While day trading and investing share the same goal of making a profit in the stock market, the two approaches are quite different. Day trading implies short term trading composed of buying and selling positions within minutes to hours, while investing has a longer holding period that can last years. There are general and specific distinctions between the two and it’s prudent to be aware of them.

What is Investing?

Investing is the process of buying assets like stocks for the purpose of passive value appreciation over time. The idea of ‘putting your money to work’ is the core theme of investing.

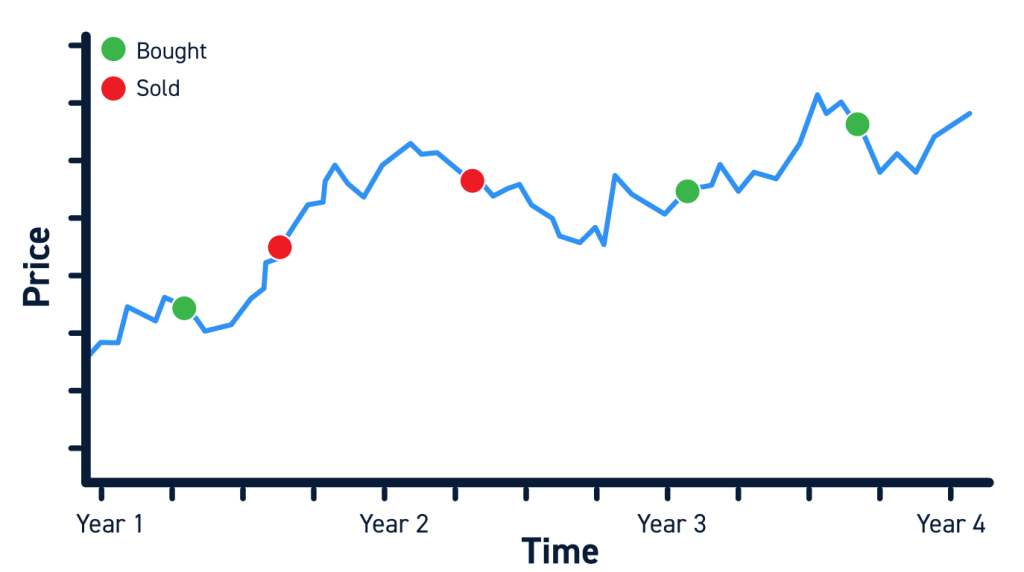

Investing is considered a passive activity requiring little oversight assuming that equity markets ultimately move higher with time. Investing relies on the fundamentals of the underlying company. The holding time can span years up until retirement if done in an IRA or 401K account. The goal is to benefit from compounding gains over time as stock markets move higher.

Passive and long-term are the two key elements to investing.

What is Day Trading?

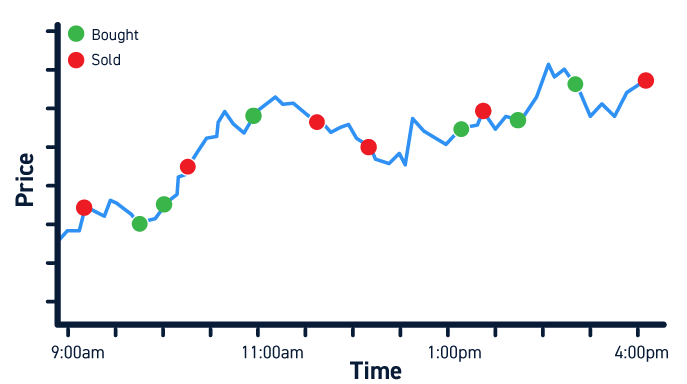

Day trading is the process of actively buying and selling stocks intraday with the goal of profiting off of the underlying price action. Day trading requires active participation to create and execute on a trading plan.

Day trading doesn’t rely too much on the company’s fundamentals, but rather the stock’s technicals. The holding time can range from minutes to hours, but positions are closed out by the end of the day. Day traders don’t hold positions overnight as the risk of gapping against their position is great.

Active and short-term are the two key elements of day trading. Both endeavors carry risk of losses.

Similarities Between Day Trading and Investing

While day trading and investing are two different strategies, they also share similarities. The broad objective of both is ultimately to make profits from stock price fluctuations usually on the long side. To achieve this goal, both have overlapping tools that can be applied for this end.

Both require the use of a brokerage to be able to place and execute trades. Basic analysis tools can be utilized including stock charts, news releases, and fundamental research. Taxes are required to be paid when profits are made for both as well.

Differences Between Day Trading and Investing

The differences between day trading and investing is what really sets them apart. Since the differences are so critical, let’s examine them in more detail.

Specific Objective

While the goal of both day trading and investing is to make profits, their specific objectives are a bit different.

Traders take advantage of short-term price action to enter and exit trades for a profit. Every position is a means to an end based solely on price.

Investing in a stock represents buying into a company and caring about the underlying operations. Investors have voting rights and are considered shareholders that benefit on the success of the company’s performance.

Timeframe

Traders focus on shorter time periods and primarily intraday but can last a few days or even weeks at most. Investors usually have holding periods that last years and even decades. Traders utilize short time frame charts that can range from one-minute to 60-minute intraday charts up to daily charts. Investors have such long-term time frames that weekly and monthly charts are often used to gauge the much broader price trends.

Frequency

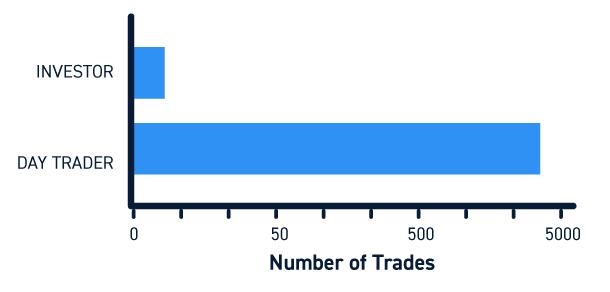

Traders can place hundreds to thousands of trades a year. Active traders trade a universe of hundreds of different stock symbols. Investors rarely trade more than a few times a year with a handful of stocks. Trading is an active endeavor where the trader is expected to cut losses quickly and maximize winners but still within a short time period. Trading requires implementing stop-losses to avoid blowing up or losing all of the capital in the account in short order. Investing is a passive endeavor where losses or profits are carried for a longer time horizon with the belief that the markets ultimately rises higher in the long run.

Risk

While both trading and investing carry risk, day trading is much riskier. Risk in trading is the product of a few factors:

- Frequency of Trading

- Position Sizing

- Volatility

- Margin

- Short Selling

Day trading often relies on the use of margin. Day traders can use 4X leverage intraday. While this enables bigger profits using more shares, it also enables larger losses in small price moves. A margin account also enables traders to short sell stocks. Short selling is much riskier than going long since the losses are unlimited. Investing predominantly consists of buying and holding positions on the long side of the market. There is usually very little short-selling with investors.

Portfolio Performance

Investors seek long-term profits to match or outperform the S&P 500 benchmark index. The day-to-day performance doesn’t really affect investors as they are focused on the long-term picture. Investors expect an average return of 10% to 20% annually which compounds during the life of the investment.

Day traders try to earn profits every day as positive performance can run into triple digits on just a single stock on the good side or blow up with potential margin calls on the bad side. Traders measure their performance on a daily basis.

Stock Types

Traders focus on volume and volatility that create tradeable price action. Stocks are simply a vehicle for trading even if the underlying company has terrific or horrible financials. Investors try to buy into companies with strong fundamentals worthy enough to hold longer term. Investors may also buy stocks they feel are undervalued or a turnaround situation where horrible financial metrics are being turned around. Investors view stocks as companies, traders view them as three or four letter opportunities.

Analysis Style

Traders tend to favor technical analysis which utilizes charts and indicators. Traders analyze price action by looking for high-probability price patterns. Traders place precision trades that predict short-term price moves. Investors tend to favor fundamental analysis which utilizes financial metrics, strategy, news, and valuations to analyze long-term company performance. Investors tend to buy and hold for the long-term and stick with the company through the peaks and valleys.

Tools Needed

Traders and investors utilize different tools. Traders need a day trading broker that provides access to direct order routing on their trading platform for better executions. Traders also need charts with technical indicators, which can be configured to best refine trading signals. Investors need a much less sophisticated brokerage to be able to buy and sell their investment positions. Basic charts provided by brokers through the internet or mobile app tend to be adequate for investors.

Taxes

When it comes to taxes on profits, there is a distinction between short-term capital gains and long-term capital gains. Short-term capital gains tax is applied to positions bought and sold in less than one-year. Long-term capital gains tax is applied to positions bought and held for more than one-year before being sold. The tax rate depends on income but can range from 0%-20%. Active traders should find an accountant familiar with their trading strategy based on the financial implications.

Wash-Sales Rule

The wash-sale rule applies when a stock is sold at a loss and then repurchased within 30 days. When this happens, the initial loss can’t be claimed for taxes. Therefore, investors need to wait at least 31 days before buying back into the same stock.

PDT Rule

The pattern day trader rule applies to traders, usually not investors. The rule states that you must have at least $25,000 capital in your trading account to day trade with margin. Balances that fall under the $25,000 threshold are limited to just three roundtrip trades (buy and sell in the same stock within the same day) every five business days on a rolling basis. A violation of the PDT rule can result in suspension of your trading for 90-days. Since investors hold for long-term the PDT rule doesn’t usually impact their account.

Conclusion

While trading and investing share some similarities, they are more different than they are alike. Active traders must not confuse investing principles with trading principles if they want to achieve long-term success.