The Short Sale Rule (SSR) is a rule imposed by the SEC that governs when stocks can be short sold. It’s designed to prevent short sellers from piling onto a down trending stock and causing the price to crater.

The Short Sale Rule is very important for short sellers to be aware of since it can directly impact their ability to trade. In addition, it may also impact traders who are going long in a stock affected by the rule. In this article, we’ll explain what the Short Sale Rule is, why it exists, and what traders need to be aware of when trading stocks that trigger the rule.

What is the Short Sale Rule?

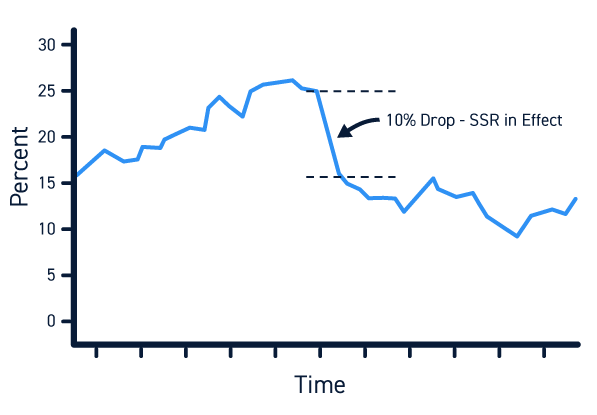

The Short Sale Rule is an SEC rule that governs when and how stocks can be sold short. Briefly, the rule dictates that once a stock falls more than 10% from its previous close, that stock cannot be shorted at the bid price for the remainder of the current trading session or for the entirety of the next session. However, the stock can still be sold short at a price above the current best bid. In addition, short sellers who already had short positions can continue to hold those positions (or cover them).

Long traders are largely unaffected, as they are able to buy shares and sell shares that they own normally.

The purpose of the Short Sale Rule is to prevent short sellers from turning a steep downturn in a stock into a catastrophe. If a stock is falling with strong momentum, it becomes an obvious target for short sellers. Short sellers piling in can push the price down further, encouraging more short selling and launching a cycle that could push a stock’s price far below reasonable levels.

That can have significant consequences for other market participants, who may face unexpected margin calls. In addition, if a stock’s value is pushed unreasonably low by an unchecked cycle of short selling, a company could suddenly become vulnerable to a takeover.

The Short Sale Rule doesn’t completely stop short selling, since traders can still sell stocks short above the current bid price. However, the rule does make it more difficult to short sell, as short sellers are required to add liquidity instead of removing it.

History of the Short Sale Rule

The Short Sale Rule originated in 1938 as the Uptick Rule. This SEC rule required that any short sale take place at a higher price than the prior trade. In effect, it meant that stocks could only be sold short when the price was going up. Any drop in a stock’s price meant that short selling was cut off.

The Uptick Rule was a direct response to the market crash of 1937, which came in the midst of the Great Depression – an event that many at the time believed was instigated in part by short selling activity. The rule remained in effect until 2007, when the SEC concluded after several years of study that it was not playing a significant role in stabilizing the stock market.

The removal of the Uptick Rule came just before the 2008 financial crisis, and its removal became a focus of criticism from major investors and Congressional lawmakers during the crisis. It remains unclear whether the removal of the Uptick Rule played a role in worsening the market crash.

In 2010, after a public comment period, the SEC adopted the Short Sale Rule, also known as the Alternative Uptick Rule.

What is an “SSR Stock”?

An “SSR Stock” is any stock that is currently under restricted trading due to the Short Sale Rule. These are stocks that have fallen at least 10% during the current or prior trading session. Short selling of SSR stocks is still possible, but short sellers must pay a price that is above the current bid.

Most stock brokers have a notification on a stock’s trading page to let traders know that it is currently under Short Sale Rule restrictions. This may be a red flag, an SSR tag, or another label. Traders can also check the NASDAQ’s daily list of SSR stocks.

Considerations When Trading SSR Stocks

For short sellers, the most important thing to know about the Short Sale Rule is that it exists. Traders who aren’t aware of the Short Sale Rule may find themselves putting time and effort into studying a short trade, only to find that it isn’t favorable when they must trade above the current bid to make the short sale.

For stocks that are currently falling but haven’t yet crossed the 10% threshold, short sellers need to be proactive. Once the Short Sale Rule is triggered, short selling of that stock at the bid is prohibited for up to two market days. Traders can still short sell the stock by paying a price above the bid, but doing so is more costly.

While the Short Sale Rule doesn’t affect long traders directly, it is something they should be aware of. Short sellers may trade more aggressively before the Short Sale Rule is triggered and short selling activity may decline significantly after that point, which could potentially affect price action in a stock. This effect is likely to be small, but could impact how traders approach a stock.

Conclusion

The Short Sale Rule is designed to prevent unchecked short selling from cratering the price of a stock. The rule is significant for short sellers, since it restricts short selling at the bid for up to two market sessions after a stock’s price falls more than 10% from its prior close. Traders can still short a stock while the Short Sale Rule is in effect by paying a price above the current bid.

Short sellers need to be proactive when trading stocks that could trigger the Short Sale Rule. Long traders should also be aware of the impact this rule could have on a stock’s price action.