When hedge funds and institutional investors buy and sell shares, they often do so in large quantities. These large trades, known as block trades, can be big enough to move the price of a stock. So, it’s important for traders to be able to recognize when block trades are happening and to know how to respond.

In this guide, we’ll explain what block trades are, why they matter, and factors to consider when you spot a block trade.

What is a Block Trade?

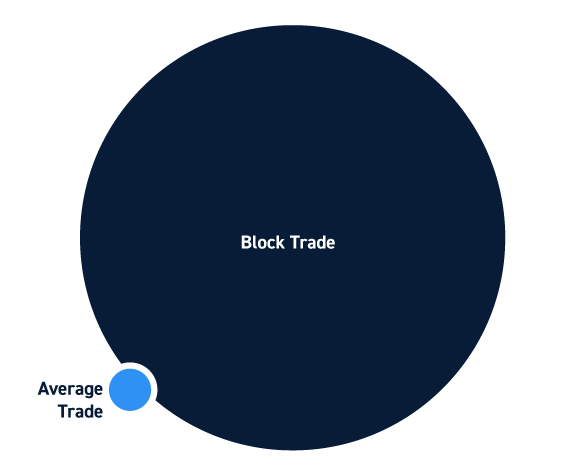

A block trade is a large trade that involves more than 10,000 shares of stock or $200,000 worth of bonds. Most block trades are significantly larger, representing millions of dollars worth of stock.

It’s important to remember that large trades over 10,000 shares might be normal for large-cap stocks. When evaluating a block trade, it’s a good idea to compare the size of the trade against the average trade size and average daily trading volume.

Block trades can take place on the open market, or they may be arranged privately between two parties. When making a block trade on the open market, institutional investors generally try to avoid attracting attention so that they don’t move the price of a stock as their trade is executed. Otherwise, sellers would drive down the price of the stock as they’re selling shares and buyers would drive up the price as they’re buying shares.

To achieve this, hedge funds and institutional investors typically place block trades through blockhouses. These are specialized trading houses that can split a block trade into smaller chunks and execute a series of trades through multiple brokerages. Blockhouses can also help arrange deals with other institutions to keep block trades out of the public market.

Block Trade Examples

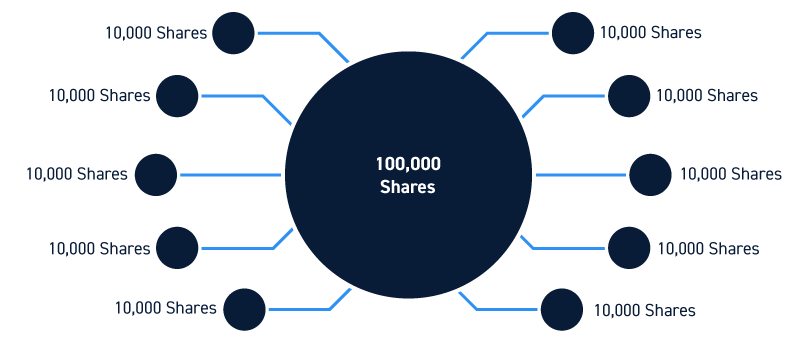

Say an institutional investor wants to sell 100,000 shares of stock. That represents tens of millions of dollars in stock. Even for a highly liquid stock, it’s likely that such a trade would temporarily drive down prices since supply would greatly exceed demand.

In that case, the institutional investor can go to a blockhouse, which might split the shares into 10 blocks of 10,000 shares each. These blocks will each be sold through a different brokerage firm, masking the overall size of the trade and helping mitigate the impact of the shares on the overall market.

If an institutional investor wants to buy 100,000 shares, they might similarly use a blockhouse to split the purchase order among several brokerages.

Alternatively, a blockhouse can help arrange a transaction directly between an institutional investor that wants to sell shares and one or more institutional investors that want to buy shares. This transaction will take place outside the public markets at a preset price.

Why Do Block Trades Matter?

Block trades aren’t necessarily important in and of themselves. Rather, they can be significant if they reveal something about an institutional investor’s intentions. For example, if a block trade indicates that a hedge fund is unloading their position in a company, that could be a sign that the fund thinks the company’s price will fall.

On the other hand, a hedge fund could simply be selling shares to gain liquidity or to hedge against another position. Without knowing more about the reasoning behind a block trade, it’s important not to overreact to a large buy or sell order.

Considerations for Evaluating Block Trades

There are several things to consider when deciding whether a block trade is relevant to your own trading.

Size

The size of a block trade matters a lot. If an institutional investor buys $1 million of stock from a company worth $100 billion, it’s probably not that big a deal. On the other hand, a trade worth $10 million or more could be quite significant and trigger more buying activity around the stock.

Price Impacts

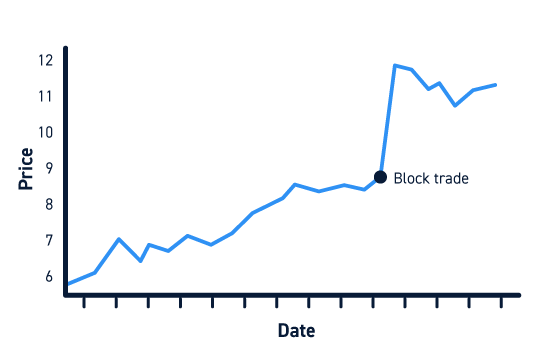

While institutional investors and blockhouses try not to move a stock’s price when executing block trades, larger trades will often have an impact. The size of this price impact is important – a 0.1% price change might not mean much, but a 1% price movement is enough for traders to take notice.

Trading Trends

A single block trade on its own is difficult to interpret. Traders can’t necessarily know the reason behind the trade. However, if there is a series of block trades in the same stock over the course of a day or a week, that could be an indicator that an institutional investor believes the stock is set to rise or fall.

“Fake” Block Trades

Be wary of “fake” block trades that can show up on the trade tape. These large trades may be the result of dark pools or market maker consolidation, and they’re actually an amalgamation of many smaller trades.

News and Other Signals

While block trades can be informative, they’re just one signal among many. Use market news to get clues as to who might be buying or selling and why. Look at other indicators to decide whether there is an entry or exit point for a trade.

Conclusion

Block trades are large trades that are typically placed by hedge funds, investment banks, and other institutional investors.

Large block trades may signal that an institutional investor is bullish or bearish on a particular company, but they can also occur for a variety of other reasons that don’t necessarily indicate a change in sentiment. Traders should keep an eye on block trades and look for patterns, but it’s important not to overreact to a single block trade.