ECNs, or electronic communication networks, are computerized networks in which traders can trade directly with one another. ECNs have several advantages, including tighter spreads and more options for after-hours trading. However, they can also have drawbacks such as high access fees.

In this guide, we’ll explain what ECNs are, how they work, and when they may be most useful for trading.

What is an ECN?

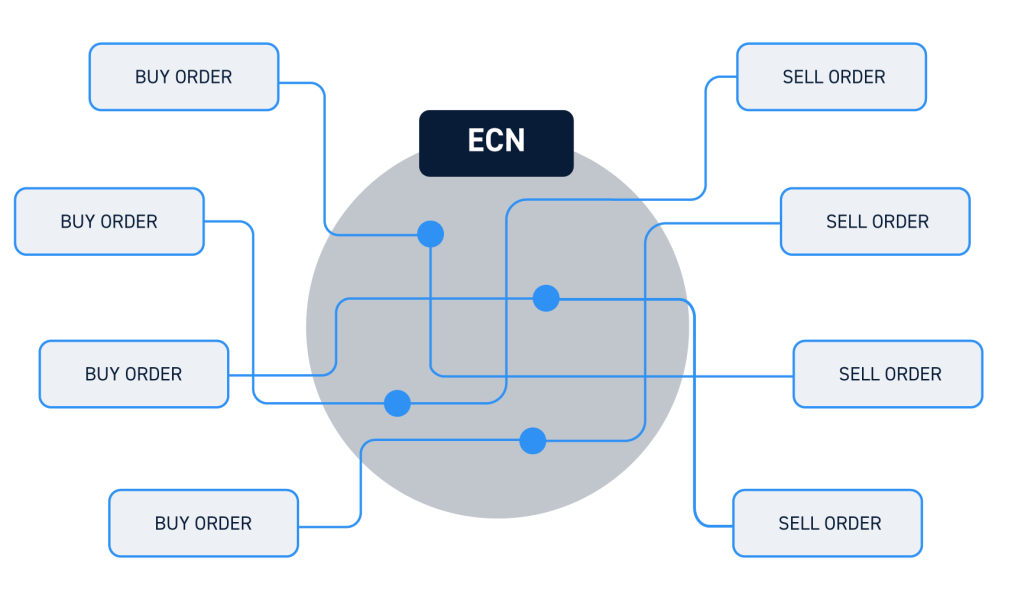

An ECN (electronic communication network) is a computerized system that matches buyers and sellers in financial markets. In contrast to traditional market networks, which require market makers to serve as intermediaries between buyers and sellers, ECNs connect buyers and sellers directly.

ECNs can be used to execute trades on major exchanges during market hours, but they can also be used to facilitate trading activity between individual traders outside of market hours. In addition, ECNs can make it easier for traders to execute international orders.

In the US, ECNs must be registered as broker-dealers similar to market makers and brokerages.

How ECNs Work

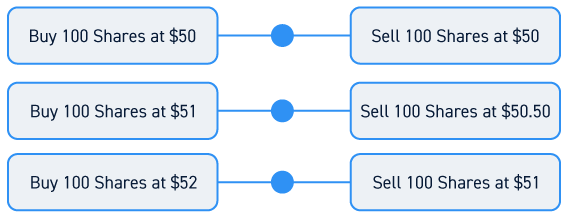

ECNs work by automatically matching buy and sell orders between traders or brokerage firms in the network. Say, for example, that you want to buy 100 shares of Apple stock. An ECN will automatically match your order with one or more sell orders for Apple stock until your order is completely filled.

ECNs get bid and ask quotes from every order entering the network, and orders are automatically fulfilled at the best possible prices. The result is that bid-ask spreads through ECNs are typically lower than those available from market makers, which can reduce costs for traders.

However, ECNs are also expensive to operate, and they pass those costs on to traders through access fees. So, trading with an ECN is often more expensive than trading with a market maker but can be made up with execution results.

Pros and Cons of ECNs

ECNs have both benefits and drawbacks.

Pros

- Tighter spreads than market makers. ECNs typically offer tight bid-ask spreads, which can reduce trading costs.

- Fast execution speeds. Since ECNs match orders automatically, they can execute trades more quickly than market makers.

- Enable after-hours trading. ECNs enable traders to buy and sell shares directly outside of market hours.

- Privacy. Traders can participate in ECNs anonymously.

Cons

-

- High access fees. ECNs may charge access fees that can add significantly to the cost of trading.

- Not user-friendly. ECNs often lack integrated charts or user-friendly order entry platforms.

- Market fragmentation. ECNs match orders on their network, and prices on an ECN can drift from those available in the broader market.

Popular ECNs

Some of the most popular ECNs are Instinet, SelectNet, NYSE Arca, EDGA, and EDGX. Instinet was founded in 1969 and is mainly used by institutional traders to facilitate trades on the NASDAQ trades. SelectNet is also primarily used by institutions and market makers. NYSE Arca was founded in 2006 and offers direct trading for most US-listed stocks and ETFs. EDGA and EDGX are both owned by Direct Edge and offer trading for stocks on the NYSE, NASDAQ, and AMEX exchanges.

It’s worth noting that in addition to ECNs, there are also ECN brokers. These are brokers that execute trades using ECNs, and they often operate across multiple ECNs to get the best prices for clients.

ECNs vs. Market Makers

ECNs and market makers are the two primary methods by which financial transactions in stocks and forex are facilitated. Both play an important role in keeping financial markets liquid.

ECNs connect traders directly, while market makers act as intermediaries. When you buy or sell a stock on an ECN, your order is fulfilled from corresponding orders placed by other traders. When you buy or sell a stock through a market maker, the market maker acts as the counterparty for your trade.

Typically, ECNs make money primarily through access fees. They don’t set bid-ask spreads, but rather charge spreads based on the orders available on the network. Market makers set their own spreads and make money primarily through those spreads. So, market makers often charge higher spreads for a given stock or currency pair than you can find at ECNs, although trading with an ECN is not necessarily cheaper overall.

Conclusion

ECNs are electronic networks that match buy and sell orders between traders for execution. Compared to market makers, ECNs often offer tighter spreads and faster execution speeds. They also enable after-hours trading. However, ECNs typically charge access fees and they are typically more complex to use than trading platforms that rely on market makers for execution.