It happens to everyone. What started off as a clear trading day has now drawn you in. You are micromanaging every tick on your stocks compulsively and placing non-stop trades. You find yourself overwhelmed and quickly taking stops and changing your opinion on direction and timing constantly. Your profit/loss blotter is getting redder with each small stop and your frustration level is through the roof. As you look back at the countless trades, you should realize that you have fallen into a dangerous state called overtrading.

What is Overtrading?

On the surface, overtrading is making too many trades. However, the real condition is a loss of control that enables the overtrading. Overtrading is a condition that has different thresholds for every trader. For one trader it could be 50 trades which may be normal for an active trader, whose overtrading condition could trigger at over 200 trades. Viewing it as a condition helps to determine the cause.

What Causes Traders to Overtrade?

Overtrading can be caused by one or a combination of factors including lack of conviction, fear, greed, frustration, anger and/or boredom. These factors cause a trader to literally short circuit and undergo an almost out of body mental experience. The trader perhaps unconsciously makes erratic trading decisions and trying to offset it with sheer volume of trades. It’s the loss of efficiency from expending too much energy on wasted actions (trades) often spinning one’s wheels.

Dangers of Overtrading

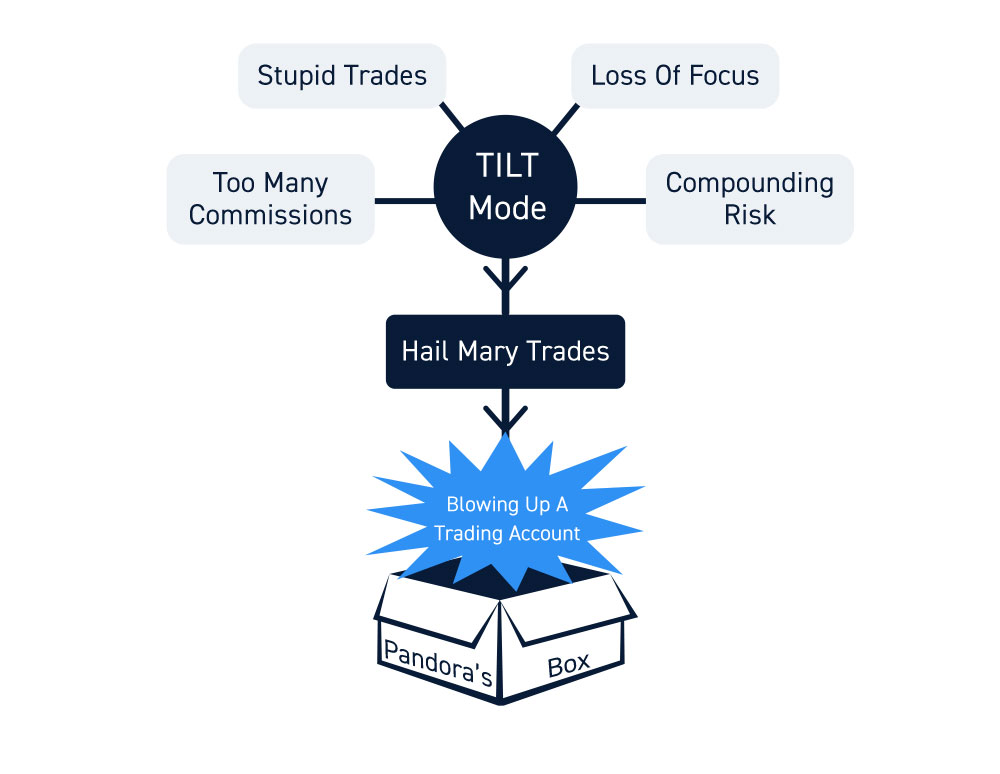

Overtrading is a “Pandora’s Box” of dangers that can be unleashed to wreak havoc with your psyche, performance and account. The list of dangers range from taking on stupid trades, spending too much money on commissions, loss of focus and compounding risk as mounting losses can push the trader into a TILT mode. Desperation causes the trader to make Hail Mary-type low probability high leveraged trades. The ultimate danger is blowing up your trading account. To keep a lid on Pandora’s Box, here are 7 tips to avoid overtrading.

1) Recognize Overtrading

Every trader has their own parameters when it comes to overtrading and what that threshold number is. The number of trades can be an indicator that you have reached an overtrading condition. The underlying state is the loss of control that is the symptom of overtrading. Recognizing that you are overtrading is the prerequisite first step.

2) Define Your Trade Criteria

Plan your trade ahead of time by specifically defining your trade criteria. What is the technical pattern set-up and the trigger? How many shares will you allocate to the trade? Will you scale into the trade are various price levels or will you try to nail it as soon as it triggers? What is your target and stop-loss? These are all questions to keep you busy until the trade actually comes to you.

Defining your trade criteria will help you determine if you actually have a trade on your hands or if you are forcing a trade.

3) Let the Trades Come to You

Being too impatient for fear of losing out or missing out on a trade can cause one to get in too early ahead of the trigger. This causes multiple stops that can lead to frustration and overtrading. Let the trade come to you. To remedy this, watch multiple stocks within the same sector so that you can cause a move at different phases using a sector leader and playing the laggards.

Find your setups and choose your triggers. When a trade is triggered, trade your plan. When it is not, sit back and wait.

4) Keep Your Emotions in Check

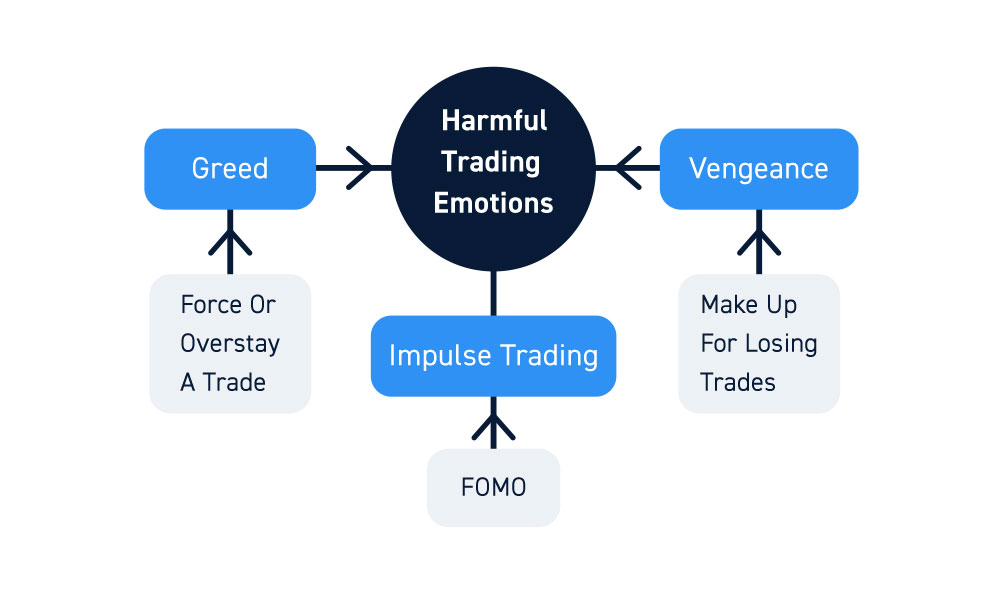

Try to be aware of what causes certain harmful emotions. Greed can cause you to force trades or overstay a trade past the exit signals. Vengeance or revenge trading forces you to make up for losing trades even when the opportunity isn’t there. Impulse trading can result from FOMO. This can trigger from watching various stock market news feeds and television networks talking up a stock.

Never place trades based on emotion. You should always trade a well-defined plan and keep emotions out of your decision-making process.

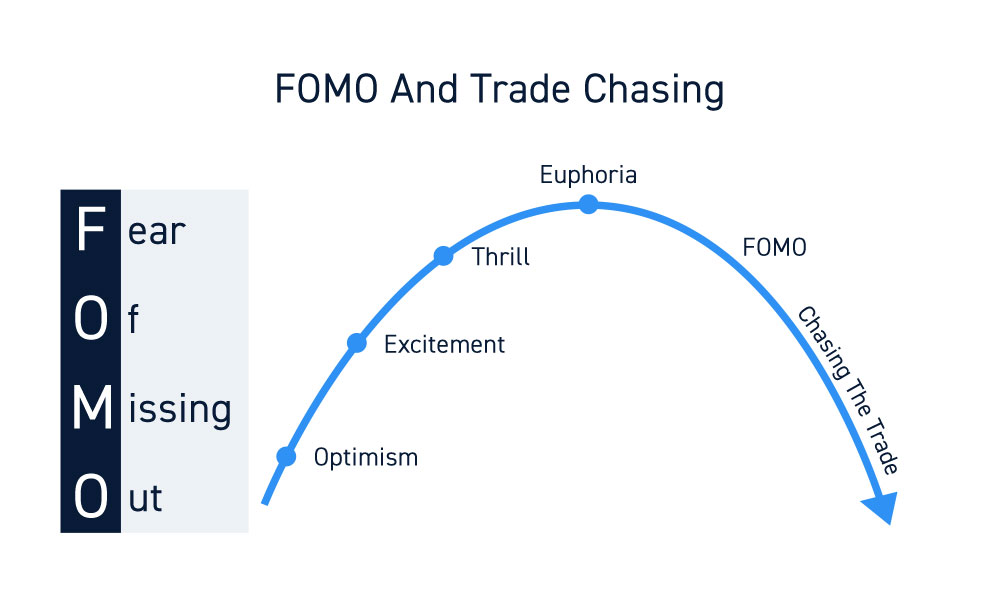

5) Avoid FOMO

Fear of missing out (FOMO) makes you chase trades past their entry levels just to feed the ego. This causes impulse trading which makes you enter or stay in trades past the exit triggers, which can lead to late stops and more anxiety and frustration leading to more overtrading. It’s a vicious cycle that must be recognized and cut off as soon as possible. Too much exposure to financial television channels, social media and trading newswires can set the stage for FOMO to creep in. Cut exposure quickly and take a break away from all the connections to the markets so you can regain narrative control from the information overload.

6) Recognize that Cash is a Position

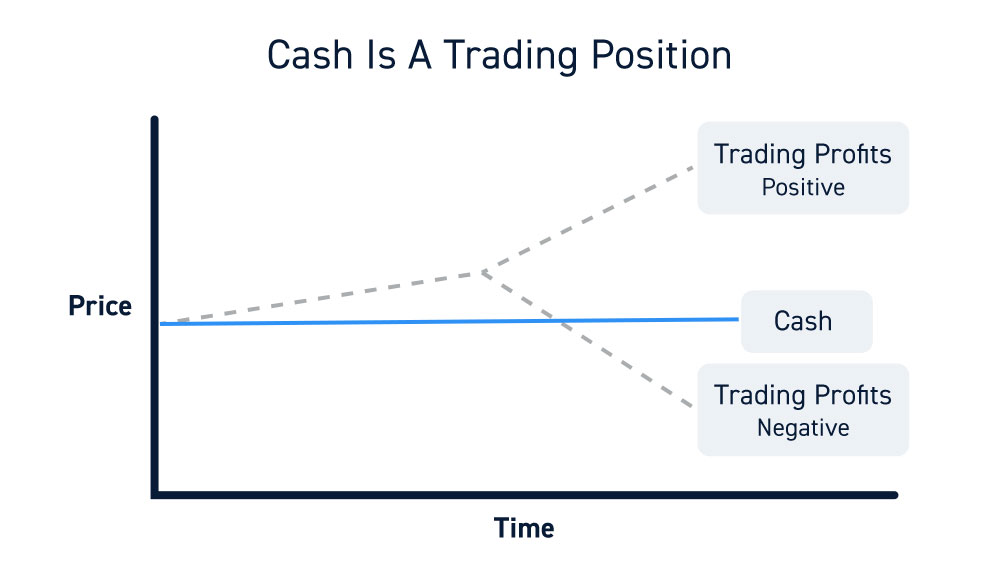

Banish the notion that being in cash means you are losing the opportunity to make money. The thought that you are in cash while other traders are making profitable trades can force you into irrational trades.

Instead, view cash as an impenetrable defense in the war of the trading day. Cash is a position that buys you time and protects you from overtrading. It’s the ultimate remedy for overtrading and therefore it is the position you must embrace the most whenever you recognize yourself falling into that state. Cash buys you the time to let the trades come to you. It’s your best friend that will help you live to fight another day. It is your personal armor.

While cash may not yield profits, it protects you from losses, which is just as important to your bottomline.

7) Learn When to Step Away

When you recognize you are nearing the overtrading state, immediately have a plan to cool down. The best remedy is to simple cut off all market stimulants like social media, television and newsfeeds and step away. A clean break with the markets and a cash position enables you to regain control. It could be for a few hours, a day or even a week. You can clear your head and replenish your tolerance thresholds, mental gauge and reestablish control over your decision-making process with better precision minus the distractions. This is one of the greatest skills you can have as a trader and one of the hardest to actually get a handle on. Learn to spot when you are spinning your wheels and grow the discipline to react immediately by stepping away.