Have you ever seen a stock exhibiting normal trading behavior and then all of a sudden the stock price drastically drops out of nowhere? This type of price action could be related to the announcement of a shelf offering or the execution of an “at-the-market” sale from a shelf offering. There are different types of shelf offerings, special regulations and filing requirements for companies to do shelf offerings, and shelf offerings can either be a good or bad catalyst for a company.

What is a Shelf Offering?

A shelf offering is a way companies can pre-register securities that can be sold in the future. A shelf offering allows the pre-registered securities to be sold in the future without needing to get approval or review from the SEC at the time of sale(s). Shelf offerings are permitted under SEC Rule 415. As the name implies, a company registers the securities with the SEC that it intends to sell in the future and puts them “on a shelf”. Once ready to sell, the company takes the securities “off the shelf” and sells them in what is called a takedown offering.

Typically, a shelf offering provides a company with a 3-year window to sell the pre-registered securities. One of the main benefits of a shelf offering is the flexibility provided to companies to choose when and how much to sell of the pre-registered securities at any time during the 3-year window. Often times, companies use shelf offerings to have the option of quickly selling securities when market conditions are more favorable at a future date.

Companies can use shelf offerings for securities such as common stock, warrants, convertible debt, or preferred stock. A company can also offer a mix of different securities referred to as a “mixed offering.”

What is a Shelf Registration?

A shelf registration is a registration statement with the SEC that allows a company to initiate a shelf offering. The main SEC form required for a shelf offering is Form S-3 for a US company and Form F-3 for a foreign company. Pursuant to Regulation S-K, a Form S-3 includes a base prospectus and other information about the securities being offered.

A Form S-3 can be a lengthy and detailed document, but the main components include:

- A summary of the company’s business and organizational structure

- Risk factors that could affect the company’s business operations and financial condition

- How the company intends to use the sales proceeds from the offerings

- Details about the securities being offered

- Distribution methods planned for selling the securities

Use of Proceeds for a Shelf Registration

A key section of the shelf registration Form S-3 is the “Use of Proceeds” section. The “Use of Proceeds” section provides insight into a company’s motivation and intent behind the shelf offering. A lot of times companies state that the intended use of the proceeds from shelf offering sales is for general corporate purposes. You might be asking yourself, “What exactly does general corporate purposes mean?”. That’s a great question.

General corporate purposes doesn’t have an exact definition and is ideally supposed to mean using proceeds for anything related to growing the company’s business and driving profits for shareholders. Ultimately, general corporate purposes means the use of the proceeds is at the discretion of the company and its key decision-makers.

If a company does have a specific plan for the use of the proceeds, such as refinancing debt or launching a new product in the future, the details may be included in this section. In the case of a secondary offering with selling shareholders only, the use of proceeds section will explain that the company will not be receiving any proceeds from the sale of securities and all proceeds will go directly to the selling shareholders.

Eligibility and Requirements for Shelf Registrations

Companies must meet certain eligibility requirements to be approved for a shelf registration and to conduct a shelf offering. There are many intricacies involved with company eligibility requirements as well as with requirements for different types of shelf offerings. Generally, there are some main requirements for companies and for each type of shelf offering. To be eligible for a shelf offering, the company must:

Company Eligibility

- Have a public float of at least $75 million.

- Have filed all its required financial reports and materials with the SEC within the previous twelve calendar months.

- Not have defaulted on any of its debt, preferred stock dividends, or rental leases.

- Not have had a bankruptcy in the past three years.

- Not have been convicted of any securities or financially related crimes in the past three years.

For primary offerings, the company must have at least one existing security already registered with the SEC. For secondary offerings, the securities being offered must already be publicly traded.

“Baby Shelf” Requirements

A company that does not have a public float of at least $75 million may still be eligible for a shelf offering by meeting “baby shelf” requirements. Some of the requirements include the company:

- Has at least one class of common equity securities currently trading on a national exchange.

- Is not currently and has not been a shell company for the previous twelve calendar months.

- Does not sell securities cumulatively worth more than one-third of the market cap of its float in any 12 consecutive months.

Well-Known Seasoned Issuer (WKSI)

Larger companies can qualify with the SEC as well-known seasoned issuers. Companies with a WKSI designation receive the benefit of their shelf registrations automatically becoming effective upon filing without needing SEC review or approval. Some of the additional benefits a WKSI receives are being able to do shelf offerings with unspecified amounts of securities and having fewer disclosure requirements in their prospectus such as the names of selling shareholders. To qualify as a WKSI, a company:

- Must meet all the standard eligibility requirements.

- At any point within 60 days of filing its shelf registration, must either:

- Have had a market cap of its float of at least $700 million.

- Have issued at least $1 billion of non-convertible securities (other than common equity) in primary offerings in the last three years.

How Do Companies File Shelf Registrations?

The shelf registration Form S-3 is filed with the SEC and available for review by investors as a preliminary prospectus, but doesn’t become effective until undergoing review and approval by the SEC. The review and approval process can take anywhere from a few weeks to a few months. You can search for, analyze, and see the effective date of a company’s Form S-3 filing on the SEC’s EDGAR database.

How Do Shelf Offerings Work?

The first step in the process of a shelf offering is for a company to file a shelf registration with the SEC. Once the shelf registration Form S-3 is approved by the SEC and becomes effective, a company can start selling the registered securities immediately, on a continuous basis, on a delayed basis, or by a combination of methods.

When the company sells the securities in a takedown, they file a prospectus supplement containing important details about each sale such as the terms of the offering and distribution method. The main benefit of a shelf offering is that even though companies file a prospectus supplement when executing the sales of the pre-registered securities, they don’t have to wait for the prospectus supplement to be reviewed and approved by the SEC in order to commence the sales.

Continuous Shelf Offering

A continuous shelf offering enables a company to start selling securities immediately after the shelf registration becomes effective and then continuously thereafter. A continuous offering doesn’t require a company to continuously sell securities after the first batch is immediately sold; it gives them the opportunity to do so if they choose to within the 3-year window of the shelf registration.

If a company knows it needs to sell securities immediately but they aren’t sure if it will need or want to again in the future, it can use a continuous shelf offering to at least give it the opportunity to sell securities in the future after the initial sale.

Delayed Shelf Offering

A delayed shelf offering is when a company has no present intention of selling securities, but it would like to have securities pre-registered to potentially sell in the future. Like in a continuous offering, the pre-registered securities can be sold at any time and in any quantities during the 3-year shelf registration window. A delayed offering doesn’t mean that a company has to sell the pre-registered securities before the 3-year window expires, only that it has the option of doing so if it chooses.

Primary Shelf Offering vs. Secondary Shelf Offering

Primary Shelf Offering

A primary shelf offering is when a company sells a new security that is not currently trading on the market. A few examples of primary offerings are a new class of common stock with special voting rights or new convertible debt. In a primary offering, you are buying securities directly from the company and the proceeds go to the company.

Secondary Shelf Offering

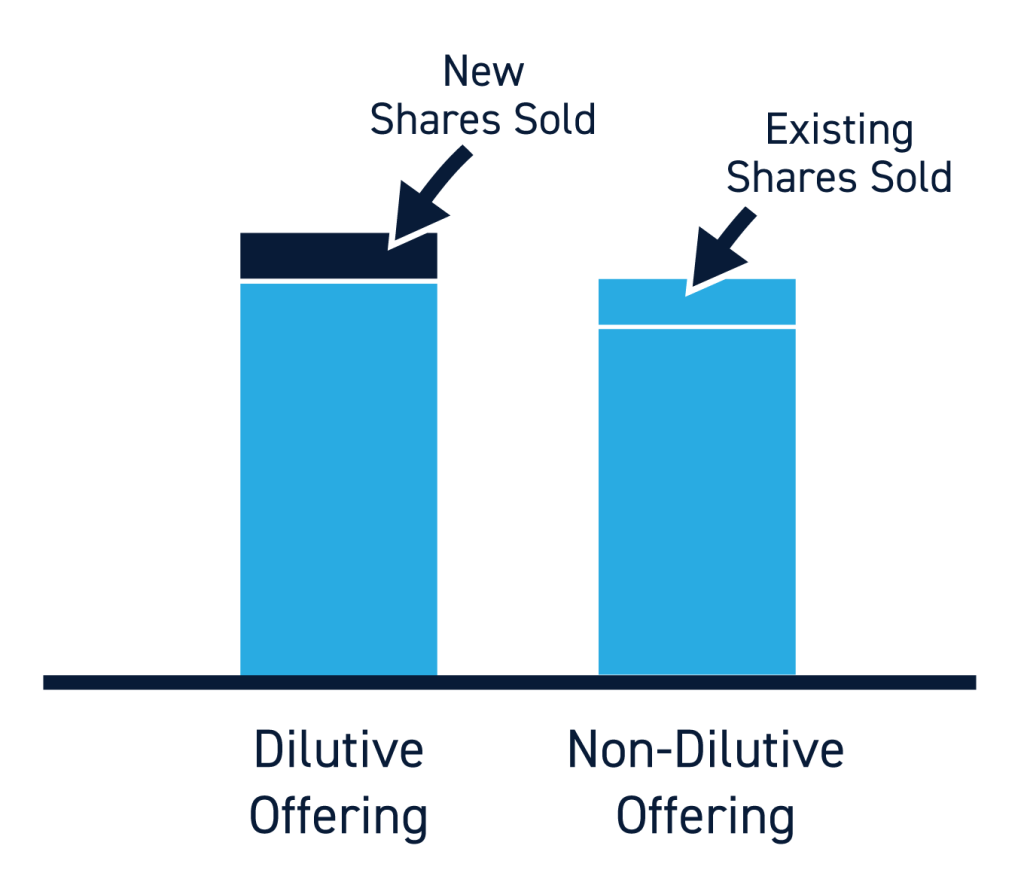

A secondary shelf offering, commonly referred to as a follow-on offering, is when more of an existing security that is already trading is sold into the market. A secondary offering can be dilutive or non-dilutive. It’s important for traders to carefully read the company’s shelf registration to understand if the shelf offering will be dilutive or non-dilutive.

A non-dilutive secondary offering is when existing shareholders (such as employees, investors, or debt holders) sell their securities into the market. No dilution happens in this scenario because the shares are already factored into the outstanding share count and the shares that are sold only get added to the float.

A dilutive secondary offering is when a company creates and issues new shares of a security that is already trading. Dilution happens in this scenario because the new shares raise the outstanding share count and are also added to the float.

Ways Shelf Offerings are Sold

Companies can choose to use a variety of distribution methods to sell securities in a shelf offering. You can view information about the company’s planned sale distribution methods in the “Plan of Distribution” section of its Form S-3. Some of the most common sale distribution methods of shelf offerings are through “at-the-market” transactions, private transactions, and underwriting transactions.

At-the-Market Transactions

An at-the-market sale is when a company sells shares into the market at current market prices. At-the-market transactions can be facilitated by selling shares into the market through market makers, agents, or distributors. The shares could also be sold to a market maker who then resells them into the market.

The ability for companies to sell shares into the market without warning is what makes shelf offerings a scary prospect for dilution. If not facilitated in the best way, at-the-market transactions can also cause stock prices to get quickly hammered down by a large number of shares suddenly being dumped into the market.

Private Transactions

Private sales or private placements are facilitated outside of the public trading market. Private sales can be made for primary or secondary offerings. Private buyers could include financial institutions, accredited individual investors, or mutual funds. Private transactions may occur at fixed or negotiated prices different than the current market price.

Underwriting Transactions

Underwriters typically enter into purchase agreements with companies with the intention of reselling the shares themselves into the market. Underwriters for shelf offerings commonly include investment banks and broker-dealers. Instead of a company doing an at-the-market sale and potentially spooking the market, they can sell the shares to an underwriter at a discount to current market prices who then will try to resell the shares into the market for a profit.

Advantages of Shelf Offerings

- Quick Access to Capital Markets

A shelf offering allows companies to quickly sell securities and raise capital when they feel the timing is right. The hard work for companies is done up front during the shelf registration statement filing process which then makes it an easy and efficient process for companies to execute sales of the pre-registered securities down the road.

- Control and Flexibility of Sales Timing

Shelf offerings extend to companies a 3-year window of opportunity in which they can sell securities at any point. Effectively, shelf offerings give companies the ability to raise capital on an if/when-needed basis during a 3-year window of time. Shelf offerings also give companies the flexibility to sell securities and raise capital all at once in the future or at different times in the future. A company with an active shelf offering has the opportunity to wait until market conditions are most favorable for it to raise capital.

- Faster Registration Processing

Traditionally, every time a company wants to do a primary or secondary offering, the SEC requires a registration statement to be filed for the securities being offered. An advantage of a shelf offering is that the shelf registration Form S-3, usually, can be reviewed and approved by the SEC quicker than a traditional registration Form S-1.

- Simpler SEC Forms and Reporting Requirements

SEC filings can be a costly and time-consuming process for companies. Generally, a shelf registration statement Form S-3 has fewer disclosure requirements and simpler reporting requirements than a traditional registration statement Form S-1.

A shelf offering also allows a company to utilize an advantageous legal concept called incorporation by reference. Incorporation by reference is a practice in shelf offerings that permits companies to simply follow all their standard SEC reporting requirements, such as 10-Qs and 10-Ks, and incorporate the reports into the shelf registration Form S-3. In other words, a company can satisfy part of its reporting duties in the Form S-3 just by including references to its other past, current, and future reports.

Therefore, companies can keep shelf registrations current by using incorporation by reference instead of having to continually make amendments to the Form S-3 or file new registration paperwork with the SEC every time they sell securities in a takedown. The simpler reporting and paperwork requirements involved with shelf offerings, compared to traditional offerings, enable companies to save time, reduce costs, and deal with less complicated filings.

Why Do Companies Issue Shelf Offerings?

Companies issue shelf offerings for numerous reasons. Some companies may issue shelf offerings for the purpose of raising capital for immediate or short-term needs. Other companies may issue shelf offerings solely for the purpose of having the option to sell securities when and if needed in the future with no immediate intention of selling securities.

Some of the primary reasons companies may use shelf offerings include to retire or refinance debt, fund dividend reinvestment programs, raise capital to strengthen their balance sheet, raise capital for a potential acquisition, raise capital for general operating expenses, or to provide a liquidity outlet for existing insider shareholders that want to sell. The reason(s) for a company issuing a shelf offering can either be positive or negative, depending on the company and circumstances. The company’s Form S-3 will provide traders with more insight into the company’s reason for the shelf offering.

Examples of Shelf Offerings

Dividend Reinvestment Program

Say, company XYZ wants to start offering a dividend reinvestment program (DRIP). They choose to utilize a shelf offering solely for the purpose of facilitating the DRIP. They check the box on Form S-3 stating that the only securities being offered are specifically for a DRIP. As previously mentioned, it’s critical for traders to read the company’s Form S-3 filing to understand the purpose of the shelf offering and not automatically jump to the conclusion that the company is another serial diluter trying to take advantage of favorable market conditions to cash out.

Failing Company Burning Through Cash

Say, a biopharmaceutical company is in the process of developing a new drug. They are poorly managing their business and they are burning through cash. They need to continually raise cash in order to keep the company operating and keep working on their drug.

They file a shelf registration for a continuous shelf offering to be able to sell up to 20,000,000 new common stock shares in dilutive secondary offerings. They immediately sell half the shares to raise the funds they need to continue operating for the next year and put the remaining half of the shares “on the shelf” to potentially be sold in the future. They got the cash they need with the initial sale, but also have started to dilute shareholders.

Six months later, they have already burned through all the cash they raised from selling the first 10,000,000 shares. However, they have just announced a breakthrough development for their drug and the prospects of the drug look great. On the positive news, their stock price jumps.

They decide to take advantage of the elevated stock price by taking another 2,000,000 shares “off the shelf” and selling them in an “at-the-market” offering which allows them to raise more working capital, but further dilutes shareholders. This cycle continues for a few more years until all the shares have been taken “off the shelf” and sold into the market, leaving shareholders significantly diluted.

Launch a Future Product

Say, a tech company is silently building a new revolutionary AI product behind the scenes that the public doesn’t know much about. They are currently financially healthy and have no need for raising capital. However, they plan on initiating a massive marketing campaign for the new AI product once it is ready to launch. They know the marketing campaign is going to cost a lot of money that they won’t be able to afford, according to their future financial projections.

They decide to file a shelf registration for a delayed shelf offering to be able to issue new debt in a primary offering when they are ready to start the new product marketing campaign. By using a shelf offering and pre-registering the debt securities they intend to sell in the future, they will be able to raise the capital they need for the marketing campaign quickly and efficiently when they feel the window of opportunity is best.

Is a Shelf Offering Good or Bad?

The Short Answer

It depends.

There are a number of factors that can determine whether a shelf offering is good or bad including, but not limited to, if the company is considered a serial diluter, what the company is going to use the funds for, the timing of when the company chooses to sell its securities in a takedown, and the types of securities being offered.

The Good

- Companies that have shelf offerings in effect have the ability to raise capital efficiently when market conditions are favorable and maintain flexible control over their balance sheets.

- Shelf offerings provide a growing company with plenty of available runway to continue raising capital and fueling its growth.

- Shelf offerings used exclusively for a DRIP provide an efficient way for investors to reinvest in the company.

- Shelf offerings grant companies a quick lifeline for raising capital if their financial condition becomes poor.

- Shelf offerings authorize a way for existing insider shareholders to sell their shares into the market and provide more liquidity to the market without negatively affecting the stock price in a significant way if done properly.

- Shelf offerings make it easier and less expensive for companies to access capital markets.

- If a stock has extremely high demand but a low share count, a shelf offering can be used instead of a traditional IPO to bring more shares into the market in a more fluid process, giving more traders and investors access to the shares.

The Bad

- Even when a good company does a shelf offering for good reasons, dilution can still result.

- Due to a certain reputation that shelf offerings currently have, it’s extremely common for a company’s stock price to drop as soon as a shelf offering is announced, or a takedown sale is executed.

- Regardless of what the shelf registration statement says, you may never truly know what the intentions of the company are.

- When a company’s stock price significantly increases, it can be very tempting for a company with an active shelf offering to take advantage of the higher stock price and start selling new or existing shares to cash out, consequently diluting shareholders.

- Companies that continuously use shelf offerings to dump new shares into the market can be considered in the trading community as serial diluters. These types of companies can have a reputation for manipulating their float, diluting shareholders, and recklessly burning through capital without increasing business results in any kind of significant way.

- Shelf offerings can be seen as a bad omen for companies with a dubious reputation because a shelf registration is, essentially, a green light given to a company that could allow nefarious executives or board members of the company to dilute the company’s stock at will and potentially use the proceeds of securities sales for inappropriate “general corporate purposes” such as buying a company jet or funding their own lavish lifestyles via execute bonuses.

Conclusion

Shelf offerings have been rising in popularity as an alternative way to raise capital during volatile market conditions. Shelf offerings can be complex, not every company utilizes shelf offerings in the same way, and each shelf offering has unique characteristics. Traders should always be sure to read a company’s shelf registration Form S-3 and any relevant prospectus supplements to understand the shelf offering.