The resurgence of market volatility has sparked renewed interest in day trading, as stocks experience history making price action for traders equipped with the skill sets to engage. Day trading involves trying to game price action during market hours and closing out positions by the end of the session. Sessions can start in the premarket and end in the postmarket, but overnight positions are rarely taken.

What Does it Take to Be a Successful Trader?

There are many factors to becoming a successful day trader. Becoming a successful trader is the by-product or outcome of acquiring and harnessing key qualities that include persistence, adaptability and a willingness to learn and improvise. There will be many errors and mistakes made in the process. The ability to learn from mistakes and spot the gaps in methodology to fill is the essence of the learning process. The path to success is as much a path to enlightenment to one’s own behavioral strengths and weaknesses and learning to adapt based on them.

Things Successful Day Traders Do Differently

Successful traders come in all shapes and forms. They may seem like a different breed of people, but they are normal people that have been through the rigorous learning curve and adapted their methodologies to work with current markets. They have also built an awareness of when things may not be going their way and have the assertiveness to take action to prevent small losses from turning into major losses. Most importantly, they are constant students of the markets and are rigorously recalibrating and adapting methods to conform with the shifting paradigms of current trading markets. Here are 10 things that successful day traders do differently:

Specialization

Seasoned day traders are aware of what style of trading their temperament works best with, scalping quick intra-day trades within seconds to minutes or swing trading riding trends for hours sometimes days.

They also have a preference of the type of stocks they excel trading whether by industry or price behavior. The most successful day traders tend to stick to stocks that best fit their preferential template. Whether they are technology stocks, retail stocks, stocks over $100, the FAANG stocks and so forth.

The key is specialization. They specialize in the style of trading and the template of price action they are most successful with and stick to it. Half of the journey is the discovery process of which type of stocks and style of trading best suits you. The right combination will be the niche that you should stick with.

Routine

Successful day traders carry out a morning routine that is borderline ritual. Traders are constantly trying to find consistency. While you can’t control the markets, you must control your routines and that’s where consistency harnesses performance consistency

The morning routine of creating, filtering and finalizing the day’s watch list. The routine of monitoring set-ups and scanning opportunities throughout the day. Traders understand this is just like a job, but one they are passionate about. Consistency starts from within and actions are all that matter. Consistency begets consistency.

Risk Management

The ability to foresee risk outcome scenarios before and during the trade is an important trait that is built through experience. Risk is about exposure and successful day traders are the most risk averse in they don’t usually take positions overnight. The goal is to eliminate risk by being in cash overnight. Embracing closure and not looking back (shoulda, woulda coulda…) is a common trait shared by top day traders.

The best traders know that managing risk is just as important as capturing upside.

Knowing When NOT to Trade

Top traders have learned there are periods where the deck is stacked against them and have the ability to administer the discipline not to trade. Some traders learn this quickly and some traders learn the hard way after taking many nasty hits. Not all markets are tradeable, and the key is knowing when the odds are placed in your favor and not hesitating in taking the shot. They understand that “no trade” is better than a losing trade.

Resourcefulness

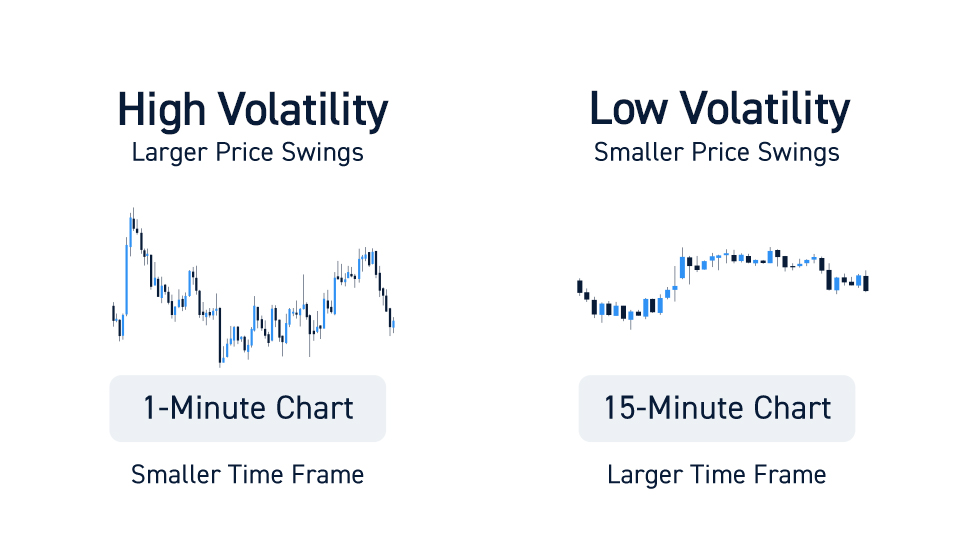

Seasoned day traders have found their honey holes for information and data. They know where to go to validate news and which tools and indicators work best in what type of markets. For example, reverting to 15-minute trending charts in flat markets and searching specific resources for the latest insights into price action or rumors.

Scaling

Successful day traders have learned about the power of scaling in every aspect of trading. They scale what works, and ditch what doesn’t. By scaling strengths and eliminating weaknesses, traders are able to consistently optimize their strategies over time. This results in higher win rates and increased profits.

Focus

This plays off specialization, as successful traders don’t lose focus or get sidetracked away from the stocks, set-ups and types of trades they specialize in. This doesn’t mean they won’t try to expand their basket of trades, but they remain focused on what works and what may work even better. This focus enables them to be more efficient and not waste actions or capital.

While new traders are attracted to shiny objects (i.e. hot stocks, sectors, etc.), experienced traders focus on what they know.

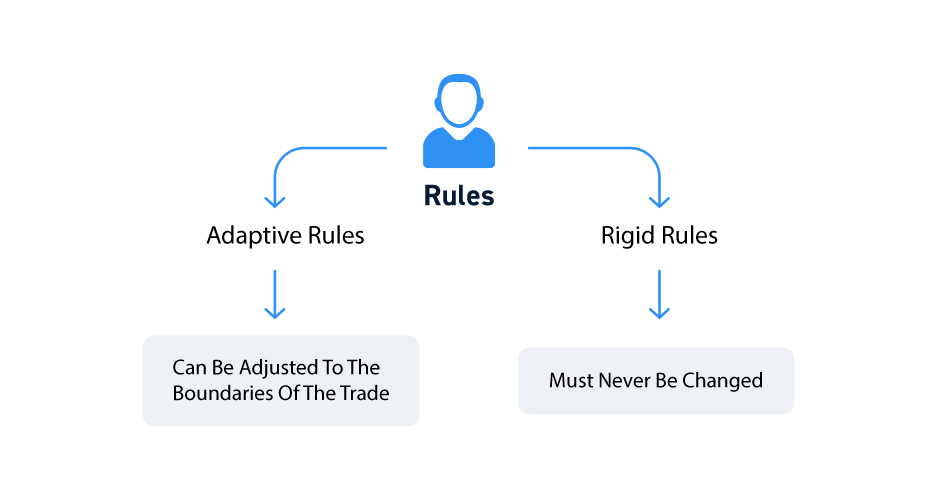

Rules

Skilled day traders have their own rules that they stick with. Some rules may be adaptive to the market trading environment like increasing max size for a specific type of high probability set-up. Some rules are not to be broken, like stopping for the day if max drawdown of – 10% in the account is hit. No questions asked. The ability to make, apply and abide by the rules is a top quality of successful traders.

Adaptive

Highly skilled day traders have reached levels where they are highly intuitive enough to adapt to market trading environments seamlessly. They know through experience how to adapt to different situations and set-ups. For example, high volatility markets with exceptional price swings call for a more momentum-based methodology prioritizing smaller time frames like a 1-minute chart while low volatility trending markets require smoothing out the choppiness with 15-minute charts.

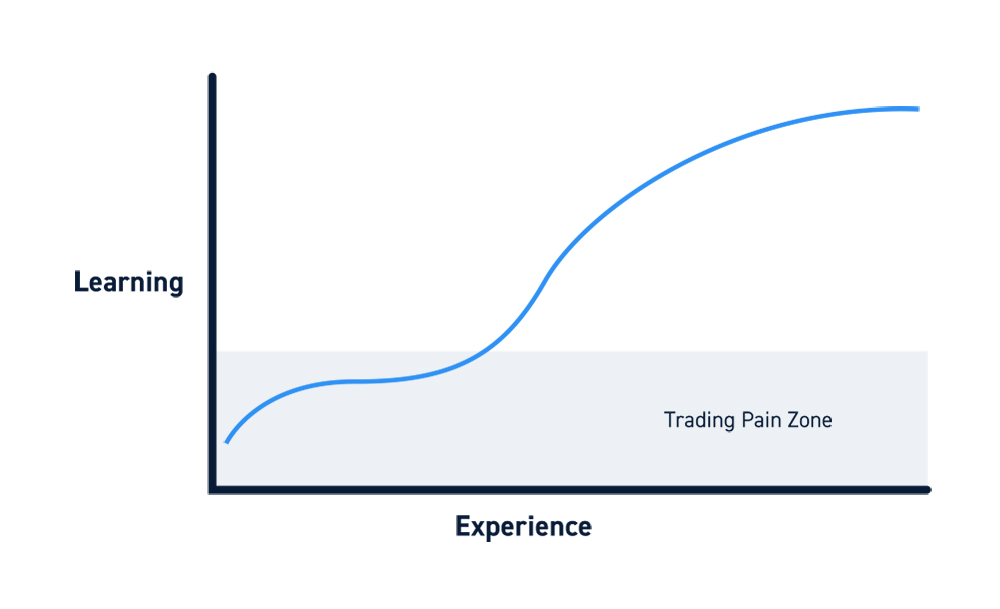

The path towards becoming a successful day trader is a journey that requires a hunger to learn and a passion for trading. Experience is the greatest teacher; however, pain is the barrier to entry. Expect to endure the pain and frustration that comes along with crossing the learning curve. The key is to preserve your capital through this process to reach the point of self-sufficiency. Focus on the process because that is what shapes the outcome.