The stock market requires both buyers and sellers to operate as an efficient market place. Beginner traders assume there is always a seller on the other side willing to supply shares for sale at the right price and vice versa when they want to sell. Traders usually learn to buy at the ask when getting into a long position and sell at the bid when exiting a position. As you gain experience, the function of “the other side” comes into play. Who is selling me the shares and who am I selling the shares to?

What is Liquidity?

Liquidity is the supply of shares available to be purchased or sold in any stock. Liquidity is determined by the stock’s float and provided by market makers, specialists and other traders. An ample supply of shares with active buyers and sellers helps to ensures a robust market with tight spreads. When buying demand overwhelms selling supply, prices tend to rise. When selling pressure overwhelms willing buyers, prices tend to fall.

Why is Liquidity Important?

Liquidity is what makes a market effective. Having plenty of active buyers and sellers helps to ensure fluent market action and tighter spreads.

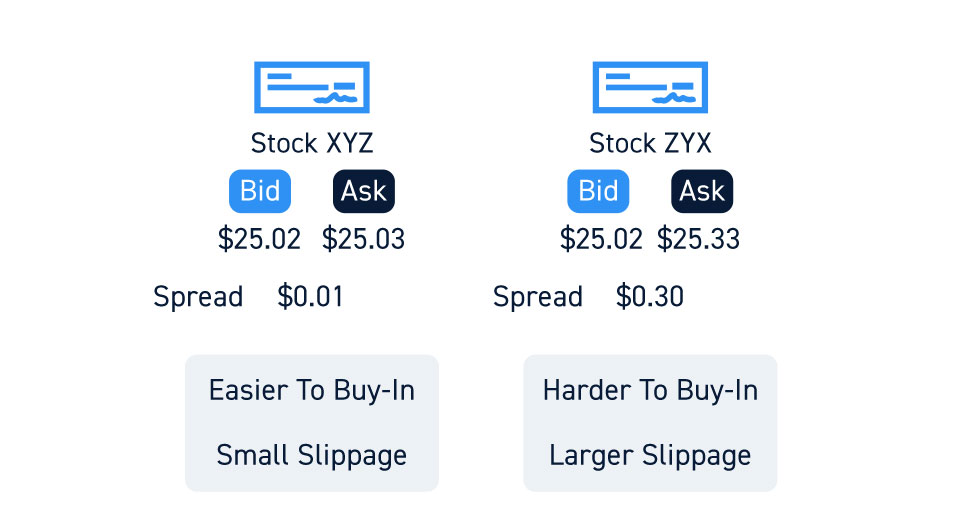

When the supply of shares is “thin” due to a smaller number of buyers and sellers, the spreads (price between the bid and ask) become wider indicating thin liquidity. This makes it more expensive to buy and sell shares.

For example, if stock XYZ has a spread of $25.02 x $25.03 (bid x ask) it is cheaper to buy than a less liquid stock ZYX with a spread of $25.02 x $25.33. The difference between a $0.01 spread and a $0.30 spread basically means you can enter a XYZ and immediately stop out on the bid with only (-$0.01) slippage versus entering ZYX with (-$0.30) slippage.

Less liquidity equates to more risk in terms of slippage.

Since liquidity makes markets effective, it’s important to consider how your trading impacts market/stock liquidity. You can either add liquidity or take liquidity, both of which have their own unique implications.

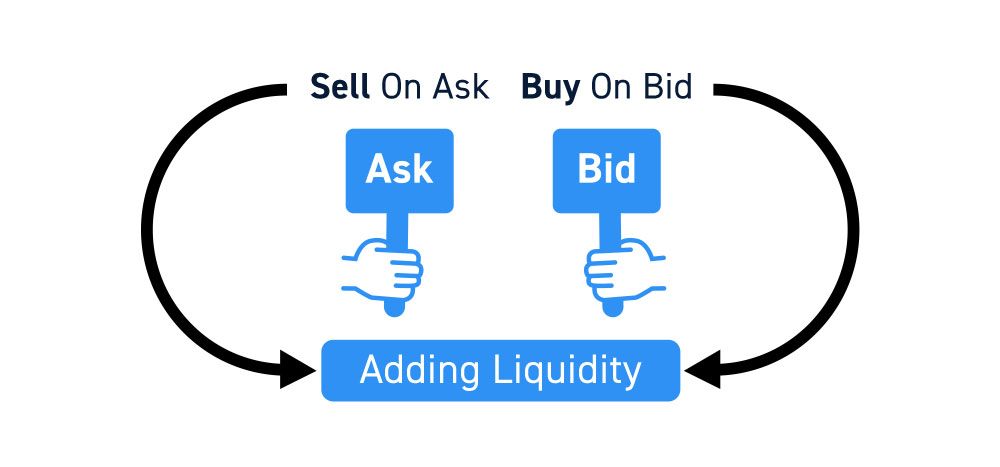

What is Adding Liquidity?

When you supply the shares to sell on the ask, you are providing the liquidity for other buyers. When you are willing to buy on the bid, then you are providing the liquidity for other sellers. In a nutshell, you add liquidity when buying on the bid and selling on the ask. This is also called being a “maker” vs. a “taker.” You are in essence playing the role of a market maker by adding liquidity.

Benefits

There are many benefits to adding liquidity.

If you’re using a direct market access (DMA) broker to route your trades, then you can earn electronic communication network (ECN) rebates . These rebates get applied directly to your commissions to cut down on your trading costs. Different ECNs offer different rebates so its best to check with your DMA broker ahead of time.

Adding liquidity is like buying at a wholesale price and selling at retail. It can give you better fill prices but requires the patience to wait for trades to “come to you”, rather than case impulsively. Adding liquidity forces you to plan your trade ahead of time and methodically place bids to buy and asks to sell. This factor can’t be overstated enough.

Psychologically, it can put you ahead of the game by thinking through the trade ahead of time and timing your entries and exits into the momentum, rather than chasing the momentum. It just feels good to get a bargain. Make no mistake, trading is all psychological.

What is Taking Liquidity?

When you buy on the ask and sell on the bid, you are taking liquidity. You play the retail customer role in the market place. This is the taker part of the maker vs. taker model. Don’t feel bad, you will often have no choice but to take the liquidity in order to participate in a pattern set-up or momentum play.

Benefits

The key benefit of taking liquidity is getting faster fills since you aren’t waiting for a counterparty. Instead, you are being serviced and paying for it.

Make no mistake, when you need to get into a trade, taking the entry on the ask or stopping out quickly on the bid is the quickest way to ensure your fills. When momentum explodes on a breakout, hitting the ask is the surest way to get in on the trade. When a stock reverses quickly, hitting the bid before the next trader is the best way to cut your losses. Speed and participation are the two key benefit of taking liquidity.

Which is Better: Adding Liquidity or Taking Liquidity?

Determining which execution style is better depends on what type of trade and strategy you’re executing. If you are primarily position trading and in no hurry to get filled as you are building a position, then providing liquidity would be a primary execution style. However, if you’re a momentum trader actively stalking breakouts and breakdowns, then you will likely be taking liquidity. In most cases, a combination of adding liquidity and taking liquidity is the best course of action.

For example, buying on the ask on a breakout and selling on the ask as prices surge helps you take advantage of the panic buying. If you’re trying to accumulate shares at a double bottom price level, then you might sprinkle bids to get filled until the shares reverse back up at which point you take liquidity on the ask to complete your position. It depends on the strategy and the urgency of entries and exits.