Cryptocurrency markets have finally become mainstream. Cable financial news network tickers include popular crypto prices in addition to the Dow Jones, S&P 500, and Nasdaq benchmark index prices. Crypto ETFs, futures and options are increasing in liquidity and popularity. Most importantly, financial institutions and bell weather companies are not only acknowledging but investing in cryptos. This sparks the inevitable question of how crypto markets impact the stock markets.

Cryptos vs. Stocks

While cryptocurrency markets still pale in market capitalization compared to the stock markets, they share many similarities. Both markets are tradeable on a general level, though liquidity varies vastly as the broader stock market carries much more liquidity.

Institutions dominate the stock market and are in the early stages of entering the crypto markets.

The stock market is a much more structured and regulated environment with added investor protections. The crypto markets are still very risky without a governing regulatory body. In fact, crypto markets are all about decentralization which goes against the idea of single governing regulatory body.

Stocks and cryptos move based on supply and demand (i.e. buyers and sellers). However, stocks have fundamental and quantitative-based intrinsic valuations based on the underlying company performance metrics. Cryptos in general have no intrinsic value since they don’t represent underlying companies with quarterly earnings reports to gauge the performance of the business operations. In that sense, it could be argued that cryptos are a more pure supply and demand driven market.

How Crypto Markets Affect Stock Markets

Since crypto markets are relatively new compared to stock markets, the question arises as to the level of correlation that exists between stock and crypto markets. Are the crypto markets coupled or linked to the performance of the stock markets? The answer is yes and no.

Let’s take a look at how these markets may impact each other.

Market Participants

First its important to note that all markets need one basic component, participants. Stock markets have deep pools of liquidity due to its market participants that include both institutional big money and retail traders.

The same retail traders that are active in the stock markets tend to dip their toes in the crypto markets. In fact, the crypto markets have much smaller barriers to entry since they don’t have the PDT rule requiring at least $25,000 in equity to make day trades. Cryptos have no minimum, no PDT rule and trade 24 hours a day and seven days a week.

These low barriers make cryptos appealing to new and beginner traders notably in in the Millennial and Gen-Z demographics.

Crypto trading may serve as a gateway to stock trading (and vice versa). The increase in participants in one market may lead to an increase in participants in the other.

Hot Sectors/Themes

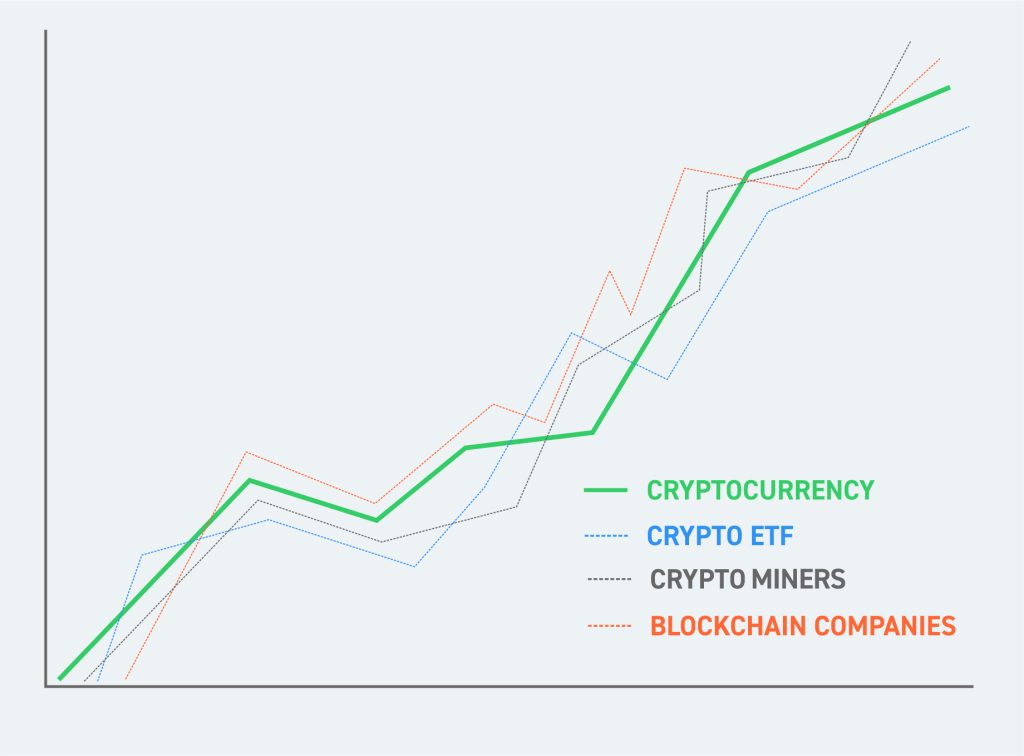

When crypto markets are hot, certain stocks, sectors, and themes may also be hot.

There are certain stocks that are highly correlated to the crypto markets. Examples include:

- Crypto Miners

- Blockchain Companies

- Crypto Brokerages

- Hardware Producers (i.e. CPU/GPU)

- Crypto ETFs

Any wide swings or trends in the crypto markets will impact the price moves in crypto-themed stocks that have holdings or operate in the crypto markets. For example, if bitcoin is breaking out, the stock of a company that mines bitcoin may break out as well.

Some hardware, CPU and GPU companies also move with the cryptos since they sell the components of mining rigs. It’s also worth noting that companies that open up a crypto-based subsidiary or invest in crypto currencies tend to get a crypto premium followed by correlation with the markets.

Some stocks (i.e. crypto ETFs) are directly correlated to cryptocurrency markets as their value genuinely fluctuates relative to the price of the underlying cryptocurrency. For example, if bitcoin increases by 10% in one day, it would be reasonable to assume that a bitcoin ETF will have a similar move.

Are Crypto Markets and Stock Markets Correlated?

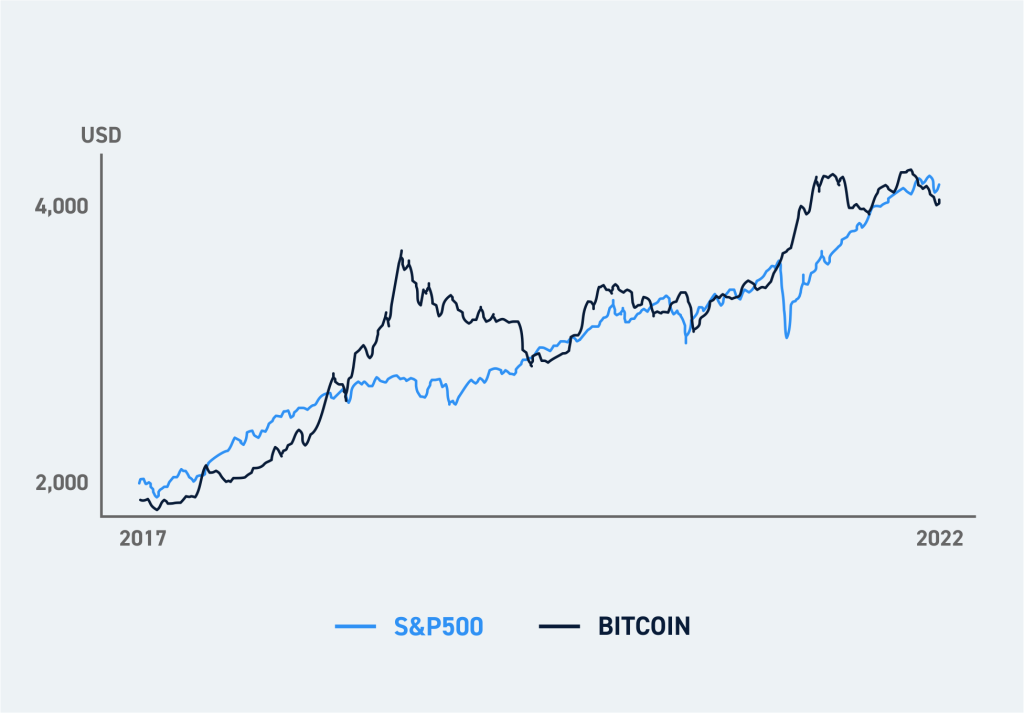

Some crypto market and stock market correlations do exist. Companies that are directly involved with the crypto markets through investment or business tend to correlate to the underlying price movement. However, there is no concise and consistent correlation between stock benchmark indices and the crypto markets. Bitcoin movement tends to determine the overall direction of crypto currencies, just as the S&P 500 index tends to determine overall stock market direction.

At times, crypto markets may move alongside stock markets. For example, retail traders may flood the markets looking to buy up both stocks and cryptocurrencies.

At other times, crypto markets and stock markets may be negatively correlated (and crypto may be viewed as a hedge to stocks).

Correlation Factors

There’s been a lot of conjecture surrounding bitcoin being the digital gold in this era. Just as gold is an inflation hedge, there is belief that bitcoin and cryptos can act as an inflation hedge.

There isn’t enough data to confirm this as history is still playing itself out. With the Federal Reserve set to implement three rate hikes in 2022 to combat inflation, crypto markets will prove if they truly are an inflation hedge or a stock market volatility hedge.

Much like commodities, the correlation may fluctuate during different periods of time. For example, oil prices can correlate with the S&P 500 index like from 2020 to 2022. They can then diverge during different periods of time like from 2014 to 2019. The same applies for gold, precious metals, and raw materials correlation.

The answer to the correlation between cryptos and stock markets is that they do correlate sometimes and diverge at other times depending on various factors ranging from interest rates, geopolitical disruptions, regulation and economic policies.