Public stock exchanges rely on professional participants committed to providing liquidity in particular stocks. These participants undertake the role of wholesalers and dealers that commit firm capital to openly compete with each other to fill trade orders. They are essential infrastructure components that keep publicly traded stock markets robust, liquid and fluid.

What Is A Market Maker?

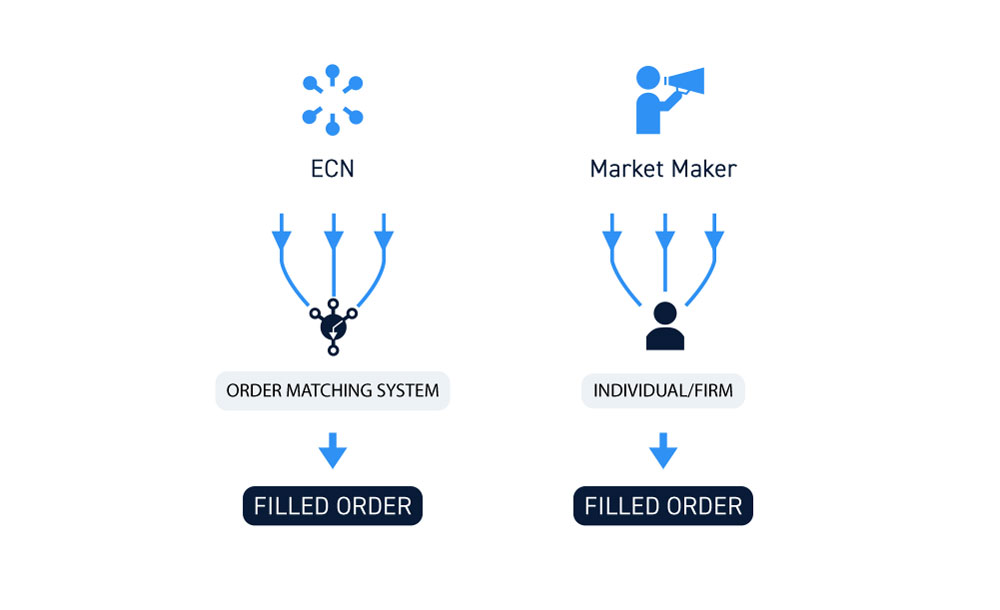

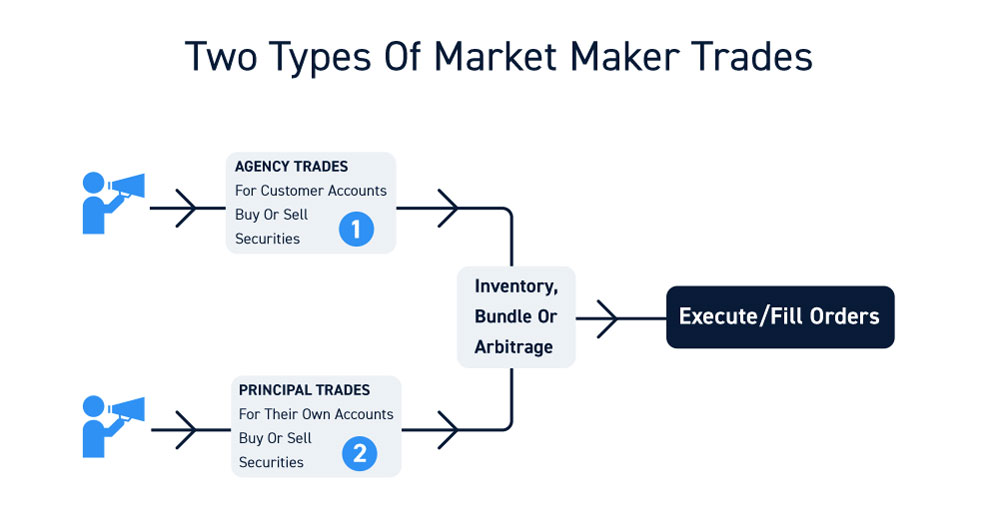

Market makers are exchange member firms composed of individual dealers that commit firm capital to compete for order flow in particular stocks. These firms conduct two types of trades. They buy and sell securities for customer accounts (referred to as agency trades) and for their own firm accounts (referred to a principal trades). While brokers facilitate trade orders from buyers and sellers, market makers actually execute/fill them. Market makers can deal directly from their inventory, bundle client orders and/or arbitrage spreads to generate profits. Originally created for the NASDAQ stock exchange, market makers also co-exist on listed exchanges including the NYSE and AMEX as third-party market makers competing with each other and specialists.

Market Maker Responsibilities

Market makers are mandated to be willing buyers and sellers at the national best bid offer (NBBO) for stocks they make a market in. They are obligated to post and honor their bid and ask (two-sided) quotes in their registered stocks.

There are three primary types of market making firms based on their specialization: retail, institutional and wholesale.

Retail market makers service retail brokerage customer orders.

Institutional market makers specialize in working large block orders for mutual funds, pension funds, insurance companies and asset management companies.

Retail and institutional market makers tend to keep a large inventory on hand, whereas wholesalers try to remain as risk averse as possible in terms of capital commitment.

Wholesalers trade shares for institutional clients and various broker-dealers not registered as market makers in particular stocks. Wholesalers deal in large volume pools often utilizing high frequency trading programs to optimize bundling and spread arbitrage strategies. These firms are also notorious for order flow arrangements compensating brokerages that direct customer orders to them.

Who Are The Market Makers?

Large retail brokers tend to use inhouse market makers as well as clear their own trades. Broker-dealers with institutional clientele like Goldman Sachs, JPMorgan and Morgan Stanley specialize in institutional market making as well as retail client orders. Wholesalers have order flow arrangements with various broker-dealers as well as fintech trading apps. Some of the largest wholesalers include G1 Executions Services, Apex Clearing Corporation, Citadel Securities, Virtu Financial and Two Sigma Securities.

Market Makers vs. ECNs

Electronic communications networks (ECNs) are the primary competitors to market makers. These electronic limit books and alternate trading systems (ATS) enable traders to take control of their executions with direct order routing. The competition with ECNs is one of the key reasons that wholesalers arrange order flow agreements to incentivize retail brokers to send their customer orders. This is especially rampant with zero-commission trading apps.

Can Market Makers Manipulate Stocks?

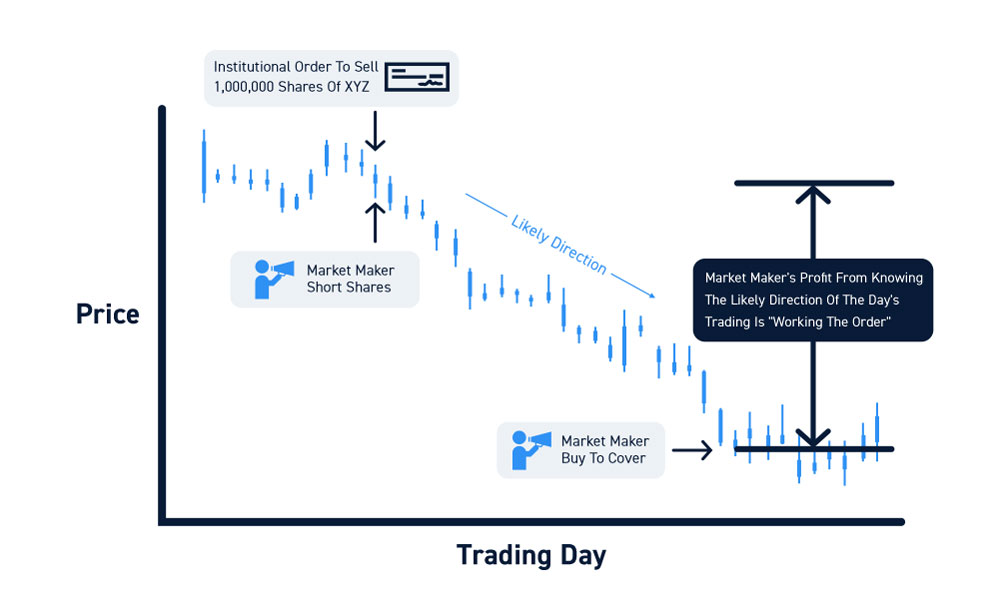

The possibility for manipulation by market makers always exists. However, the definition of manipulation is a grey area. If a market maker wants to push down a stock price, then they take the risk of getting squeezed and vice versa. However, if a market maker has an institutional order to sell 1,000,000 shares of XYZ, chances are it will make a negative material impact on the share price. The market maker would “work” the order by shorting stock in the open market and close out the trade by purchasing the institutional order. Market makers are allowed to make agency trades and principle trades so if they short an additional 50,000 shares knowing they can drive down the price to cover, it’s doable and not illegal.

Are Market Maker Signals Real?

There was a time where “ax” market makers had the clout to trigger self-fulfilling prophecy like signals. For example, GSCO absorbing shares on the inside bid would trigger traders to step in front and cause prices to rise. However, those days are long gone as the name of the game is to hide transparency to minimize market impact. This has fueled the risk of ECNs and ATS including dark pools. Market makers rarely attempt to show transparency these days.

How Do Market Makers Make Money?

They arbitrage spreads, fills and can take the other side of customer orders. They have unlimited capital and can perform naked shorts. They often utilize high frequency trading programs under the guise of volume participation programs to execute these arbitrage strategies.

What Should Traders Pay Attention To?

Traders should pay more attention to time and sales over level 2 screens since those are actual trades versus the “intent” of trades. When you see a level 2 screen gyrating violently as bid/ask spreads gyrate wildly, but very few trades get posted on time and sales, it’s a sign of spoof attempts or manipulation. Many traders believe that market makers love to intentionally trigger knee jerk and panic reactions.

Routing properly to improve executions is the best way to avoid potential market maker induced shakeouts and impulse trades. Using a direct market access (DMA) broker to control your order routing ensures that market makers won’t take the other side of your trades. ECNs are the bane of market makers and empower individual traders with market maker-like features like placing hidden and iceberg orders.

Pay attention to the order flow of market makers with big volume. The massive electronic wholesalers are notorious for order flow arrangements with retail broker-dealers. They often take the other side of trades so it’s prudent to spot when they are too committed to one side or the other.

Be conscious of misdirection whether from traders or market makers. Be aware of late prints as well as hidden and iceberg orders on time and sales. When you see just 100 shares offered on the inside ask but time and sales prints over 10,000 shares executed at that price, it tells you there is a heavy hidden seller. The faster you spot this, the quicker you can avoid or trade the fade as participants panic out. While spoofing is illegal, it can still be present in thinner traded stocks where level 2 shows a lot of activity but actual trades on time and sales is minimal. Be careful not to chase these stocks, but rather use hidden or iceberg orders to enter on pullbacks.

The tightening of spreads and migration to ECNs and ATS have thinned out the number of market-making firms. To defend against a ‘stacked deck’ on your order fills, it’s prudent to consider using a DMA broker that enables direct order routing platforms for instant and transparent executions.