The question of how powerful your trading computer should be tends to arise often. It only makes sense that your hardware should be capable of providing charts with indicators as well as execute trades simultaneously. How much computing power you need for day trading depends on many factors as well as your own commitment to success and longevity in this endeavor. The costs can range from a few hundred to several thousands depending on your style of trading and experience.

Do You Need a Special Computer for Day Trading?

Before we dive into the specific of building a trading computer, let’s address a prerequisite. Do you need a special computer for day trading?

The short answer is no. A “day trading computer” is not a special type of computer for day traders. It is simply a computer that has the necessary hardware to keep up with a trader’s software.

A trading computer is a tool to trade, and it should at the very least keep up with you. The main goal of a trading computer is to help you execute your strategy better. As you gain more experience and seasoning, you can upgrade the performance, trading platforms and more monitors in time.

Considerations When Building a Trading Computer

If you’re going to build and customize a trading computer, then there are many considerations to keep in mind. Here are some of the key factors to decide upon before making purchases:

Windows vs. Mac

Choosing between a Windows-based PC or a Mac OS based PC is the first consideration. While Apple computers have come a long way in gaining market share to most areas of computing, trading platforms and programs are still dominant on Windows PCs. Perhaps its tradition but most stand alone trading platforms and direct access broker platforms prefer a Windows PC.

If you are a diehard Mac fan, then it’s possible to use a MAC with a Windows emulator if your brokerage platform only works on Windows (i.e. Bootcamp or Parallels).

Most trading software is Windows-only, so think carefully if you opt to go with a Mac. The exception is web-based and cloud-based brokerage platforms that may be operating system neutral, but these tend to be generic and lack direct access for serious day trading execution.

Laptop vs. Desktop

The question of whether to go with a laptop or a desktop computer relies on how much trading you will be doing. Swing traders that travel often may consider using a laptop. Day traders will require more screen real estate than just a single laptop.

The name of the game is monitoring and tracking set-ups and triggers to execute. For most this is only be possible with multiple monitors on a desktop computer.

While some laptops are very powerful, even a 17-inch screen isn’t enough to have both your execution platform and charting together. Laptops are great as a temporary mobile trading solution, but your main trading activity should be done on a desktop.

Desktop Specs for Trading Computers

Desktops can run the gamut of performance and pricing. In the beginning, you will want to get at least the minimum specifications to start trading. Here are the key specs to consider:

Hard Drive (SSD): You should consider an SSD hard drive for optimal speed. Legacy hard drives (HDD) are clunky and more prone to stalling out the computer either with charts or background activities especially on Windows. You won’t be storing a lot of data on the hard drive if used solely for day trading so an SSD 250 GB or higher will typically suffice.

RAM: This is key to performance when utilizing lots of charts and indicators. The higher your RAM, the more charts and quotes you can watch. A day trading computer should have at least 8 GB of RAM. It’s a good idea to max out the RAM as much as possible as you will notice a material difference especially when operating on multiple monitors.

CPU: This is the brains of your computer. While CPUs continue to increase in speed as costs come down, the bare minimum to consider is a quad core 2.8 GHz 64 bit processor. This should enable your system to work with the latest operating systems. Having multiple cores enables your charting and number crunching to perform quicker. It’s also important to check the number of slots on the motherboard to have the option to expand your ram and graphic cards as your trading sophistication grows.

Graphics Card: Since this isn’t a gaming computer, the only graphics you will be using are charts and platforms. The most important factor is the ability to connect multiple monitors on your graphics card(s). Make sure to choose a graphics card that can accommodate the number of monitors you plan to use and the resolution of those monitors (i.e. 4K monitors).

Operating System: As reviewed earlier, Windows is the preferred operating system for day trading since most trading software will only run Windows. If you still prefer Mac, then there are work arounds like using Boot Camp in Macs that have Intel chips. Windows 11 can be installed on MACs is using Parallels to emulate a virtual TPM chip. Simply put, a Windows PC is the easiest way to run trading and charting software.

Monitors

Screen real estate is critical for day traders. Having the ability to have many charts and feeds available in front of you can improve your efficiency as a day trader. However, having too much going on can spread you too thin and also make you susceptible to fear of losing out (FOMO). As a rule of thumb, you can always add more monitors as you get acclimated (as long as your graphics cards can support them).

How Many Monitors Do You Need?

In the beginning, it’s preferrable to have a separate monitor for your brokerage execution platform and a separate one for charts and data feeds. Keeping them separated helps to keep your focus between monitoring and executing trades on stocks.

As you gain more experience and proficiency, you can begin to expand the number of monitors as needed provided you have the space at home or office. You can opt to allocate a number of charts grouped in sectors by monitor or any variation. It’s best to slowly add screens as you improve your trading performance and expand your attention capacity. Ultimately, it becomes a personal preference based on your style of trading. Keep in mind, you want to be between having too many screens or too few screens. Aim for what is optimal for you.

What Size Monitors Should You Get?

This is a matter of personal preference and the physical space you have available for your day trading computer set-up. Monitors can be mixed between sizes and resolutions for optimal use.

Beginner to Pro Monitor Set-Up

A beginner set-up would consist of 2-3 medium-sized 24” to 27” monitors in landscape mode. An intermediate set-up could consist of 3-5 medium sized monitors in portrait mode or 2 large 43” to 55” monitors for a seasoned pro day trading set-up.

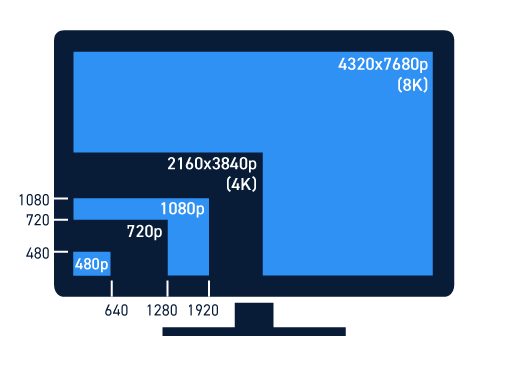

Screen Resolution

The screen resolution makes a large difference as well. A 4K screen can be the equivalent of more than two 1080P screens. This depends on how much physical space you have and your vision. If you have to squint hard to see quotes, then it’s not worth getting an ultra-high definition screen. Keep in mind that 4K has more pixels resulting in more screen real estate to place more charts and programs. The 4K is preferred for larger sized monitors to maximize the physical space with screen space without having to zoom in.