Investors can hold onto long positions for years or even decades without running into problems. But most short positions are much shorter in duration – a few months to a few years at most.

There are several practical limitations that limit how much time traders can short a stock for. In this article, we’ll explain how long you can hold a short position.

What is Short Selling?

Short selling is a type of trading in which traders bet that the price of a stock will go down. When traders short sell a stock, they make money if the price of the stock drops and lose money if the price of the stock goes up.

How Short Selling Works

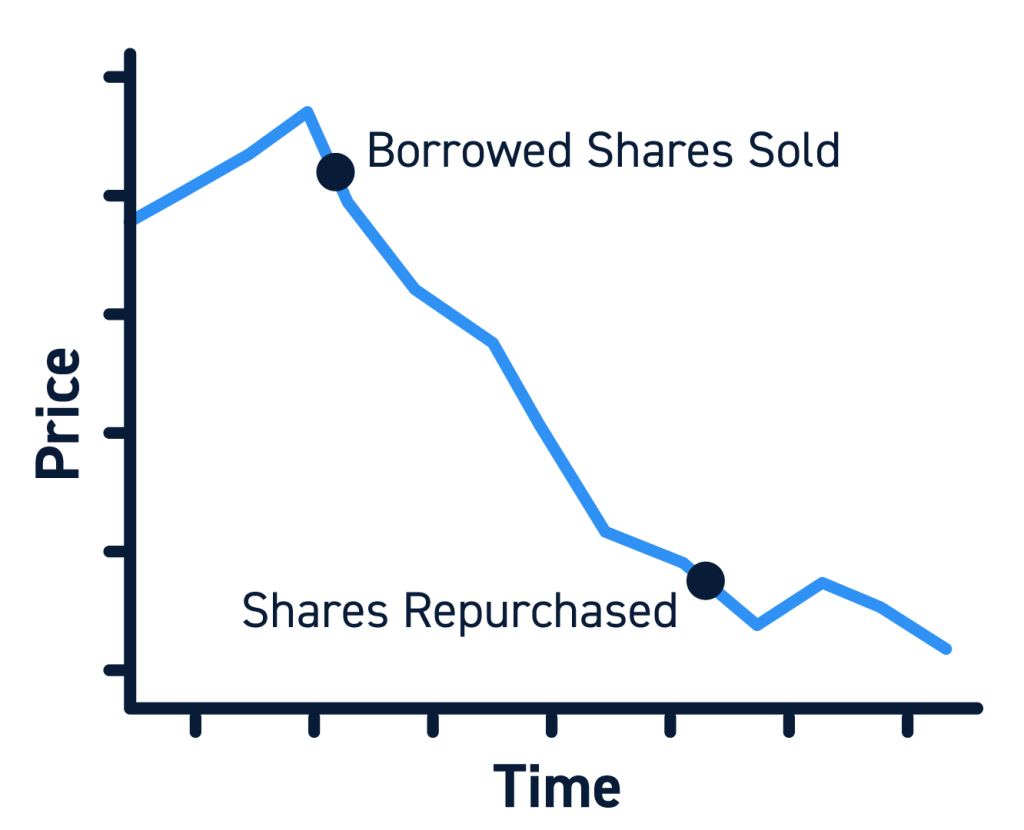

Short selling works somewhat differently from buying shares of a stock. When a trader wants to short a stock, they first borrow shares from their brokerage firm. The broker typically charges a fee (short interest) each day the shares are borrowed.

The trader sells the borrowed shares at the current market price, then waits for the price to go down. When it does, they can repurchase shares at a lower price and return the shares they borrowed to their broker. This is called covering a short and it closes the trade.

Importantly, traders are still responsible for covering their short even if the price of the stock goes up, not down. In this case, short sellers lose money because they have to pay more to buy shares and cover their short than they sold the borrowed shares for.

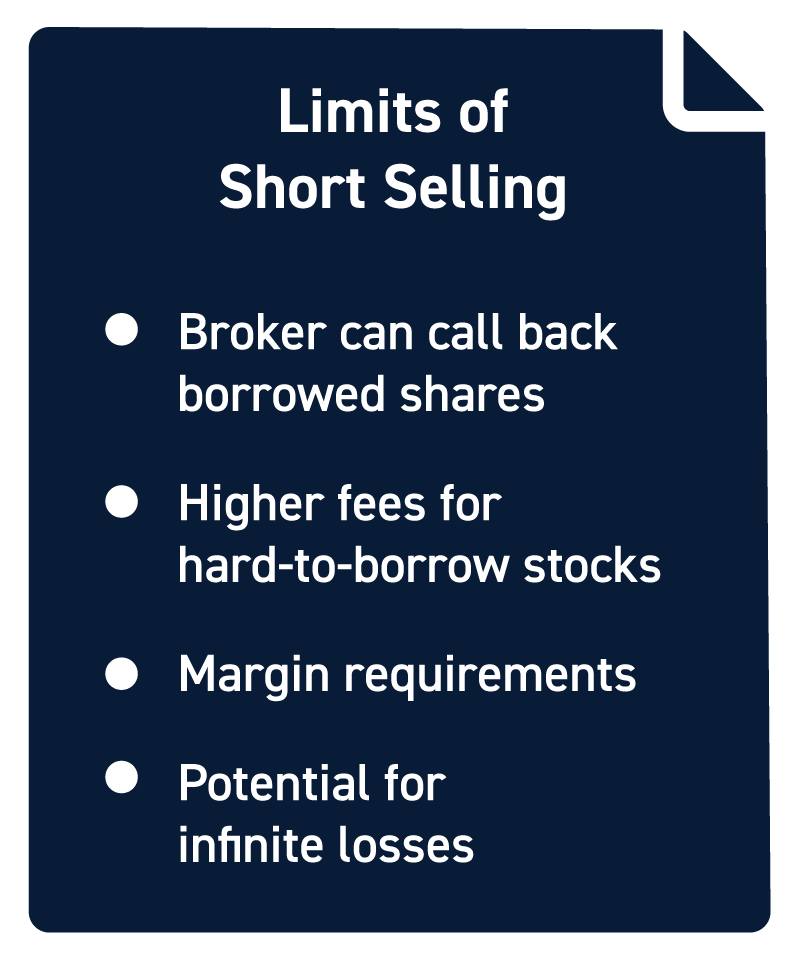

Short sellers need to be aware of a few critical details. First, borrowed stocks can be called back by a brokerage firm at any time. Once they’re called back, you may not have much time to cover your short and could be forced to take a loss. In any case, borrowed shares always need to be returned eventually.

Another thing to keep in mind is that your ability to short sell a stock depends on whether your broker can lend you the shares. Highly volatile or in-demand stocks may not be available for lending. Some brokers have a hard-to-borrow list that indicates which stocks may not be available to sell short.

How Long Can You Hold a Short Position?

There’s no specific time limit on how long you can hold a short position. In theory, you can keep a short position open as long as you continue to meet your margin requirements.

However, in practice, your short position can only remain open as long as your broker doesn’t call back the shares.

Limits on Holding Short Positions

The main limitation on holding long-term short positions is that your broker can call back the borrowed shares.

Stocks that are easy to borrow can typically held for a long time without being called back. These are stocks that brokers hold a lot of shares of, that rarely experience high volatility, and that aren’t in high demand among short sellers. As an example, Apple and Amazon shares are generally easy to borrow and the chances of a short position on these stocks being called back is low.

Hard-to-borrow stocks or stocks that require a locate request (which confirms shares are available to borrow) are more likely to be called back sooner. Hard-to-borrow stocks also have higher borrowing fees, which can make it costly for traders to hold these positions for more than a few weeks or months at a time. In general, hard-to-borrow stocks are sold short only for brief periods when a stock is most volatile.

Another thing to keep in mind is that to keep a short position open, you must continue to meet margin requirements for your position. Margin requirements can change quickly if a stock experiences high volatility.

Moreover, since borrowed shares must always be returned eventually, short selling can lead to theoretically infinite losses as the price of a stock rises. Brokers use margin calls to prevent this from happening. For example, if you have a $10,000 short position in an account with only $12,000, your broker may issue a margin call or call back your shares if the price of the underlying stock rises by 50% over a brief period.

Conclusion

At least in theory, you can keep a short position open for as long as you continue to meet the position’s margin requirements. However, in practice, your ability to keep a short position open is determined by whether or not your broker calls back the borrowed shares at some point. Short positions on easy-to-borrow stocks may be held for many years, while short positions on hard-to-borrow stocks can span only days, weeks or months at a time.