Understanding Routes

A route is a path an order takes to get to the market. When you hit the “buy” or “sell” button, your order follows a specific path before arriving at the market where it is matched with other buyers and sellers.

The concept of routing is new to many traders since most brokers have limited (if any) routing options. You simply enter your order and wait for it to get filled. You may not even think about what’s going on behind the scenes.

While routing may be an afterthought to some traders, it can actually have a noticeable impact on your execution speeds, fill prices, and trading fees.

Let’s use a real-world analogy to demystify the process.

You plan on visiting a friend across town to watch the big game on Sunday. You want to get there as quickly as possible to minimize travel time, get first access to snacks, and ensure you don’t miss a second of the big game. There are dozens of combinations of side streets and highways you can take to get there, but you only care about the most efficient. You are not looking for just any path, you are looking for the best one.

The same is true in trading. Traders can use different routes to improve efficiency, speed, and cost-savings.

What You Need to Know

A route is a path your order takes to get to the market. This path can have a noticeable impact on order execution speeds, fill prices, and trading fees.

Types of Routes

There are three main types of routes to be aware of.

Market makers are firms or individuals responsible for providing liquidity and matching orders.

Smart routes are routes that are programmed to achieve the best fills in specific scenarios.

Different routes may be chosen based on your objective (i.e. fastest execution vs. lowest trading fees) or time of day (i.e. pre-market, market hours, and after hours).

Routing Fees

Routes have fees that are charged on a per-share basis.

There are generally two pricing options associated with each route: one for adding liquidity and one for taking liquidity.

Taking liquidity means buying on the ask or selling on the bid.

Generally, taking liquidity is more expensive than adding liquidity. Certain routes will even reward adding liquidity by offering a rebate.

ECN rebates allow you to get credited instead of charged for using a route (when adding liquidity.

Routing Fee Example

Assume a route has a 0.002/share rebate for adding liquidity and a 0.0032/share fee for taking liquidity. Here is a fee comparison for a 1,000 share order.

Taking liquidity: $3.20 Fee

Common Questions About Routes

Below are some of the most common questions related to routing. You can also check out our in-depth routing guide to learn more.

How do I choose my routes?

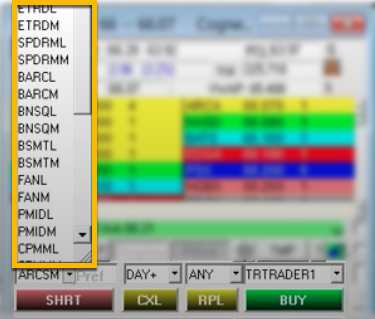

You can select your preferred route when placing an order from within the trading platform. There is a route dropdown selector within the order entry section of the level 2 window.

What are the benefits of choosing your own routes?

Choosing your routes gives you more control over your trading. Every route has its own unique advantage and every trader has their own unique preferences.

Choosing your own routes can help improve execution speed, fill rates, fill prices, and trading fees.

How should I choose my routes?

Choose your route with your primary objective in mind. Are you looking for the fastest execution, the best liquidity, or the most cost-effective option (i.e. rebates)?

You can find descriptions of each route on the table below (under routing options)

You may also experiment with different routes to see which ones are most suitable for your personal trading style.

Which routes should I use if I don’t have a preference?

Some traders have very specific routing preferences and others don’t.

If you don’t have a preference, you can stick with the default route when you place an order through the platform.

How do I execute orders outside of market hours?

You must select a route that has a start time available for outside of market hours trading (listed below).

How do I know if a route offers a rebate?

A full list of routes and fees/rebates can be found on the routes page.