When you execute a stock trade, there are a number of actions that take place behind the scenes, or back office. While you may have bought and sold a stock in a matter of seconds, there is a complicated process that happens during the trade and after the trade, notably the settlement process to officially clear the trade and have it documented in the “books” to properly reflect the new owner of the shares.

What is a Clearing Firm?

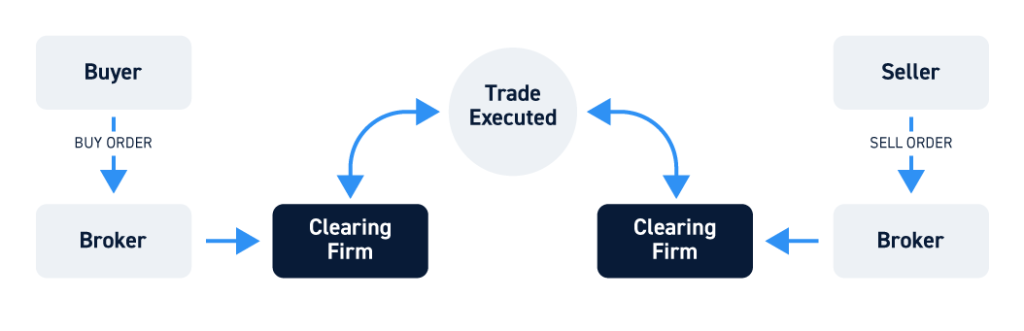

A clearing firm, also referred to as a clearing house, is a financial institution that settles trading transactions. It verifies the trade and manages the settlement process to clear the trade. The clearing firm matches the buyers and sellers and takes on the financial and legal risk for completing the trade.

Settlement is completed when funds are received. This process takes two business days and is referred to as T+2 (trade date plus two additional days). Margin accounts enable traders to make more trades without having to wait for actual settlement since the funds are borrowed and returned upon closing. Often times, introducing brokers will outsource this function to a clearing firm that will handle the settlement process for a fee. This is the “back office” which is labor intensive and costly to handle in-house for smaller brokers.

Clearing firms are essential when borrowing shares for short sales. Exceptional clearing firms tend to carry more short inventory of stocks. It’s not unusual for traders to have their brokers contact several clearing firms to locate shortable shares for traders. While this is done electronically, it can still take time and much effort for hard to borrow (HTB) stocks. Clearing firms are also responsible for ensuring the funding and delivery of securities between counterparties.

Clearing Firms vs. Brokers

Brokers are the conduit which enables customers to access the stock markets and place trades. Once that buy or sell button is hit and the trade is executed, the clearing firms handle the back-office duties to ensure that the trade and monies are settled and cleared.

Brokers must utilize a clearing firm to enable their customers to execute trades and traders need a broker in order to place trades. Clearing firms then take on the financial risk of the trade settlement. In that vein, the clearing firm is financially responsible for the completion of the trade sequence.

If the trade fails for any reason, the clearing firm is responsible for paying the counterparty to settle the trade and help maintain a smooth marketplace. It’s rare for a trade to fail since the broker is responsible for making sure the buyer has the funds to complete the transaction and the seller has ownership. The clearing firm is responsible for the delivery of the security and reporting the data of the trade. Brokers and clearing firms work hand in hand together to carry out the complete trade sequence from the moment you click the buy and sell buttons.

What is a Self-Clearing Broker?

Some brokers have the resources to handle the clearing process in-house. Brokers that settle their own trades and handle the duties of a clearing firm are called self-clearing brokers. As the name implies, they clear their own trades without any outside parties being involved. These are literally vertically integrated financial institutions that have the resources to handle the time consuming back office roles and responsibilities to settle trades. From access to the markets and trade initiation through the settlement and clearing process, it’s all processed under one roof resulting in more efficient completion. A self-clearing broker can provide many benefits to its customers with all the resources and processes in house.

What Are the Benefits of a Self-Clearing Broker?

As outlined, a self-clearing broker handles trade settlements in-house to clear trades. This results in many benefits to its customers which include:

Control

Having end-to-end trade clearing in-house naturally provides more control for the broker. The brokerage has complete control in a vertically integrated fashion. Any irregularities can be detected and corrected immediately without having to go back and forth with a third-party as there is no middleman involved. While errors with trade settlements are rare, it’s good to know any problems can be handled quickly and efficiently under one roof. This is great for customers as there is complete accountability in a one-stop shop model without having to work through layers of middlemen. Brokers that cater to specific types of customers like active traders further elevated their value since more trades means more clearing with a single point of contact for the customer and back office.

Efficiency

When an introducing broker uses an outside clearing firm any and all communications must be made to this outside party whose interests are not exactly in line with the brokers client. Self-clearing firms work to provide answers in a more streamlined manner as the end client is directly tied to the whole entity. These questions may be related to money movements, margin calls etc…

Short Selling

Clearing firms play a major role in short selling. When traders borrow or locate stocks in order to short it, they are effectively borrowing from a clearing firm. This works because clearing firms hold a vast number of the stock certificates for a given stock, and so it is able to seamlessly process the transaction internally. In the event of stocks that are not easy to borrow, the clearing firms securities lending team reach out to multiple financial institutions to borrow more stock. These teams with strong relationships within the industry can offer an advantage to traders who lean on a short selling strategy.