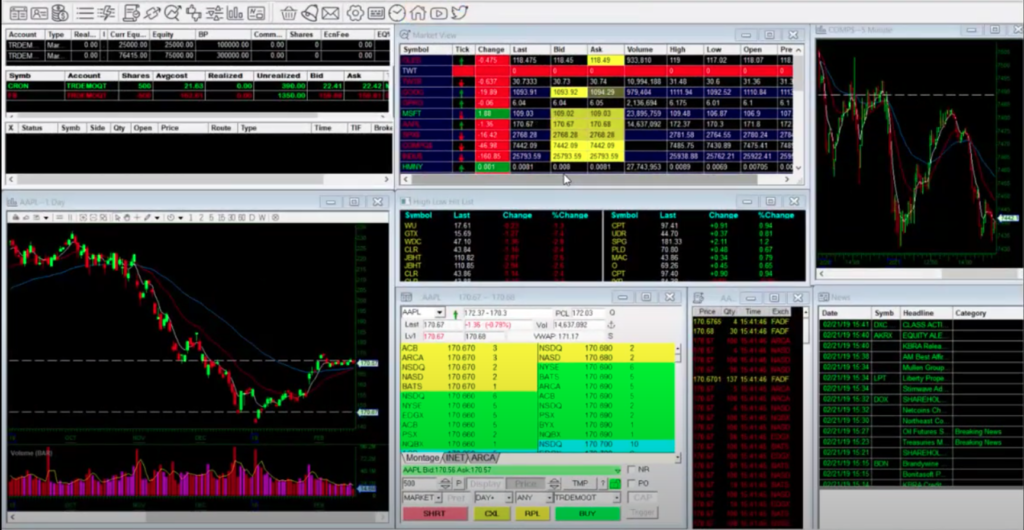

Speed is a cumulative effect generated from efficient and seamless functionality. High caliber trading platforms are built and designed with the trader in mind. Intuitive, frictionless flow from the easy layout positioning of data windows, programmable hot keys, and robust low latency data including quotes, charts, news, and signal generation.

Reliability is often taken for granted with all platforms until outlier situations occur. A solid trading platform is less likely to have network problems, freezing of data or execution issues that can impact trades. While anything can happen, access to a live person customer support in a timely manner is crucial. Zero-commission trading-app platforms are notorious for multi-day e-mail only customer service often outsourced to virtual call centers with clueless reps reading off pre-written templates.

Customization that allows traders to position layouts and windows any way they desire is critical. Every trader has their own preferences to smooth out workflows in the most seamless manner to enhance speed and efficiency. From multi-layout configuration to linking windows, programmable hot keys to routing preferences, and everything that allows a trader to tweak settings are needed are mandatory. Platforms need to be flexible to enable agility and form fit around a trader’s preferences.

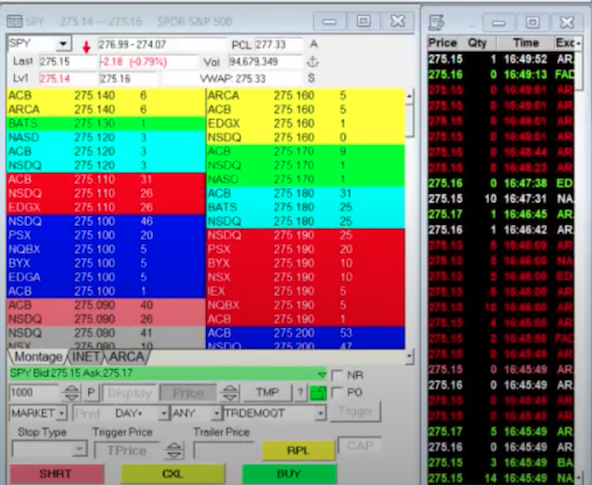

Order Management Tools are critical for minimizing market impact and optimizing execution. Direct order routing to ECNs and ATS with the ability to place hidden and iceberg orders places transparency control in your hands, not the market makers.

Data Feeds are crucial for price interpretation and tracking order placements and fills. Data feeds must be reliable, accurate, and cost-effective. Any disruptions here bring trading to a screeching halt.

Level 2 windows enable traders to quickly route their orders to any number of ECNs and ATS. Trading platforms should provide access to all ECN limit books, including NASDAQ Total View and ARCA. Detailed time and sales windows go hand in hand with level 2 screens since they can validate actual trades and not just based on level 2 movement activity. Tape readers rely on time and sales to gauge the real-time supply and demand for their tickers. The pricing on these is determined by the exchanges, but traders should have access if they choose to subscribe.

Charting is the most critical tool for interpreting price action, pattern set-ups, triggers, and signals. Advanced charting with pre and post-market charting capabilities is a must. Seasoned traders rely on the basic indicators, but their platforms should have the ability to customize and configure indicators as well as set alerts and alarms when specific prices or patterns trigger.

Hot Keys are essential shortcuts that can be performed with the stroke of a key or combination of keys. Having the ability to cancel all bids, asks, or open orders instantly rather than going through each order manually demonstrates the efficiency of hot keys. Trading platforms enable traders to execute multiple actions with a single hot key configuration. This saves time and effort and allows the trader to remain focused.

Mobile Access through a mobile version trading app of a full trading platform is an extra added convenience that allows traders to walk away from their screens. While these apps provide access and immense convenience, they are not a substitute for a full trading platform. Mobile access is a back-up add on feature used as needed, not to be relied upon for all trading activity.

Alerts are like having multiple eyes on the market simultaneously. The ability to create and adjust alerts based on price or indicator parameters takes a load off your back. A solid trading platform enables traders to quickly set alerts after determining key triggers, “Set it and forget it.”

Stock Discovery Tools help expose traders to new trading opportunities by bringing stock ideas to the forefront. These tools can be price and pattern scanners that filter through watch lists or market criteria. New intraday high/low lists that update in real-time provides a constant flow of tradeable candidates for continuation or reversion trades. Newsfeeds can help traders interpret the underlying catalysts driving share prices or provide an opportunity to take a position ahead of the latecomers.

Options Trading Tools for traders seeking to implement options strategies for directional, hedging, or income generation purposes can be an additional source of opportunity. Options can help lever trade ideas with less upfront capital. Solid trading platforms should provide the tools, including reliable options chains, advanced order types enabling multi-leg executions. Important data metrics include real-time tracking of the Greeks (delta, theta, gamma) and volatility measurement and outcome trajectory tools.