Understanding Contango and Backwardation

The age-old theme of trading and investing follows the mantra, “Buy low and sell high.” However, there are widely traded and owned exchange-traded-funds (ETFs) that practice the opposite mantra, “Buy high and sell low.” Why on earth would anyone invest in an instrument practicing that type of management 80% of the time? As it turns out, the pricing structure of contango is “normal” for futures but a nightmare of certain types of ETFs.

What is Contango?

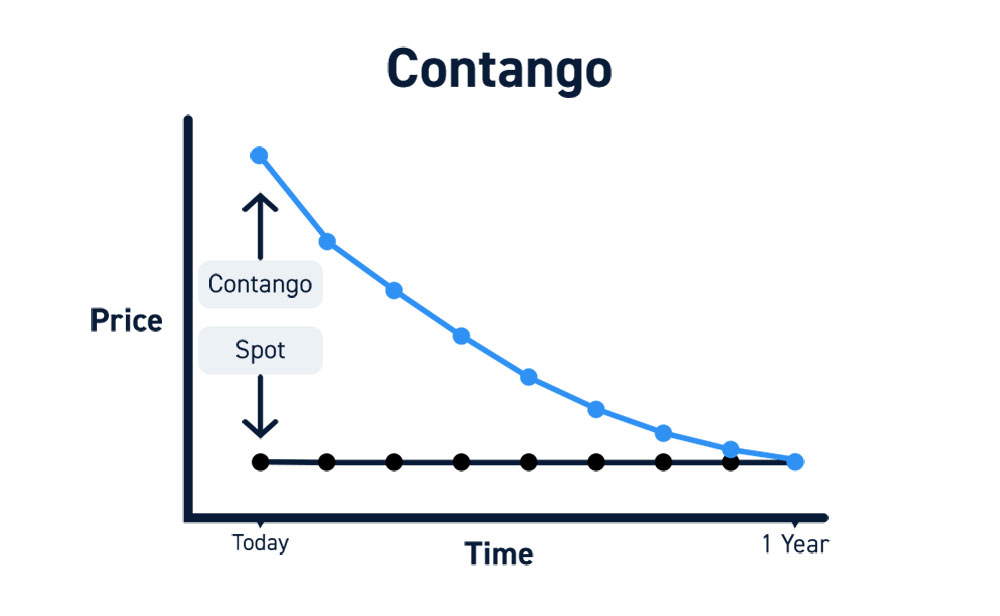

Contango, also called forwardation, is the pricing situation found with futures contracts where longer-dated futures consecutively trade at higher prices than the spot (current period) contracts. Usually, time premium and/or carry costs (for commodities) normally makes long-dated (further out) futures more expensive then near-term or current month futures.

Equity options follow contango pricing, where long-dated options carry a higher premium than the front month options. Futures markets are in a state of contango approximately 80% of the time. As expiration nears, the futures move closer to the spot price as buyers prepare to take delivery of the underlying commodity to close out the contract.

What is Backwardation

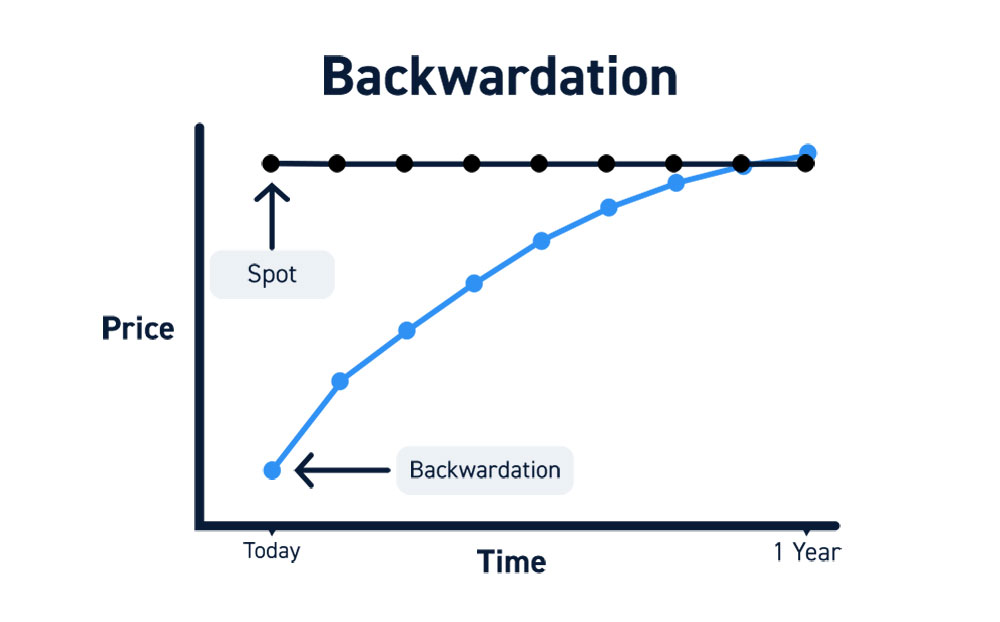

The opposite of contango is backwardation – a pricing situation where the spot price trades higher than longer-dated futures contracts. This implies demand for the commodity spiked so hard that it’s worth more now than later as demand falls off. This is also a sign of volatility spikes, which can trigger from demand shock and/or supply disruption.

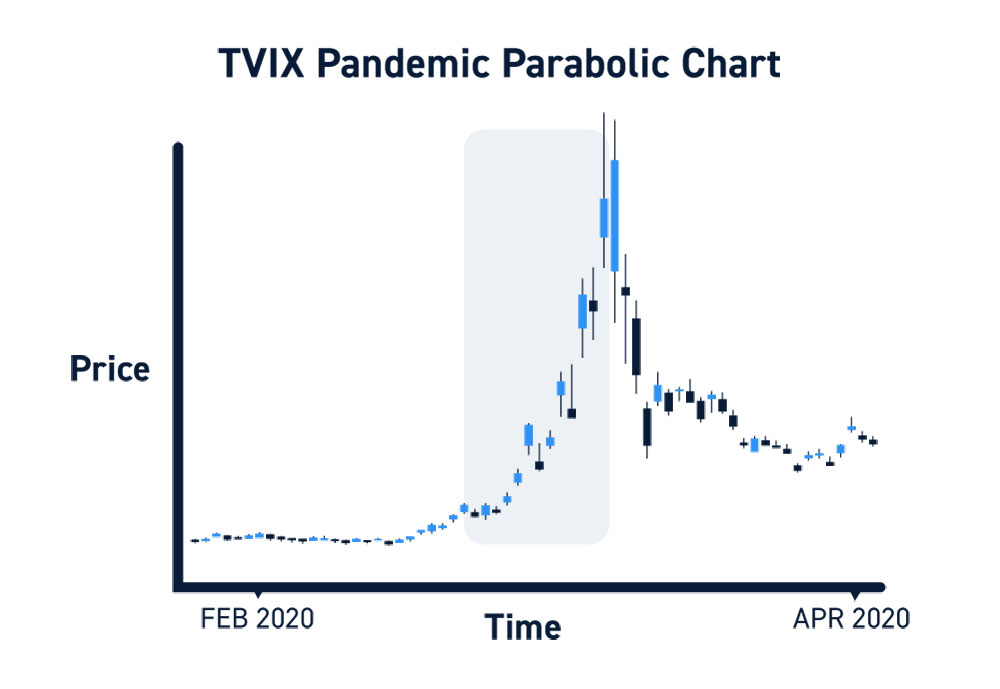

In the case of commodities, crude oil futures are normally in a state of contango until a demand/supply shock triggers like a war or geopolitical tensions in the middle east. Crude oil futures have carry costs to store the physical oil which lend to the contango effect. As front month futures near expiration, the future and spot prices overlap as buyers take physical delivery from sellers. Backwardation tends to occur less than 20% of the time with VIX futures. When the COVID-19 pandemic triggered the S&P 500 index ETF (NYSEARCA: SPY) collapsed of (-35%) in five-weeks, VIX trading instruments like UVXY and TVIX went parabolic causing extreme backwardation when the current spot priced higher than the long-dated futures.

Why Traders Need to Understand Contango and Backwardation

Even if you don’t trade futures contracts, contango could make a material impact if you trade ETFs that trade underlying index of commodity futures. Leveraged ETFs on the VIX, crude oil, gold and even the S&P 500 all fall under contango pricing.

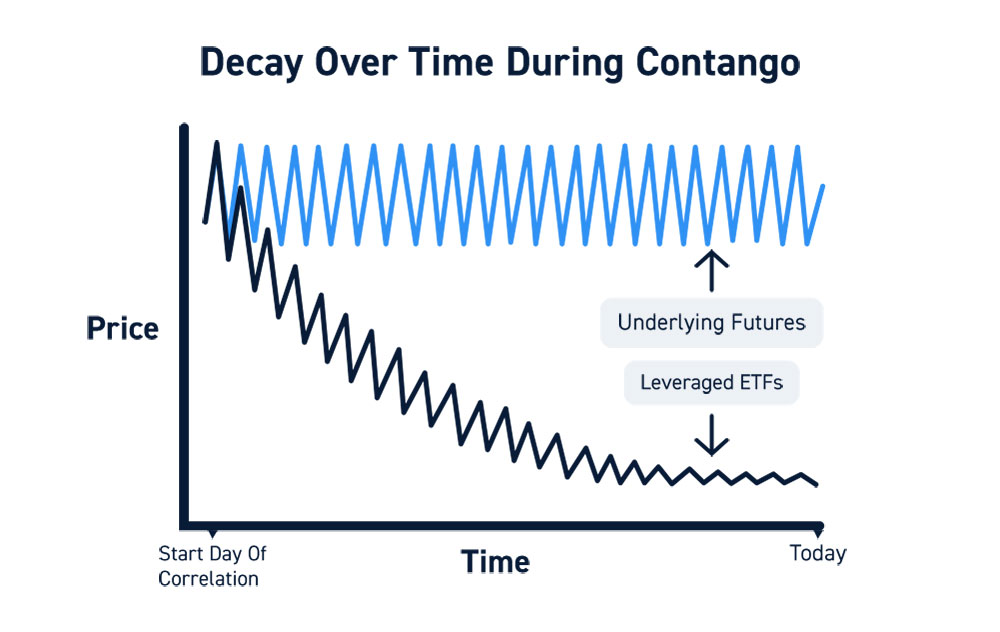

However, certain instruments like VIX products and leveraged ETFs state the objective is to mirror the “one-day performance” of the underlying index or commodity. Usually, this done synthetically buying and selling the futures contracts. In a normal contango market, an ETF will buy the forward month futures while selling the spot or current month contracts to keep an average inventory for a 30-day period. It’s a perpetual process of rolling the futures forward. However, ETFs can’t roll over futures, instead they buy the further out futures at a higher price to replace the current futures being sold at a lower price. This results in decay over time during contango periods. This is why leveraged ETFs like the UVXY tend to lose 8 to 13% monthly during low volatility periods. Long-term investors should never hold these ETFs in a portfolio as the time decay erodes value.

Impact on ETFs

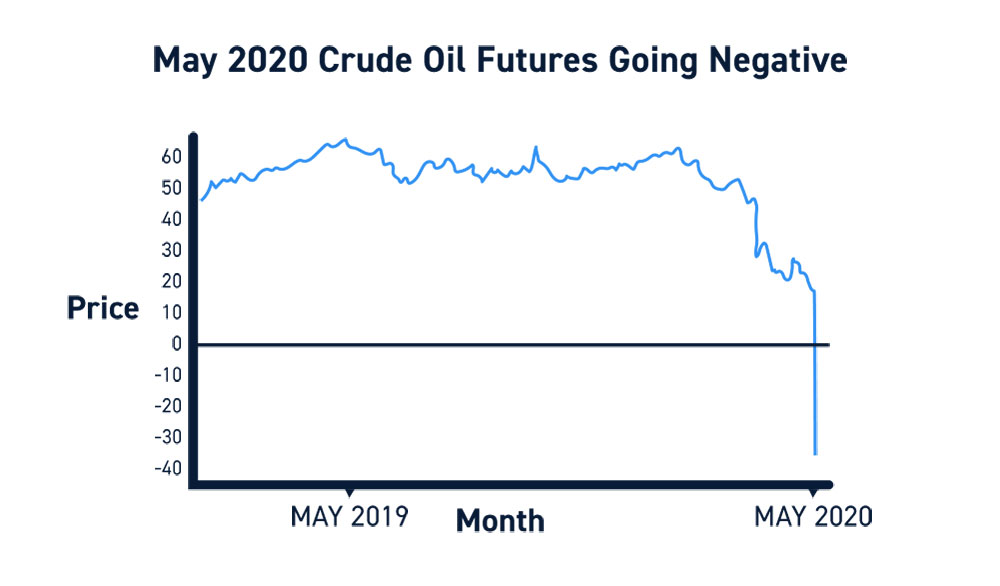

The effects of extreme contango and backwardation can result in the malfunction and breaking of ETF products. On April 23rd, 2020, investors and traders were witness to an unprecedented event when May crude oil futures went negative the day before expiration sinking to negative (-) $34 per-barrel.

Due to the global demand freeze from the effect of COVID-19 and oversupply, buyers actually refused to take delivery due to the carry costs of storage. In fact, the buyers were paying not to deliver the oil, which is how the contract price went negative. Each contract representing 1,000 barrels of crude oil.

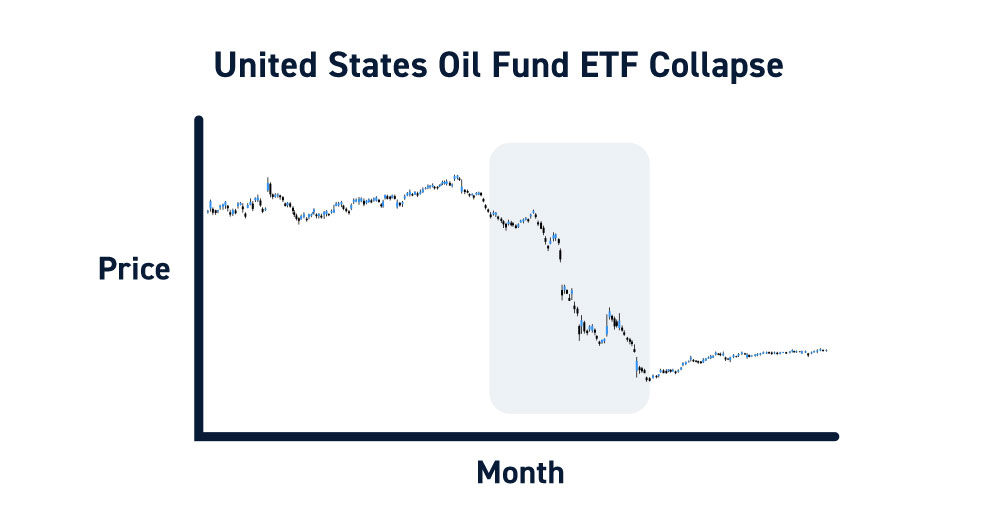

Unfortunately, this disruption caused the widely held United States Oil Fund (NYSEARCA: USO) ETF to collapse and malfunction as extreme contango went into effect. The lasting ripple effect is not only the loss of value, but the loss of confidence in widely held ETF products as investors get a rude awakening to what they were actually holding.

Conclusion

The takeaway lessons here are traders is to be very cautious holding any leveraged or commodity ETFs beyond a short-term time frame. It also helps to be aware of the underlying mechanics behind how these ETFs mirror the performance of the index or commodity. If futures contracts are involved to take on synthetic positions (rather than owning the actual commodity), then be aware of the embedded value decay and erosive nature of the contango effect.