Electronic communications networks (ECNs) are electronic limit books that match up buyers and sellers while bypassing middlemen and market makers. Many of the earliest and largest ECNs have expanded and evolved into Alternative Trading Systems (ATS) that operate like their own financial market exchange.

ECNs can be accessed through a direct market access (DMA) broker trading platform. These specialized platforms enable traders to route orders directly to their preferred ECNs with the best liquidity and pricing at that moment. Liquidity is the name of the game. The ECNs are willing to incentivize liquidity providers with passthrough commission rebates.

How Order Routing Works

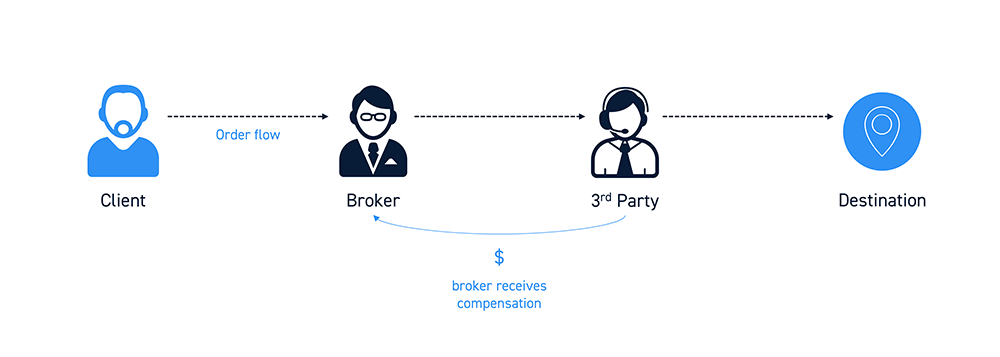

When it comes to executing your buy and sell orders, your broker acts as the facilitator. You either have the choice to select how your order gets routed with a DMA broker or no choice with a retail brokerage.

Retail brokers receive payment for routing the orders to a preferred market maker or liquidity provider under prearranged order flow agreements.

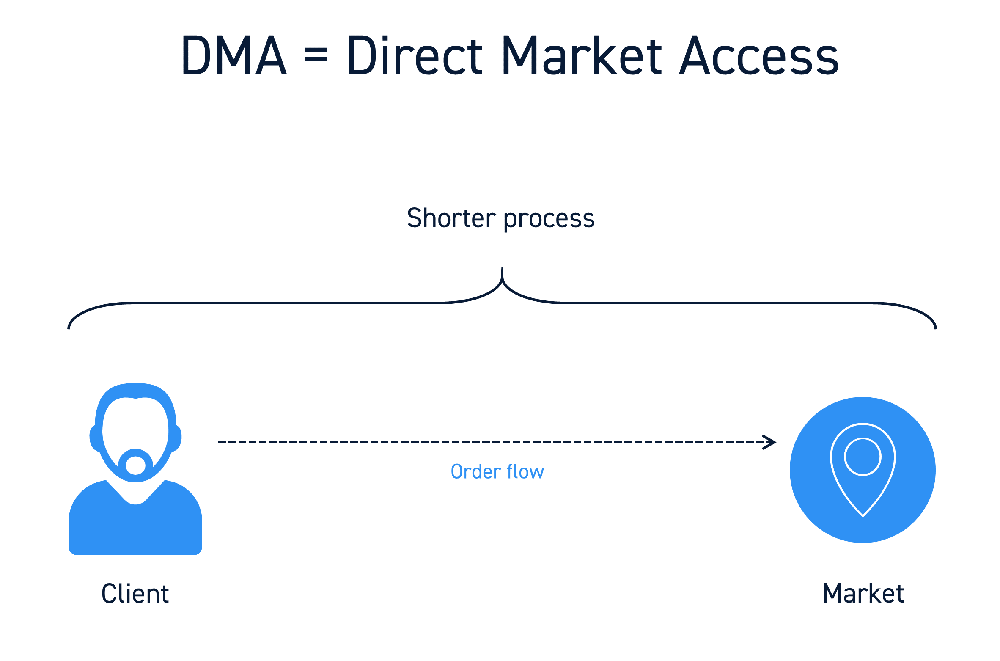

DMA brokers default orders to a smart routing algorithm with complete access for traders choose their own routing to ECNs, ATS, exchanges or market makers. DMA brokers place the control and transparency in the trader’s hands.

Order flow arrangements incentivize retail brokers to funnel their customer trade orders to preferred liquidity providers. While not illegal, prior abusive practices in the past have resulted in regulatory disclosure requirements of payment for order flow arrangements. This practice is prevalent with almost all retail brokers and fintech trading apps especially if they offer zero-commission trades. Typical retail investors are either oblivious or apathetic to these practices.

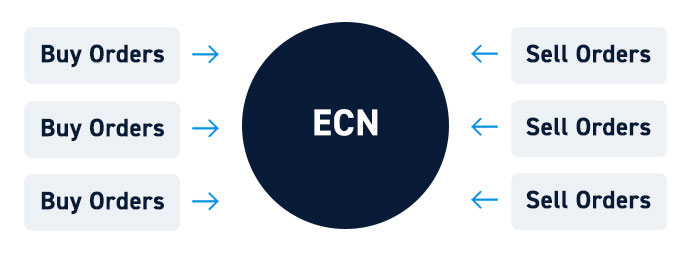

What Is An ECN?

ECN’s are virtual liquidity exchanges operating electronic order books that enable buyers and sellers to conduct trading activities without meddling from middlemen. Think of an ECN as a marketplace that involves minimal interference from intermediaries. If a buyer wants to buy 1000 shares of XYZ at $5 and a seller wants to sell 1000 shares at $5, the orders are matched up at the ECN. There is no need for a third-party to look for liquidity.

Every ECN displays the NBBO and posts executed trade as required by regulators. Traders can view the depth of prices and liquidity using a level 2 screen on their trading platform.

ECNs enable directly routed orders to match up against relevant orders for execution. The speed of fills is instantaneous and consistently quicker than fills with a market maker. ECN rely on having the most liquidity available for stocks. They incentivize liquidity providers with ECN rebates while charging liquidity takes a passthrough fee similar to a toll operator.

What Is Liquidity?

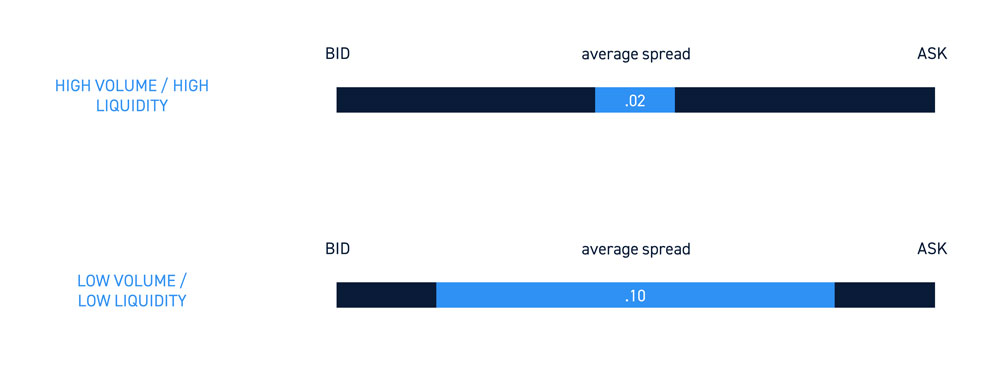

Liquidity is the ready availability of shares to buy or sell, an abundance of supply ready to meet or exceed demand.

Heavy liquidity results in tight bid and ask spreads of $0.01. Thinner liquidity indicates less availability of shares resulting in wider bid/ask spreads.

Rather than having market makers, ECNs expect market participants to provide liquidity as a “maker” and/or take liquidity as a ”taker”. These roles are aptly named. Participants add liquidity when they place limit orders to buy on the bid or sell on the ask. Traders take liquidity if they buy on the ask and sell on the bid.

ECNs charge a toll called a passthrough fee to takers. However, they also provide rebates for participants that provide liquidity. The fees and rebates are applied automatically upon execution.

ECN Rebates

The ECN fees and rebates are applied automatically upon execution. It’s prudent to check with your broker on their policy for ECN rebates. Most retail brokers will pocket the rebates as they can determine policies. DMA brokers typically allow traders to earn a portion of the rebates when they sell shares on the ask and buy shares on the bid.

Executing trades by routing orders directly to the ECN of choice automatically triggers the fees and ECN rebates. ECN fees vary based on their popularity and liquidity. Fees are higher than the rebates, which enables the ECN to pocket the difference.

Considerations

It’s always prudent to stay on top of the ECN rebate policies and schedules as determined by your broker. Commission-free and zero-commissions brokers often don’t allow ECN access and instead hand your orders to middlemen under prearranged payment for order flow agreements. This can result in having high-frequency trading programs take the other side of your trades.

While the ECN rebates are an incentive, be aware that your limit orders may not get filled if there is too much liquidity. Earning ECN rebates requires patience and a good knowledge of technical analysis to place limits in a timely manner at the right price inflection points. Often times, a trade may require taking liquidity on the entry but being able to step in from the momentum long enough to provider liquidity on the exits (IE: selling into the buyers or covering into sellers).