New traders are highly encouraged to use trading simulators prior to trading with real cash. Even seasoned veterans recovering from a losing streak can rehabilitate themselves with simulators.

The purpose of simulators is to properly “test” out your strategies and familiarize yourself with the process of game planning and managing trades. However, don’t make the mistake of assuming the results on a simulator are identical to real life trades. This misguided assumption has spawned many cautionary tales of newbie traders blowing out real accounts after being “successful” on a simulator.

The Process of Becoming a Successful Trader

Just as with any endeavor, trading success requires crossing a learning curve. The learning curve is similar but also different for everyone.

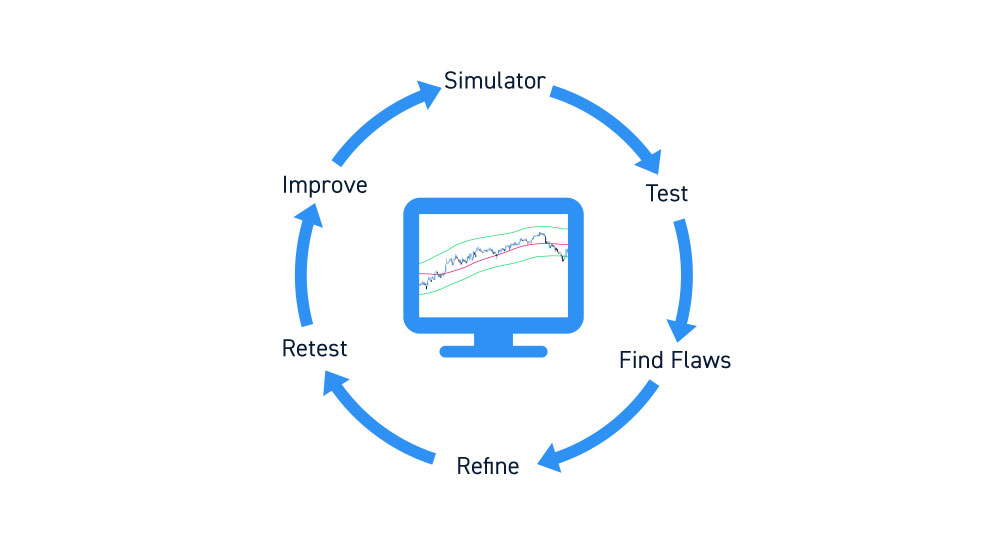

The sequence is to learn, test, optimize and repeat.

Learn what? Methods, strategies, processes, planning and execution are all part of the learning curve. The goal is to acclimate yourself from the basics to the familiarizing yourself to the nuances of trading. It’s a constant work in progress. The learning curve can be expensive when using real cash. This is where trading simulators come into play by helping alleviating some of the trial and error costs that can whittle down your trading capital. Simulators help you “test” first, before going live.

The Importance of Testing Your Trading Strategy

Day trading is difficult, make no bones about it. If it were easy, then everyone would be doing it. Incidentally, literally “everyone” was doing it during the year 2000 internet bubble. That didn’t last long as the subsequent market meltdown eliminated a majority of them and cast a bad shadow on the term “day trading”.

In the two decades since the internet bubble, technology has improved, and newcomers are abundant. However, keep in mind, the markets will exploit your flaws sooner or later. There is a difference between being lucky and being skilled. If you get lucky, spend that time to get skilled. Skilled traders find an edge, lucky traders think they found an edge (that “everyone” is using) until the luck runs out.

Testing your strategy gives you the opportunity to analyze it’s viability and effectiveness without risking your capital.

Here are a few of the reasons why testing is so important.

Rule #1: Protect Your Capital

Your trading capital is your lifeblood as a trader. It’s the key to longevity. Treat it as if it was your real baby. Simulators are like training wheels so that you can gain familiarity and confidence in your trading strategy, before you trade real money.

Protect Yourself from the Unknown

You only know what you know. If you haven’t been exposed to it yet, you will find out. Pain is the best teacher, but it doesn’t have to be at the cost of your capital. Why risk your hard-earned money on an unproven strategy? Test it on a trading simulator throughout all types of market conditions looking for flaws so you can find the vulnerabilities.

Refine Your Strategy

Here’s where trading simulators help the most if utilized properly. Find the flaws in new or existing strategies, so you can refine them. Losses on a simulator don’t hurt. By taking away the emotional part of losing money, it keeps your head level enough to maintain a clinical mode for finding maladies.

Getting Started With Trading Simulators

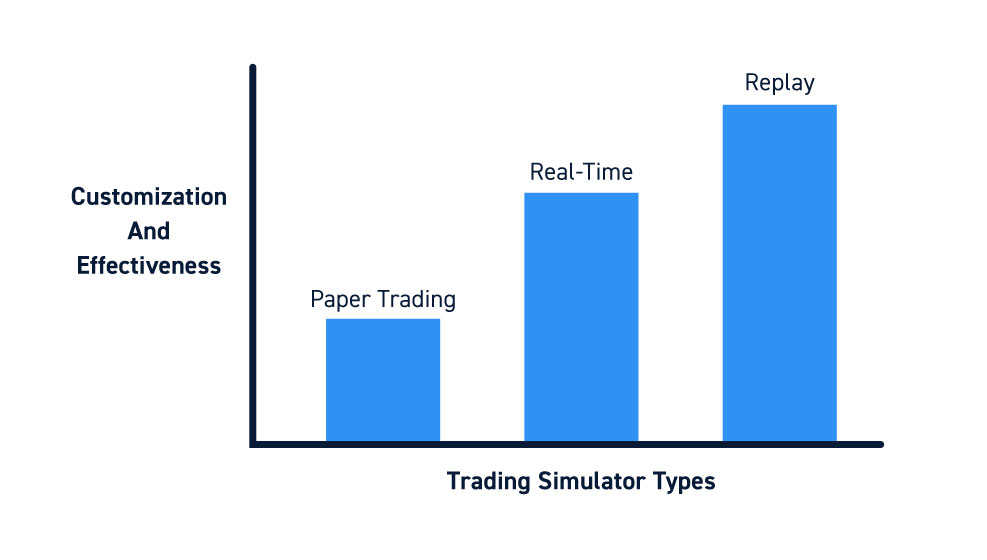

When it comes to trading simulators, there are three basic types. The goal of each is to simulate a real trading environment.

Paper trading is a basic form of “simulated trading” where you basically post trades on paper and analyze the results. For example, you may say, “I would have bought 100 shares of $XYZ at $15 and sold them at $16.” You would log all of these paper trades to see how effective your strategy is.

The problem is that it’s too easy to assume proper trade fills and hypothetical exits after the fact. This is purely theoretical and serves no execution authenticity. It can help in terms seeing how a trade patterns play out but be careful not to curve-fit results.

Real-time simulators enable you to actually click the buy and sell buttons on a trading platform to place trades in real-time with fake money. It’s more realistic in that it places you right in the action having to make decisions in real-time as the market action unfolds. It enables you to get closer to the “real” thing but don’t make the mistake of assuming fake money profits are anything close to reality.

Replay simulators actually replay the historical market data at your convenience to simulate placing you selected periods in time. It’s like using a time machine and placing yourself back in time to make decisions and see how the actual outcomes unfolded. This enables you to trade and immediately see how it would have played out. This is a great way to back-test strategies but be careful not to curve fit results here.

Mistakes to Avoid When Using Simulators

With all the benefits of using a trading simulator, they are also prone to misuse which can actually hurt your progress. Familiarize yourself with these common mistakes to avoid so you can spot them and immediately get back on the right path.

Using Unrealistic Trading Size

This is at the top of the list for a reason. Maxing out leverage to take the maximum size on a trade and “letting it ride” through massive losses until it becomes a massive profit sounds ridiculous, right? What’s even more ridiculous is when the trader believes they would have made a massive profit in real life and decides not to waste any more time on a simulator when they could be making big profits with cash.

This sounds naive and dangerous, but it happens more often that you think. This disaster starts when newbies get frustrated and just max out size on simulator trades. Don’t be a cautionary tale. Use realistic trading size and focus on the trade, not the imaginary profits (or losses) you see on the screen.

If you are going to trade with A $30,000 account, you shouldn’t be paper trading with a $300,000 portfolio. Remember, your goal is to simulate a real trading environment.

Using Trading Strategies that Aren’t Relevant

Even though real cash isn’t on the line, you shouldn’t be taking trades you normally wouldn’t. Remember that the simulator is an educational tool to stimulate your decision-making process in real-time. This means simulating the trade size, strategy and management you would be implementing with real cash.

Don’t trade 10,000 shares of a stock and strategy you wouldn’t normally trade, just to “test” if it will work out. Look for high probability set-ups and execute realistic sizes, entries and exits. Take stop-losses when the conditions change, instead of maxing out shares on low probability as if you were playing a video game.

It’s easy to get caught up in the “game” component of a simulator, but you need to remember that the simulator is an educational tool. Your goal is to test the exact strategy you plan to trade with real cash.

Ignoring the Emotional Component

This is also an inherent flaw with trading simulators. The transition from simulator to cash doesn’t consider the emotional components of fear, greed, panic and frustration. Former Heavyweight Boxing Champion “Iron” Mike Tyson put it best when he said, “Everyone has a plan… until they get punched in the mouth!”. Trading simulators are like fighting in a sumo wrestler suit, there is no actual pain.

Unfortunately, this can spawn a false sense of confidence that can get shattered when trading real money. Remember that you are creating templates and habits whether you are aware of it or not when using a trading simulator. Bad habits can spawn by misusing simulators. The most dangerous is going on “TILT” out of frustration and or fear during real money trading. If you’re frame of reference is just throwing hail Mary maxed size trades when you’re in the red on a simulator, it can shape your mindset when trading real money.

If a (-$500) trading loss hurts in a real account, then it should hurt as much in a simulator too. Convince yourself of that and be conscious of when you’re not being realistic.

Being Impatient

Crossing the learning curve is a slow process, which a trading simulator can help accelerate if used properly. However, some traders rush to use real money after just a small period of “success” on a simulator.

Thoughts of “I could have made $500 if I traded real money instead of wasting the opportunity on a simulator!” are common. Trading is a marathon, not a sprint. Remember to tell yourself that you goal is to develop and galvanize skill sets that will pay you for life. You can wait a few months for this possibility, right?

Being Impulsive

Trading can be boring because patterns can take time to play out. When triggers form, they can happen quickly. Both of these conditions can cause you to over trade and chase trades. They stem from being impatient. Patience is required when trading on a simulator and with real cash. The opposite of patience is impulse and reckless. Gauge which mode you are in throughout the day.

When to Make the Leap from Simulated Trading to the Real Thing

After you’ve tested your strategies and methodologies through up and down markets, you may feel that you’re ready to trade real money. Before you proceed, make sure you follow best practices:

Prove you have a consistent profitable strategy. This means you should have a track record (and a trading journal) documenting consistent profitability. This doesn’t mean anomalies where you are hitting homeruns, but consistent base hits. Analyze your performance and the market context in which you were the most and least successful. Which periods of the day were you most profitable (market open, mid-morning, mid-day, late afternoon, last hour)? Collect stats and metrics. As you gain consistency, then consider transitioning to real money.

Start Small as You Transition

You are basically trying to emulate your consistency on the simulator with real money. To neutralize the emotional maladies like fear and panic, you must use very small share sizing so you can focus on the trade, not the money.

This transition is like taking off the training wheels or stepping into a pool slowly to acclimate to something you are somewhat familiar with now. Acknowledge the differences between simulator and real money trading (IE: trade executions and fills). Feel your way around these differences as well as the similarities (IE: strategies and patterns).

Don’t Be Afraid to Go Back to the Simulator

This is absolutely key. If you find flaws in your strategies, do some troubleshooting without risking your precious capital. Go back on the simulator. Remember the sequence mentioned earlier: learn, test, optimize and repeat. This can be done with the least damage through a simulator. The benefits of using a trading simulator can far outweigh the shortfalls as long as you understand what to expect out of it. It’s a tool that can bolster your evolution as a trader without costing you your capital to help you survive the learning curve.