In the world of trading, the term “route” refers to the path an order takes to get to the market. While most traditional discount brokers automatically route orders for clients, day trading brokers give clients control over their order flow.

If you’re a trader using a day trading platform, you should have the ability to route your orders. However, a simpler way to manage the order routing is by using the smart order routing, which most day trading brokers provide for clients.

What is a “Route” in the Stock Market?

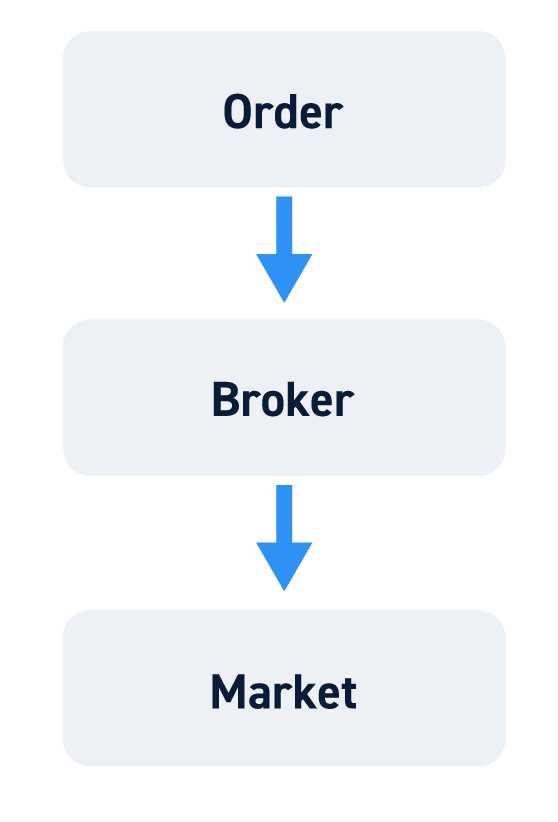

The route is the vehicle for your trade order. When you place a trade order with a regular brokerage, it gets transmitted to the broker and then to the market maker or order flow agreement partners to get executed.

The broker is the “middleman” that decides the destination for your order to fill. Often they have order flow arrangements with 3rd party liquidity providers to pay to have orders routed to them.

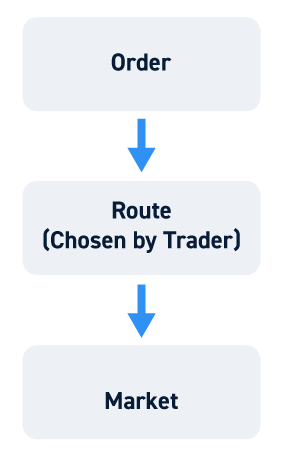

When you use most day trading brokers, you can eliminate the middleman role and route directly to your destination. This can result in faster and more efficient executions.

Types of Stock Market Routes

When you place a trade order, it can be executed to fill through many different stock market routes. However, not everyone can control which route it takes. The most common route among discount, regular, and full-service brokers is through market makers, usually in-house or outsourced to third party through order flow arrangements. Market makers and specialists work the orders sent to exchanges like the NYSE, NASDAQ, and AMEX.

If a trader is using direct market access type brokers, then they will be able to select their order routes to electronic communication networks (ECNs). ECNs are electronic order books that automatically match up buyers and sellers based solely on the best price. They provide freedom of choice and liquidity but for a price in the form of pass-through fees, which can also result in rebates if you provide liquidity (buying on the bids and selling on the asks in most cases).

What is a Smart Order Route?

Most direct access type brokers also provide smart order routes (SOR), which are algorithms that route your orders and scan for the best price and liquidity.

Smart order routes can simplify the order routing process and are preferred by many new traders and active traders. Doing so can eliminate the effort of directly routing each order manually. Smart routes are an efficient and easy way to utilize order routing for self-directed traders.

Types of Smart Order Routes

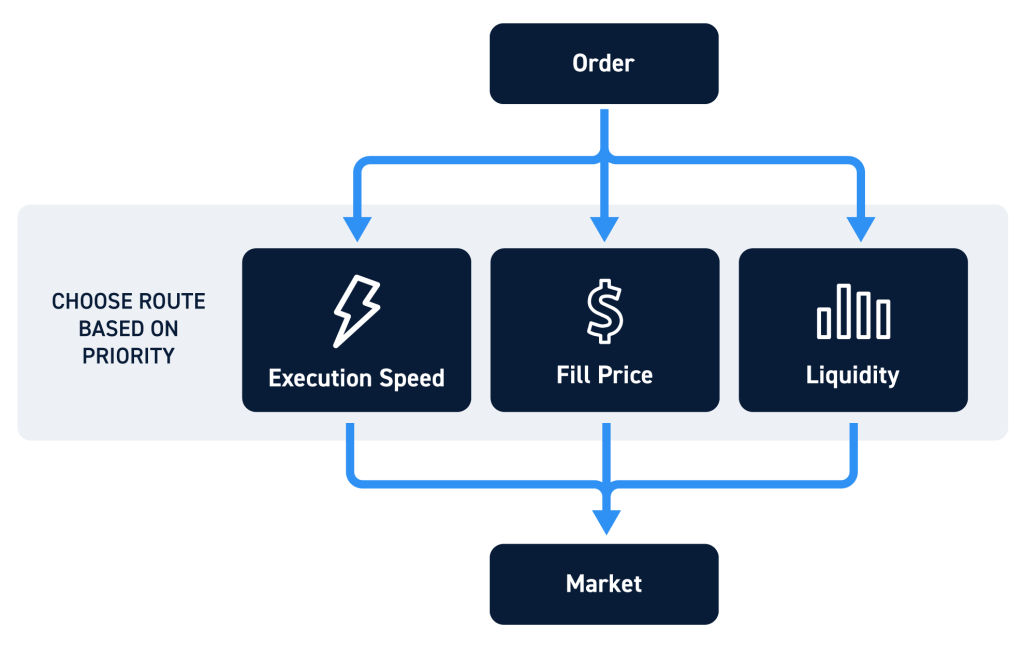

Smart order routes are programmatic routes that come preconfigured but can also be modified to for certain preferences. The goal is to find the most efficient route for your order. This means an order can be broken up into multiple pieces as the algorithm selects and executes on the most efficient routes.

Smart order routes are usually configured to meet a certain objective. Some may favor fill speed rate over the fill price and vice versa. Keep in mind that access to various order routes is contingent on the access provided by your broker. Brokers offer differing sources to order routes and dark pools.

Smart Order Route Configurations

Smart order routes may be configured in a variety of ways.

You can set the smart route to prioritize dark pools, depending on the accessibility your broker provides. Dark pools have no posted bid or asks, they are hidden from the lit market (thus dark).

You can prioritize smart order routing to improve liquidity, which means getting your share requests filled even if the price is higher or lower depending on whether it’s a buy or sell.

Smart order routing can be configured to improve fill prices, which means to only fill your orders up to your limit price.

You can also utilize dynamic ratio indicators to target specific fill prices like the volume-weighted average price (VWAP) or time-weighted average price (TWAP).

Benefits of Smart Routes

Smart routes are simple to use, fast, convenient, and automated. They take the leg work out of order routing. The benefits of using smart routes boils down to three advantages over manually routing orders.

They can provide excellent executions since the algorithms are very fast and simultaneously scan the routes to meet your execution preferences faster than any human can.

In doing so, they can also provide improved liquidity as these algorithms can route orders to multiple destinations to fill your requested share size amounts. You may want several thousand shares of XYZ at a certain limit price. The smart order route may fill your order partially through three different ECNs and a dark pool within seconds. This results in improved fill prices as the smart route searches for the best fill prices simultaneously.

Should You Be Using Smart Routes?

If you have a preferred ECN or ATS then you may consider continuing to use that as your primary source. However, if you don’t mind utilizing multiple routes to get your execution, then consider smart routes.

Often times you can configure the smart order routes to specify which destinations and prioritize the order of the scans as well. If ARCA is your preferred ECN, then you may be able to set it as the first priority in the smart route.

Ultimately, it boils down to your objectives like price or liquidity. It’s best to test multiple routing options offered by your broker. Only through this effort will you be able to find the best executions for your style of trading and match your preferences to meet your strategy requirements.