Executing trades by placing orders can be simple or complex depending on the orders types you implement. The access to different orders types depends solely on your brokerage platform.

While discount and zero-commission brokers attempt to simplify the process often through order flow arrangements that limit your capacity for advanced order types, they don’t do you any favors when it comes to customizing your executions.

Direct access brokers (DAB) provide more choices at a cost but enable the freedom of direct order execution and access to advanced order types. This can be a crucial tool in a traders arsenal. While the specifics of placing advanced orders may differ depending on your platform, the mechanics and uses are the same.

Advanced Order Types

What They Are

Advanced orders are used for more precise fills based on user specified circumstances. They are refined orders that trigger when certain conditions are met. They are more complex than the basic manual market and limit buy and sell orders as they abide by certain conditions and parameters.

When to Use Them

In a nutshell, they can and should be used when conditions warrant and most importantly when they fit your strategy. The specific parameters needed to trigger should be based on your strategies with the intention of improving execution conditionally.

Let’s take a look at a few advanced order types.

VWAP Order

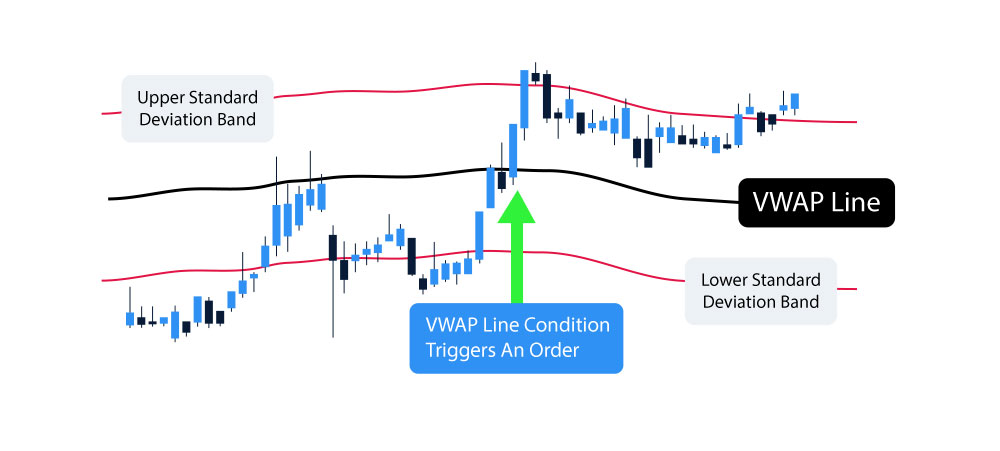

The volume weighted average price (VWAP) is the average price of a stock based on volume. Heavier volume prices have more of a weighting and thus the VWAP considers both price and volume. The VWAP is used by institutions and professionals to gauge both quality of executions and trends. Using algorithmic VWAP order types you are able to place orders with the intention of executing over a set time relative to the VWAP.

How It Works

Since the VWAP is a line in the sand price that determines trend and provides liquidity, you can place BUY and SELL orders when the VWAP price hits. Depending on your platform, you would specify VWAP as the limit price when placing your BUY or SELL order. Depending on your brokerage platform, you may have a customized VWAP trading algorithm that will automatically send orders with the goal of executing in-line with the VWAP.

When You May Use It

A VWAP order is used to get executions automatically near the VWAP level to assure fills are in line with the daily average. You can use it to follow the trend automatically (IE: Buy on pullbacks on the VWAP for uptrends). When you want to be objective and take the emotions out of the equation, then you can use the VWAP algorithm order for your strategy. It is important that you are using a full trading methodology.

TWAP Order

What It Is

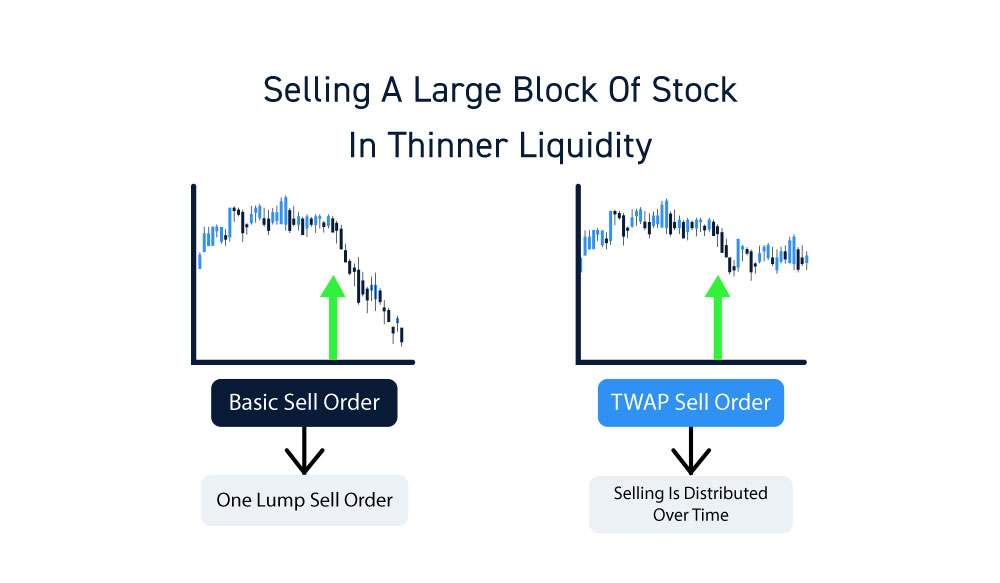

A time weighted average price (TWAP) order prioritizes time as trades are executed evenly in smaller pieces throughout the day or over a specified period. This is typically used to minimize market impact by breaking up a larger orders into smaller lots executed evenly throughout the day.

How It Works

The TWAP is calculated by averaging the open, high, low, and close for each period bar. The TWAP order will automatically spread out the fills for a large order at these prices. It’s best to check with broker on the specifics of entering a TWAP order.

When You May Use It

If you have a large block of stock you wish to trade (BUY or SELL) especially in a thinner liquidity stock, then you can consider placing a TWAP order which will execute smaller pieces of the order throughout the day. The goal is to spread out the order in both size and time to minimize market impact.

Market-on-Close (MOC) Order

What It Is

This is a market order that executes your trade at the market closing price. While a fill is guaranteed, the price is completely at the discretion of the market. Use caution with these order types since price can be extremely volatile at the close, depending on several factors.

How It Works

The goal of an MOC order is to obtain the last possible price for the trading day when there is potentially significant volume. For NASDAQ stocks, a MOC order must be placed by 3:45pm EST. For NYSE stocks, a MOC order must be placed by 3:50pm EST. At 3:58 pm EST, the MOC orders can not be cancelled or changed after the cutoff times.

When You May Use It

An MOC order should be considered if you need to execute your trade as close to the closing price as possible. It’s also used among international traders in different time zones, so they don’t have to stay up in the wee hours of the morning. Most importantly, they are used when you are not able to open or close a position at the end of the day. This order enables your trade to execute as close to the last price as possible, but the price is not guaranteed.

Market-on-Open (MOO) Order

What It Is

Much like an MOC order, MOO is an order that is placed to execute as close to the opening price as possible. The goal is to get filled at or near to the first print price of the day regardless of what the price is. These orders can be risky due to the typical volatility of the open and unpredictable nature of price at the open.

How It Works

All MOO orders need to be placed before market open. For NASDAQ stocks, all MOO orders must be placed up 9:28 am EST, at which point the orders can’t be cancelled or changed. Check with your broker on the mechanics of placing an MOO order on your specific platform.

When You May Use It

The market opening is extremely volatile. You should consider a MOO order when you need to get filled on the opening price print preferably with a large order. Perhaps there is good news that will trigger buying pressure on the open, you could place a MOO order to get a fill. For thinner and more illiquid stocks, an MOO can be used to offset the opening volatility and attain a guaranteed fill. Keep in mind that an execution is guaranteed but price is not.

Conditional Orders

What It Is

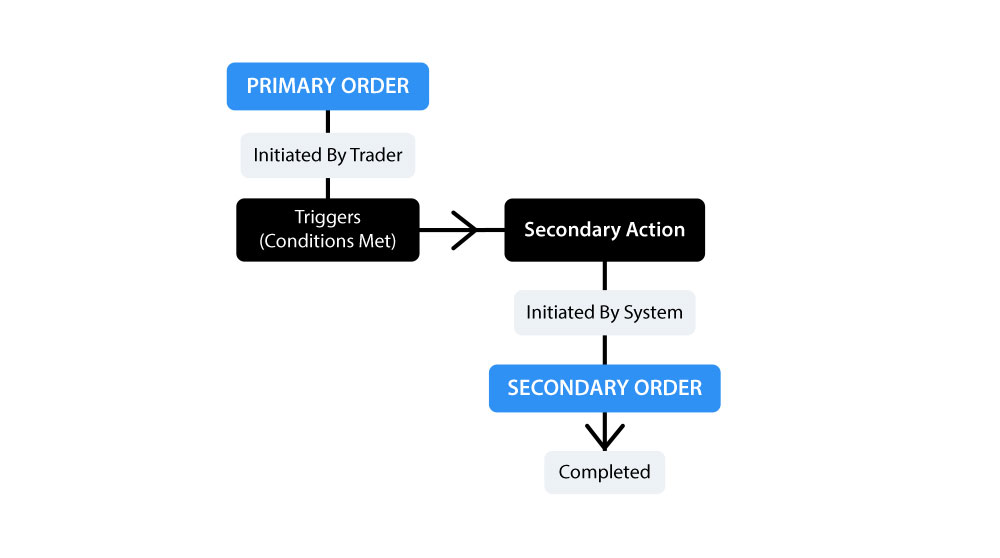

As the name implies, these orders are executed based on specific conditions and parameters configured by the trader. These conditions are based on certain actions that trigger a secondary action. A primary order is executed on a trigger, which can then trigger a secondary order immediately or upon conditions applied to the primary order. Conditional orders are the first step towards semi-automating your trading strategy. Most brokerage platforms provide conditional orders, however, check with your broker on specific directions to placing the various types of condition orders.

Common Types of Conditional Orders

Here are some of the more commonly used condition order types. Keep in mind that you will have to configure the time in force (IE: good-until-cancel or intraday) as well as stipulating a limit order or market order upon triggers on both the primary and secondary orders.

One-Triggers-the-Other (OTO)

This order is composed of a primary order that triggers a secondary order upon getting filled on execution. For example, placing a OTO limit buy order for 1000 shares of XYZ at $15.70 with a sell limit order at $16.50. In this example, the OTO order only triggers when the $15.70 limit price is executed. Once the trade is filled, then a secondary order to sell 1,000 shares at $16.50 is then placed.

One-Cancels-the-Other (OCO)

This OCO order is comprised of two trade orders and whichever order triggers first will cancel out the other order. For example, you own 500 shares of XYZ at $30. You can place an OCO order to sell the 500 shares at $35 and at $25. One order is a profit exit and the other is a stop loss. If XYZ surpasses $35, the OCO order will sell the 500 shares and cancel the sell 500 XYZ at $25 limit order. Vice versa, if XYZ stock falls under $25, then it will sell the shares for a stop-loss at $25 and cancel the sell 500 shares at $35 limit order since you don’t have the shares.

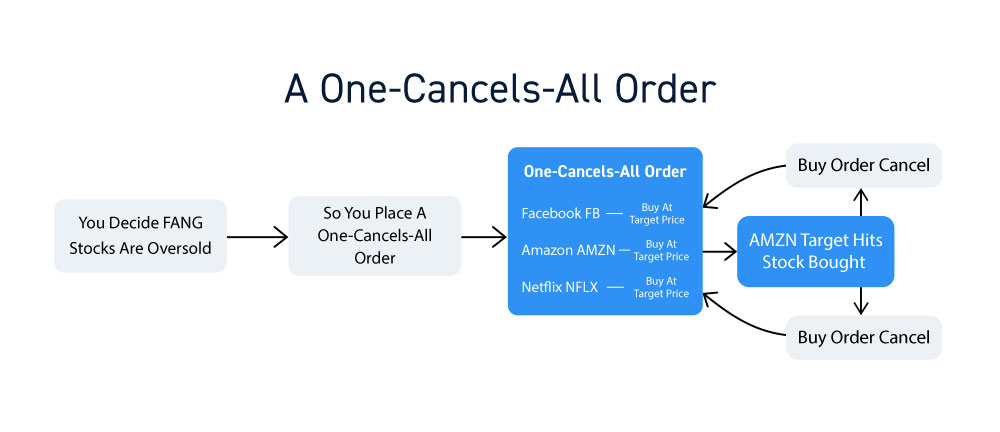

One-Cancels-All (OCA)

The OCA order will cancel the other orders when trigger. You may have three separate order in place in an OCA order. The moment one of the orders is executed, it will automatically cancel the other two orders. For example, you may want to enter a position in three different stocks. You can place a buy limit price for each stock and whichever stock executes first will cancel the buy limit on the other two orders.

Combinations of the Above

Once you understand the mechanics of conditional orders, you can string them together. As mentioned earlier, this is the gateway to semi-algorithmic trading. The benefit is that the computer executes your orders with no emotion and second guessing. You can extrapolate the orders with multiple legs and conditions.

When you may use it

Conditional orders enable you to semi automate your strategy. Once you get comfortable placing conditional order, you can utilize them in situations where you admittedly may get chopped out of a trade or are emotionally attached to the stock(s). There is also a convenience factor since you may have a basket of stocks you are watching and can’t follow each one closely.