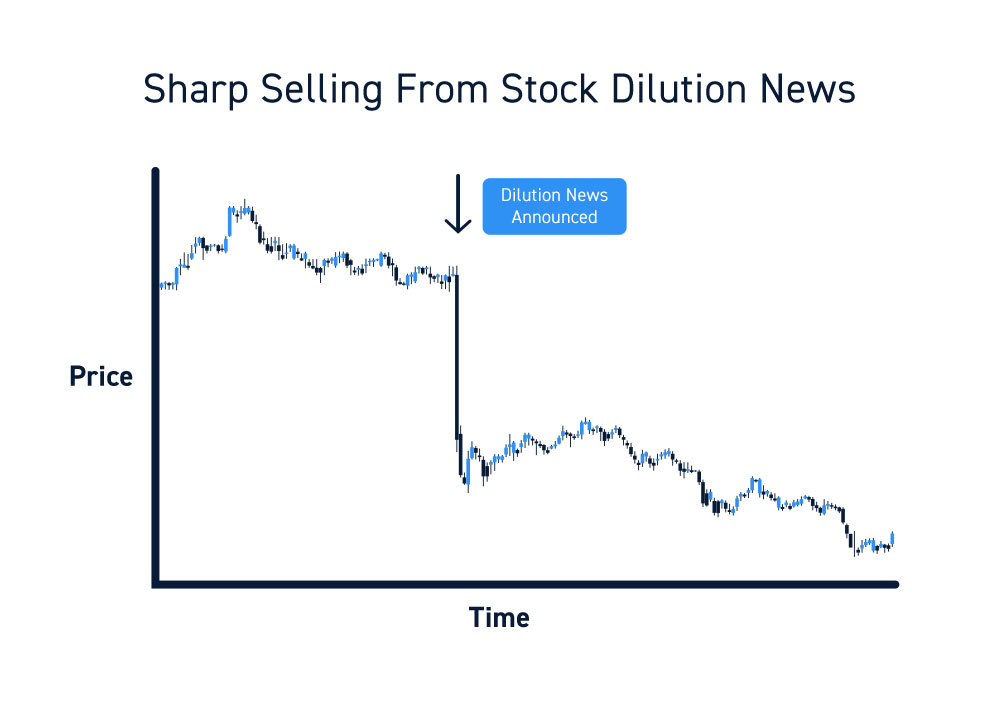

When a publicly traded company announces a secondary offering, the underlying stock price tends to fall sharply. When a public company announces an all stock based acquisition of another company, usually the acquiring company’s share price also tends to sell-off. Logically, you would think an acquisition would improve the acquirer’s value. So why are investors selling the shares causing the price to drop?

In this article, we are going to discuss stock dilution and how it can impact trading activity.

Understanding a Company’s Share Structure

With publicly traded companies, it’s important to separate the actual business operations from the publicly traded stock. While a stock’s price may reflect a company’s valuation and investor sentiment, it can also be influenced by its share structure and the events that impact it.

What Do You Own When You Buy a Stock?

Stocks that freely trade on the U.S. stock exchanges are common shares. Common shares represent a piece of the underlying company. If you buy 100 shares of a company comprised of 10,000 shares, then you would theoretically own 1% of the company. Common shares also tend to include voting rights enabling investors to caste their votes on proposals and proxies put forth by the board of directors, often at the annual meeting (IE: executive bonus plans, mergers, adding or removing directors).

Company Share Structure

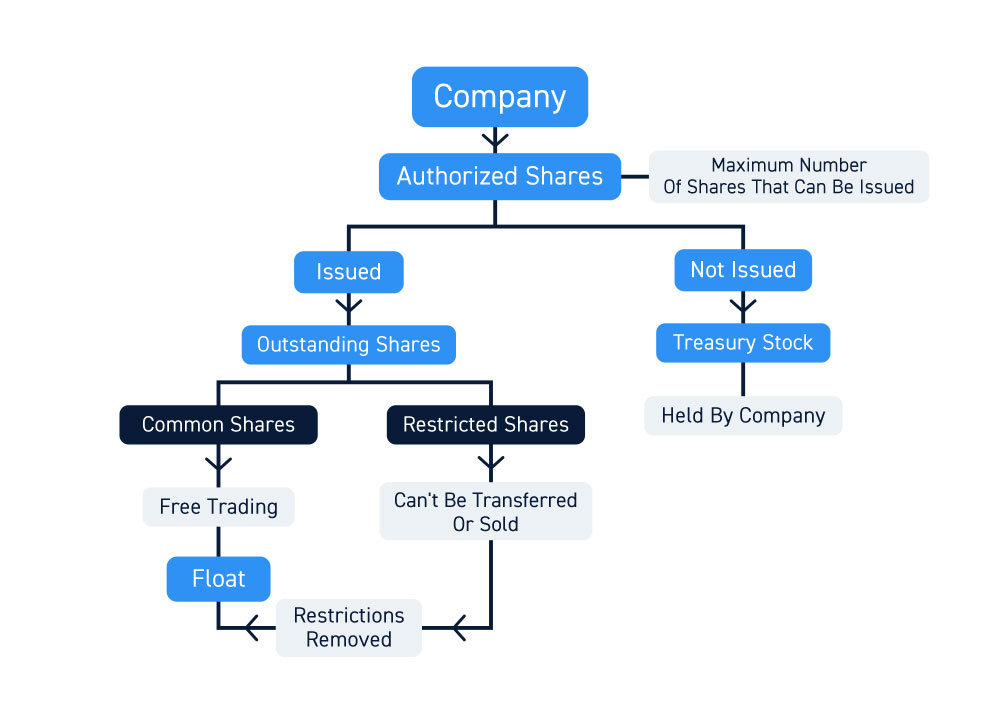

Publicly listed companies decide how they want to allocate ownership with their share structure.

When a company is created, it must state the total authorized shares it can issue upon inception. These are the maximum number of shares that can be issued. Companies don’t issue all authorized shares immediately nor will they likely ever issue all authorized shares.

The outstanding shares are the total number of shares that are issued, excluding shares held by the company which are called treasury stock. Outstanding shares include both free trading common shares and restricted shares.

Free trading shares are common shares that are bought and sold in the markets with no restrictions.

Restricted stock must be converted to free trading shares by removal of restrictions. Restricted shares can’t be transferred or sold and are usually issued as compensation for employees, consultants and insiders. Restrictions tend to involve vesting time periods and or performance milestones and benchmarks. When restrictions are removed, the free trading shares are added to the float.

The float is the total amount of free trading common shares that can change hands between buyers and sellers in the open market. Float represents the supply of trading shares and is a good measure of liquidity. When a stock float is thick, it indicates heavy supply and liquidity but also makes for sluggish price appreciation. Thinner floats indicate smaller supply which can result in faster price movements but also carry more slippages with wider bid and ask spreads.

What is Dilution?

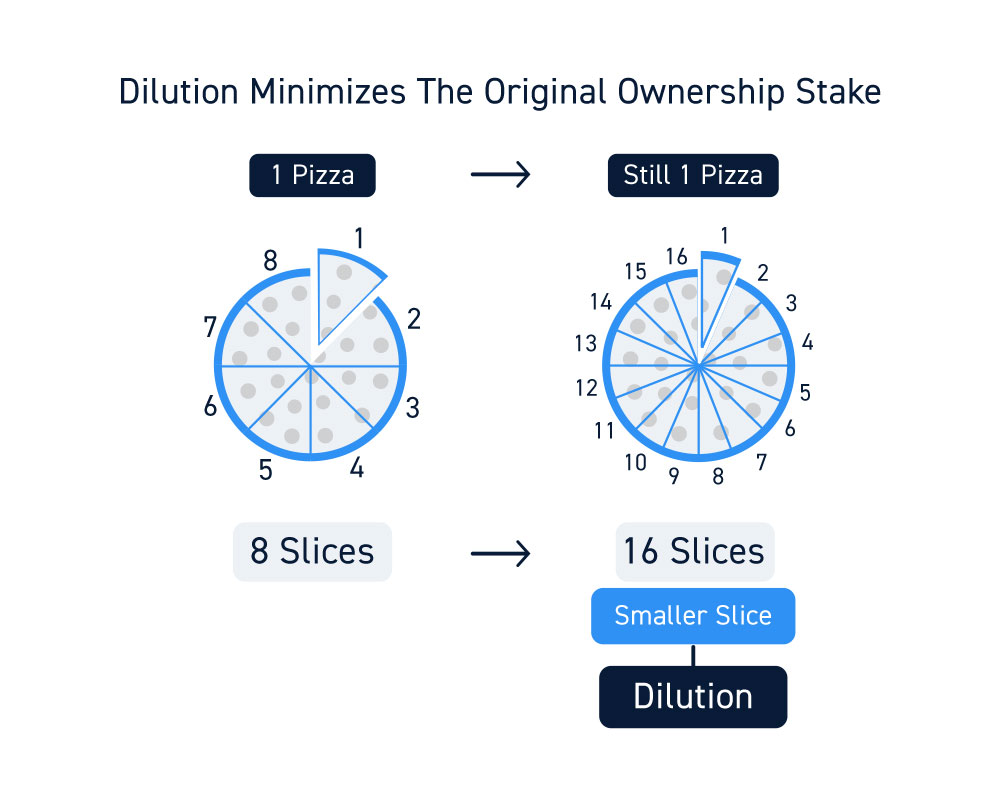

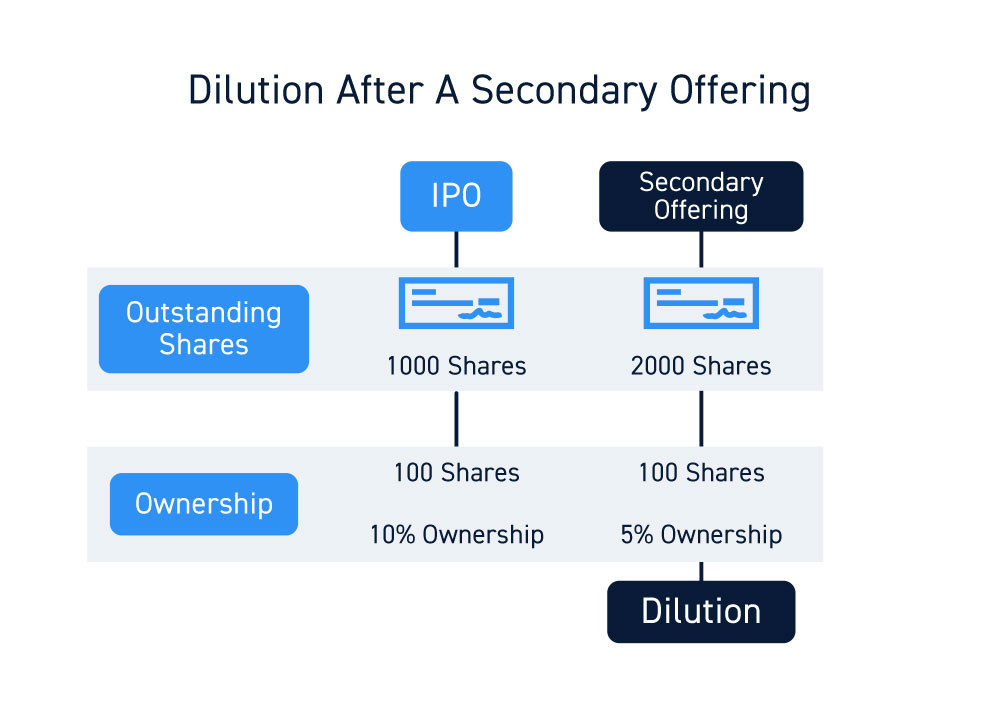

In a nutshell, dilution occurs when a company increases its outstanding shares. If a company issues 1000 shares, your 100 share purchase gives you a 10% ownership stake. However, if the company issues another 1000 shares through a secondary offering, your 100 share ownership stake drops to 5% because of dilution (100/1000 vs. 100/2000). It’s like a big pizza pie where every time a slice gets cut into more pieces, the pie stays the same, but each piece of the pie gets smaller. As an investor, your 100 votes are now worth 50 votes at the annual meeting. Naturally, this would upset you as long term shareholders despise dilution.

Why Dilution can be a Red Flag

The fact that dilution minimizes the original ownership stake for existing shareholders is why selling tends to occur. Dilution reduces the value of positions held by current shareholders.

When a company increases its share count, it causes the ownership stake for each share to shrink. It’s like cutting the original large pizza pie from 8 slices to 16 slices. It’s still the original large pizza pie but with more slices and each slice is smaller. If you’re just getting to the table, then you may not mind. However, if you had an original slice that is about to get smaller, you might consider selling your slice to avoid the dilution.

No one likes having their stake diluted. This is why events and actions that cause stock dilution are met with sharp selling resulting in falling share prices. Announcements for secondary offerings are met with sharp stock declines.

Types of Dilution

Dilution of often occurs when the company is trying to raise cash. This can occur by executing a secondary offering that adds more shares to the outstanding shares.

It can also occur by selling warrants which are a form of long-term options where the company receives cash from the warrant sale and more cash when the warrants are exercised. When warrants are issued, that technically dilutes shareholders but not until the warrants are exercised.

When warrants are exercised, that’s when the common sells shares at deeply discounted prices to the warrant holder. Often times, they may turn around and sell those shares in the open market. However, in many cases the warrant holders may actually short stock in the open market and cover by exercising the warrants. This can put a ceiling on rising stock prices until the warrants are exercised. Investors tend to be weary of company that issue lots of warrants due to the dilutive nature.

How to Factor Dilution into Your Trading

It’s easy to conclude that share dilution only affects long-term investors and doesn’t impact day trading, but that’s not always the case. Dilution impacts liquidity which impacts price action. Also, certain events that trigger dilution have very material impacts on price action near-term and longer term. It’s prudent to be aware of this and plan accordingly.

Look for Outstanding Warrants

The total number of outstanding warrants can be found in form 8-K and 10-Q filings. Companies with a ton of outstanding warrants are susceptible to new shares flooding the market soon, which may present directional trading opportunities.

Recognize That Offerings are Usually Red Flags

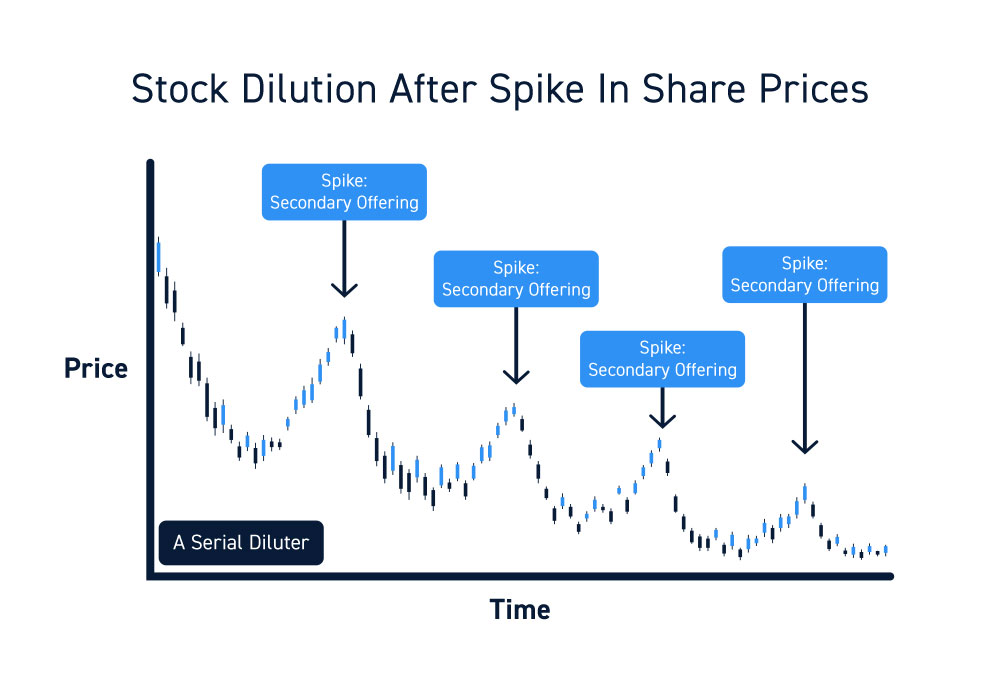

Most company’s stock prices drop upon announcing a secondary stock offering. Companies tend to price secondaries after a sharp spike in share prices. The secondary offerings tend to be priced at a discount to the market, which accelerates price drops. Small cap stocks are notorious for this as well as companies that are burning through cash.

Identify Serial Diluters

Some companies are infamous for announcing offerings after every major price spike. Be weary of holding shares in these companies as there are often bag holders after each spike. Recognize these companies and strongly consider closing out positions before the bell to avoid getting stuck during an announcement afterhours.

Dilution provides opportunity to those traders that are aware of it and factor it into their trading. While dilution alone is not the basis for placing a trade, it can trigger price action or explain inaction for those who recognize it.