While the era of zero-commission trading has arrived, traders are finding out the hard way that you get what you pay for. From trading outages to stuck orders with delayed confirmations to horrible order fills, the gamut of maladies gets exposed during times of major volatility.

Seasoned traders understand that while the markets can’t be controlled, order routing can.

Regular Brokers vs. Direct Market Access Brokers

There are generally two types of online brokers.

The typical discount brokers usually charge per trade (or now offer zero-commission equity and ETF trading). Customers are allowed to place market orders, limit orders, and a few advanced orders. While the platforms appear to have all the “bells and whistles”, they don’t allow direct order routing meaning all orders are automatically routed in-house.

Orders are routed to the broker before they hit the market (a small, but important detail). Discount brokers may sell order flow to various third parties and/or trade against clients’ orders. Since these brokers cater primarily to long-term investors, this doesn’t present much of a problem. Investors tend to be less sensitive to execution speed and fill prices (within reason). To these investors, the commission cost-savings are worth it, however day traders require more control over their order flow. This is where direct market access brokers come in.

Direct market access (DMA) brokers are specialized brokers that enable clients to take control of their order routing. Clients generally have access to market makers, electronic communication networks (ECNs), stock exchanges and alternative trading systems (ATS).

Traders who utilize DMA brokers can select the destination of their trade orders or use algorithmic smart routing. DMA brokers charge a base commission per trade and/or per share in addition to passthrough fees and/or rebates depending on the chosen route and price limit of the order (i.e. maker or taker). These brokers accommodate active traders who place a high value on control, liquidity and transparency with their fills.

To better understand the difference, let’s look at what happens when you place a trade.

What Happens to Your Order After You Click Buy or Sell?

A complicated sequence of events occur when you submit a trade order.

For regular brokers, the order is delivered in-house to be worked by their own market makers or outsourced to preferred third-party broker-dealers via order flow agreements. The quality of the fills depends on inventory, liquidity and volatility. In calm markets, traders may not notice too many discrepancies with their order fills. However, in fast and volatile markets, the discrepancies can become more apparent. Limit orders may become tougher to fill completely and market orders may result in unpredictable fills. Trade confirmations may also take longer to complete.

Direct Market Access brokers have a different process.

Trade orders placed through a DMA broker get sent directly to the ECN, ATS, stock exchange, dark pool or market maker that the trader specifies. If routed directly to an ECN limit book, the order can also include many additional augmentations (IE: hidden and iceberg). Orders that match the limit book get filled instantaneously usually in fractions of a one-second with confirmations.

At this point, you may be wondering what an order route is.

What is an Order Route?

An order route is the selected destination where an order is sent to be filled. Your order route can determine the speed with which your order does/doesn’t get filled and the price at which your order is filled.

Orders can be sent to a national stock exchange (IE: NYSE, NASDAQ, AMEX) where market makers compete to fill your order, or to an ECN or alternate trading system (which include dark pools and smart routes).

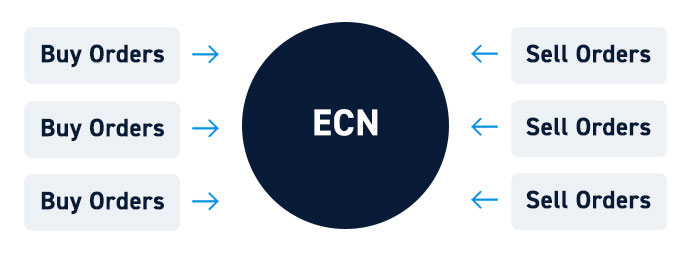

ECNs were originally created to bypass the proverbial “middlemen” like specialists and market makers, who would manually match up orders and use their own capital to provide liquidity. This gave the middlemen too much control and transparency. This ushered in the era of electronic order books where supply and demand were clearly displayed and available for the taking (as buyers would directly engage with sellers).

As ECNs evolved, the need to minimize transparency to avoid market impact became such a top priority that completely invisible ECNs known as dark pools emerged. These order books are completely invisible showing no bid prices, ask prices, or order size. Trades would only be shown on the time and sales after execution. Institutions used dark pools to trade massive sized blocks amongst each other. The largest ECNs and dark pools have established themselves as ATS, as they compete for order flow and liquidity.

Types of Order Routes

There are three major U.S. stock exchanges: NYSE, AMEX and NASDAQ. These exchanges also own smaller exchanges (IE: NASDAQ owns the PHLX (Philadelphia Stock Exchange) and BSE (Boston Stock Exchange).

Orders routed to these exchanges get filled by a specialist (NYSE and AMEX) or market makers (NASDAQ).

Outside of these exchanges, ECNs and ATS bypass the middlemen to connect buyers and sellers directly and sometimes very discreetly. The most popular ECN/ATS are ARCA, INET/ISLD, EDGE, BATS and BTRD.

A level 2 screen enables access to these ECNs, ATS, and market makers.

How to Take Control of Your Order Routing

In order to take control of your order routing, you need to have an account with a direct market access broker.

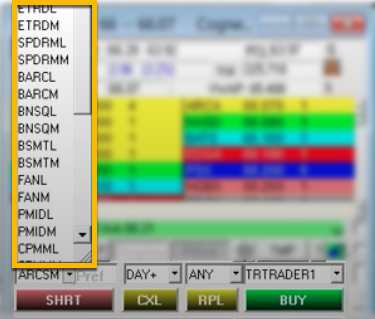

Using a DMA broker enables you to pick and choose the order route for your trades. When placing an order with a DMA broker, you will have the option to choose which route you’d like to send your order to.

You can also configure a pre-set sequence of order routes. This comes in handy when a stock may have thinner liquidity or even in cases where a stock has tremendous liquidity (i.e. collecting rebates by routing entries on cheaper ECNs and exits on higher rebate ECNs).

Benefits of DMA and Order Routing

There are many benefits of using a DMA for order routing.

Direct routing enables much faster executions, confirmations and cancels. It also enables potentially better fills and liquidity since you may route directly to an ECN that may be showing large size on level 2. This is especially helpful during pre-market and post-market trading periods where liquidity thins out without the presence of market makers. In certain situations, speed of execution can make the difference between participating in a trade and sitting on the sidelines.

Another important benefit of direct routing is the ability to place “hidden” orders that are invisible on the limit books. This enables you to buy or sell larger sized orders without showing it on the order book, which can make an immediate market impact against you (i.e. displaying 10,000 shares to sell on the inside ask can cause bidders to quickly step off and sellers to step in front of your order).

ECNs also enable “iceberg” orders which let you display a smaller size while trying to sell more shares (i.e. displaying 100 shares on the inside ask but trying to sell 3,000 shares).

Routing Fees and Rebates

In addition to broker commissions, ECNs charge passthrough fees for taking liquidity (i.e. buying on the inside ask and selling on the inside bid).

ECNs also provide rebates for providing/making liquidity (i.e. buying on the inside bid and selling on the inside ask), meaning you can actually get paid for your order flow.

Using a DMA broker enables you to configure a pre-set sequence of ECNs to be able to enter positions through ECNs with cheaper passthrough fees and exit on ECNs with larger rebates.

Conclusion

Direct market access brokers are ideal for active traders who seek to be in control of their order flow and want abundant access to liquidity. In heavy volume volatile trading markets, direct access routing is akin to taking the EZ-PASS road while the rest of the commuters are stuck in bumper to bumper traffic. Traders who regularly like to trade the pre-market and post-market sessions will appreciate the additional liquidity choices having access to a multitude of ECNs while retail traders are limited to a single ATS. The difference in fills can be dramatic. The ability to hide transparency with hidden and iceberg orders can mean make a huge difference when trying to limit market impact with your orders while maximizing price executions.