The ability to borrow stocks is essential for short selling. The process of borrowing a stock is distinct from the process of buying a stock and depends heavily on your brokerage. In this article, we’ll take a closer look at how borrowing stocks works.

Why Traders Borrow Stocks

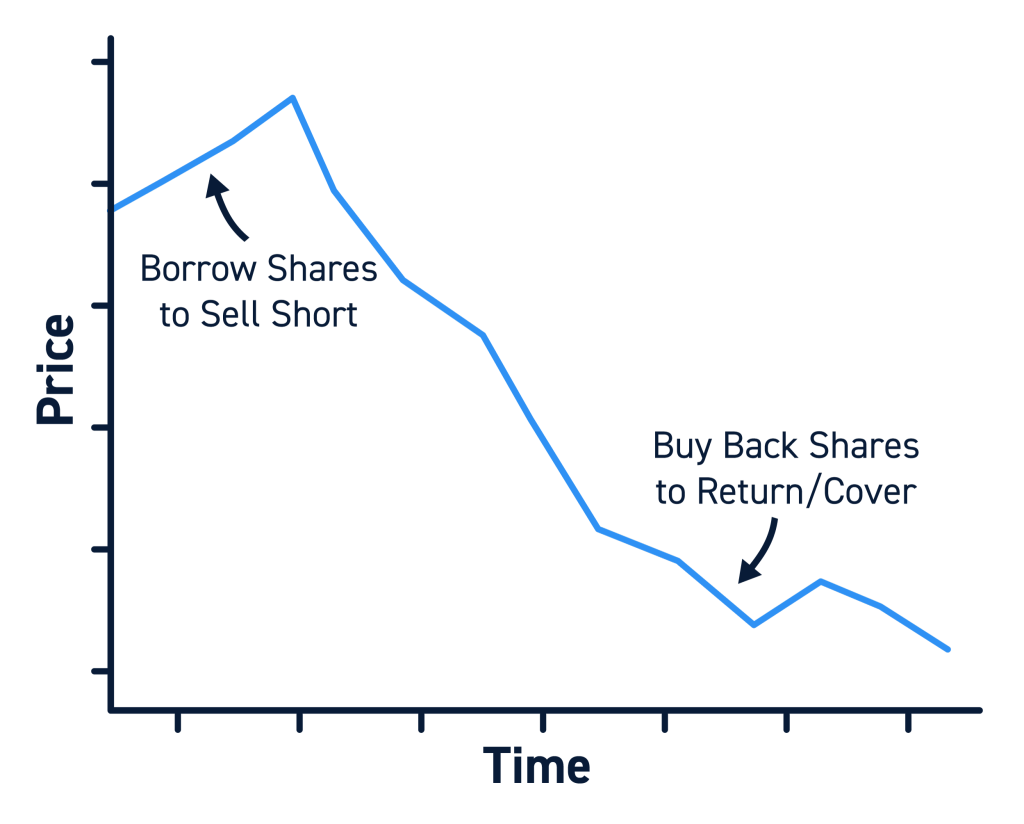

Traders typically borrow stocks in order to short sell the stock. This is a way to make money when the price of a stock falls.

When short selling, a trader borrows shares of a stock from their broker and then sells them immediately. Then, if the price of the stock falls, the trader can buy back shares at a lower price and return them to their broker. The difference between the price the trader initially sold the shares for and the price they repurchased the shares for is their profit.

What Does it Mean to Borrow a Stock?

Borrowing shares of a stock works a lot like any other type of borrowing. You’re on the hook to pay back what you borrowed and you have to pay interest for the privilege of borrowing.

In the case of borrowed stocks, paying back what you borrowed means that you have to give back the shares at some point in the future. If you borrow shares to sell them short, you have to buy the same number of shares back. Buying back shares to close a short position is known as covering.

Brokers also charge interest, known as a borrow fee, for borrowing shares. This interest is usually charged on a daily basis for as long as your short position remains open. The borrow fee that your broker charges can vary from one stock to another.

How Do You Borrow Stocks?

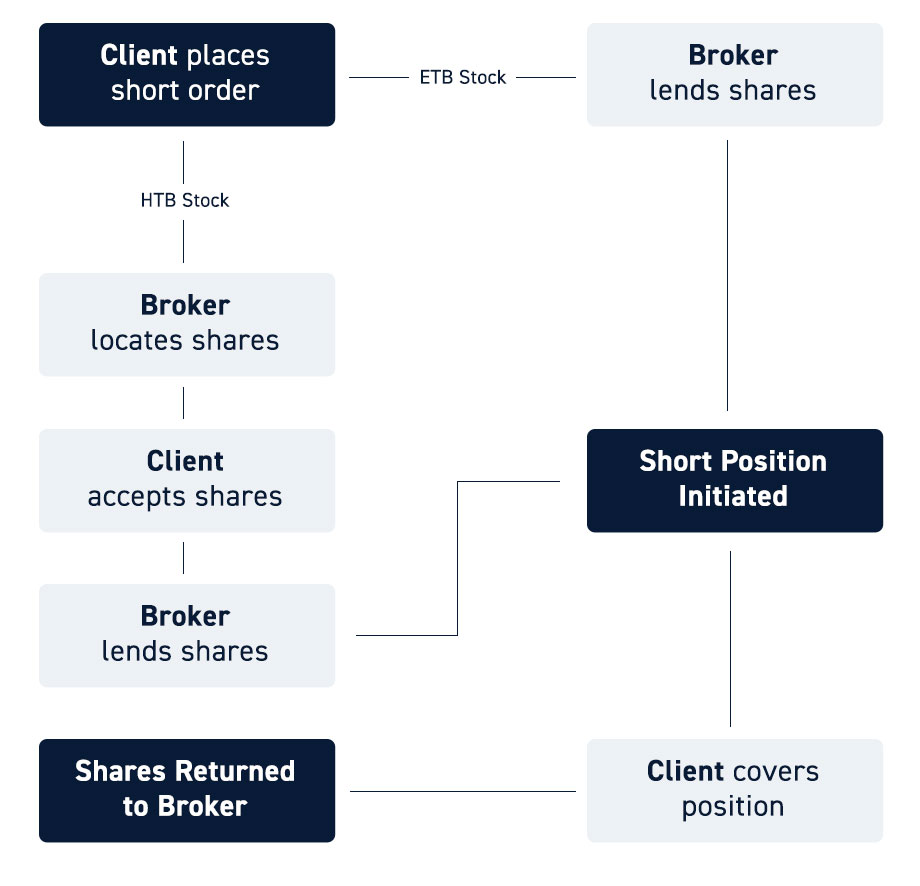

The process of borrowing stocks to open a short position differs from broker to broker. In some cases, all you have to do is enter a short order with your brokerage. If available they will lend you the shares and automatically sell them at the current market price.

Note that in order to borrow and short stocks, you must have a margin trading account with your broker. As long as your short trade is open, you’ll need to have enough cash in your account to meet your broker’s margin requirements.

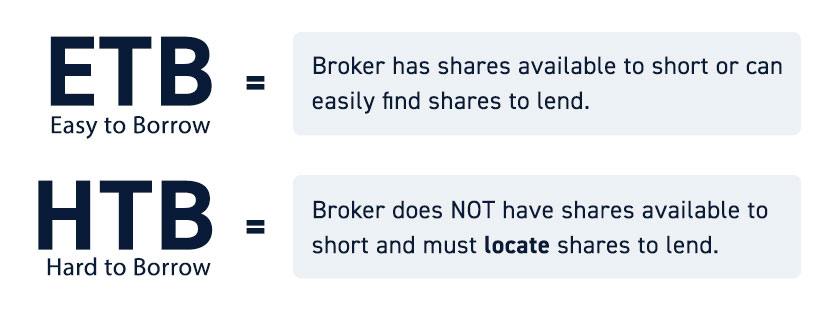

There is one wrinkle to borrowing stocks: not all stocks are equally available to borrow. That can lead to differences in how simple it is short a stock and how much it costs.

Easy-to-borrow Stocks

Easy-to-borrow stocks are stocks that are readily available for borrowing and short selling. Your broker may have a lot of shares of the stock available to borrow and the stock isn’t in high demand for short selling. Easy-to-borrow stocks typically come with the lowest borrow fees.

Hard-to-borrow Stocks

Hard-to-borrow stocks are stocks for which your broker may only have a small number of shares available or no shares at all. Stocks may be hard to borrow because they have low liquidity or are in high demand among short sellers.

Borrowing hard-to-borrow stocks may require a broker that specializes in short selling. These brokers offer a service known as a “locate.” When you make a locate request, you’re asking your broker to find the shares you want to borrow from another source, such as a different broker or firm.

Locates generally incur an additional fee on a per-share basis. For example, it may cost $0.10/share to borrow shares of a hard-to-borrow stock that requires a locate request.

If your broker can locate shares and you pay the locate request fee, you can then borrow and short them. Hard-to-borrow stocks usually come with higher borrow fees on top of the locate fees.

These stocks may also get called back faster than easy-to-borrow stocks, which is important to keep in mind before placing a trade.

How Long Can You Borrow Stocks For?

How long you can borrow stocks for depends to a large extent on whether they are easy-to-borrow or hard-to-borrow stocks. In general, you can borrow stocks for an unlimited amount of time as long as you continue to meet your broker’s margin requirements and your shares are not called back.

For easy-to-borrow stocks, there’s relatively little risk that your shares will be called back (as long as you meet the margin requirements). So, you may be able to keep a short position open for months or years.

For hard-to-borrow stocks, it’s possible that your broker calls back the borrowed shares sooner. Once the shares are called back, you have to close your short position and return them.

Conclusion

Traders typically borrow stocks in order to sell them short. Sometimes you can borrow a stock simply by entering a short sale order with your brokerage, although you may need to make a locate request if you want to short hard-to-borrow stocks.

You have to pay borrow fees while your short position is open as well as continue to meet your broker’s margin requirements. At the end of your trade, you must buy back the borrowed shares and return them to your broker.