Basics of Margin Trading

When you are trading with margin, you have the ability to leverage your capital (4-to-1 intraday and 2-to-1 overnight). This leverage is a helpful tool when used properly, but there are also associated risks. When you use leverage, your risk exposure is amplified. For example, if your account is leveraged 4-to-1, it only takes a 25% move to wipe out all of your capital.

Accordingly, we take certain precautions to keep you and your capital safe.

Concentration Limits

Concentration limits focus on limiting buying power on a particular symbol (intraday), rather than reducing overall account buying power with increased margin requirements. Please see here for detailed examples and FAQs regarding our concentration limits.

Margin Maintenance Requirements

The use of margin and engaging in day trading requires you to monitor your positions, leverage, and equity % levels closely. Please be mindful at all times of your position risk in your account and/or market volatility.

We generally consider equity levels at 40% or below to be at heightened risk, especially if there is only one position in the account. If your equity level falls below 40%, your positions may be liquidated in an amount that will return your equity level to 40% or higher without notice. In instances of high volatility, you may be subject to full liquidation at the discretion of our risk department.

This notice is in accordance with the Margin Disclosure Statement provided upon opening your account. We would like to remind you about some of the risks involved with margin account trading, which include but are not limited to:

The firm can force the closure/exit of any positions or assets without contacting you.

You are not entitled to choose which securities or assets in your account are liquidated to meet a margin call or risk situation.

The firm can change its house maintenance margin requirements at any time and we are not required to provide you an advance written notice.

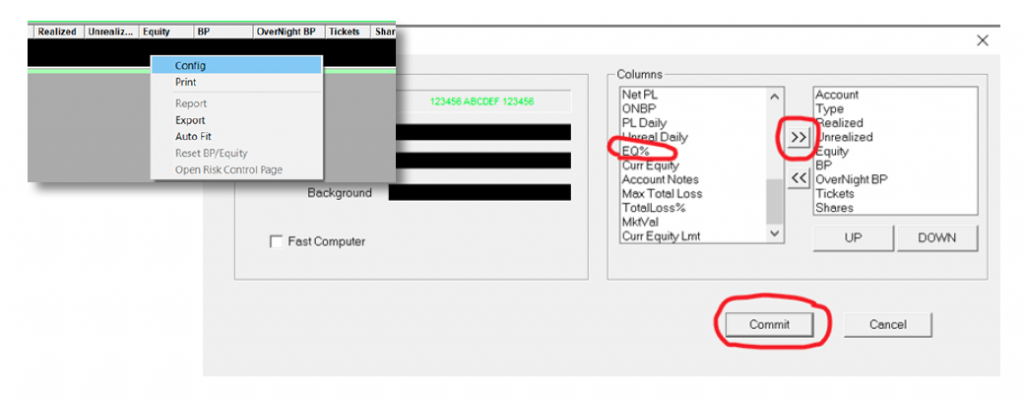

In order to add the equity percentage column to your DAS Account Window, please follow the instructions below:

Right click in an unpopulated space on Account Window Select Config Add “EQ%” to your active columns Click Commit

Risk Management Best Practices

The best way to avoid finding yourself in a precarious position is to take a proactive approach to risk management. Below are a few best practices to keep in mind.

Do Not Trade With Money You Cannot Afford to Lose

Trading is risky by nature. Do not risk your livelihood by exposing necessary capital to the market.

Avoid Unfamiliar Territory

Trading risk is heightened when you venture into the unknown. If you are not comfortable with a particular trading setup or style, avoid it.

Be Cautious With Leverage

Leverage is a tool, and like all tools, it must be used properly. Leverage should be used to diversify risk, not to increase risk in a single investment.

Understand the Heightened Risk of Short Selling

Short positions have theoretically infinite risk. While a long position can only lose 100% of its initial investment, short positions have no risk ceiling.

Limit Your Per-Trade Risk Exposure

Be cautious of going “all-in” on any position, especially when using leverage..

Cut Losses Early

“Cut losses early” is the most cliche trading advice for a reason – it works.

Common Risk Management Questions

Below are answers to some of the most common questions about risk management.

What can trigger a margin call?

A margin call occurs when the market value of securities in the trader’s margin account has fallen to the point that the trader’s equity (the cash value in your account)) does not meet the established minimum percentage requirement (Click here for Clear Street minimum margin requirements). If the trader does not deposit the required funds, liquidate enough securities, or in some cases, have enough appreciation in the account, CenterPoint’s credit desk will sell a certain number of securities sufficient to bring the account back to the minimum margin requirement.

How do I avoid a margin call?

To avoid margin calls, a trader must always make sure that the amount of equity in the account is enough to sustain the amount of leverage/margin of the entire market value of the position. The Clear Street minimum margin requirements will be different for long and short positions.

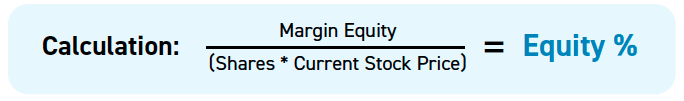

What is my equity percentage and how do I track it?

You can monitor your equity percentage in the DAS Trader platform.

Right click in an unpopulated space on Account Window Select Config Add “EQ%” to your active columns Click Commit

How much leverage do I have?

CenterPoint traders have 4-to-1 intraday leverage and 2-to-1 overnight leverage.

What happens if my account falls below $25,000?

If your account falls below $25,000, you will not have buying power until the account is back over $25,000.

Where can I find my buying power?

Your buying power will be listed in your trading platform in the account monitor window as well as the client portal.