Celebrating Over 10 Years as a Leading Broker for Active Traders

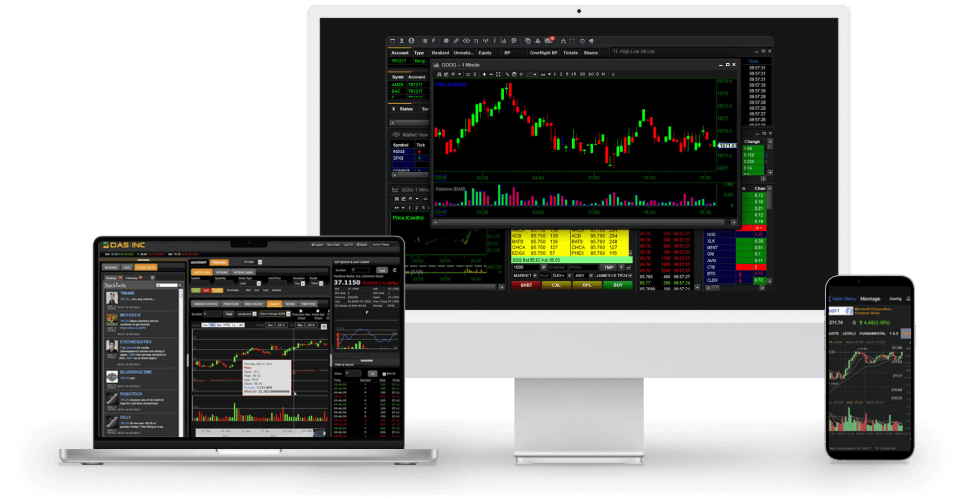

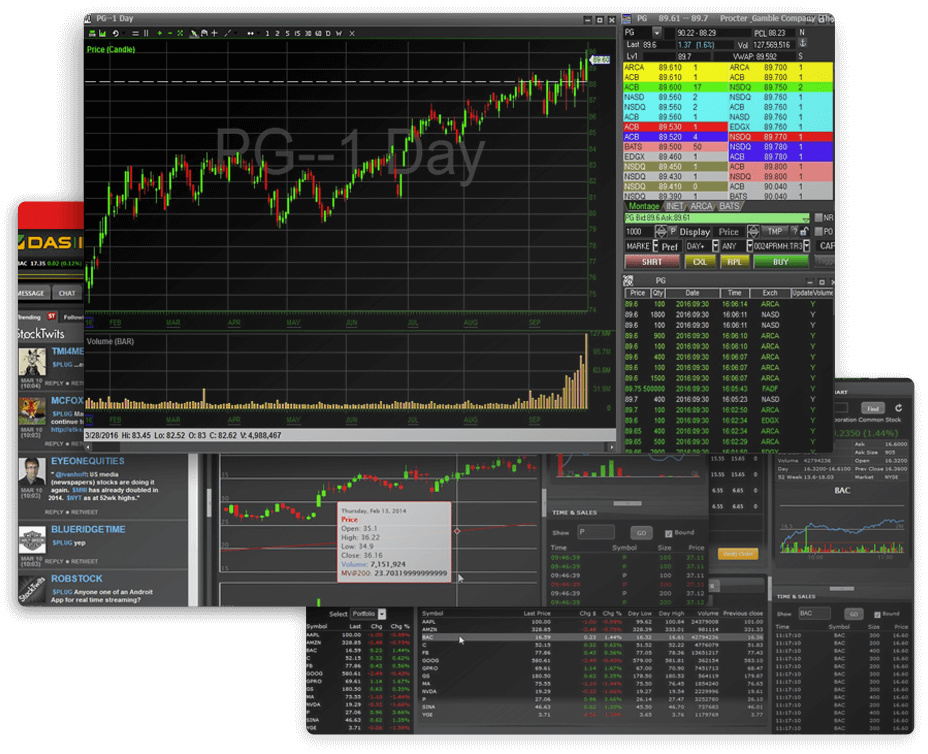

Technology

State-of-the-art day trading platform built for speed and power.

- Fast and Reliable

- Real-Time Data

- Advanced Charting

- Streaming Level 2

- Rapid Order Executions

- Advanced Trading Tools

- Advanced Order Types

- Built-In Scanners

- Hot Keys

- Support You Can Count On

Free Access to Trading

Tools & Software

Up to $7,500 in Annual Value!

All CenterPoint clients are eligible for free access to innovative technology designed to give traders an edge in the markets.

Charges will never apply. However, accounts trading less than 100,000 shares/mo are subject to having access revoked.

Industry-Leading Short Inventory & Locates

Our clearing firm offers an extensive easy to borrow list and has an industry leading securities lending team with decades of experience. This further places CenterPoint as a top competitive choice for traders who rely on shorting as a major part of their trading strategy. Never miss a trade…

- Extensive Easy-to-Borrow List

- In-House Securities Lending Team

- Locate Discounts Up to 30%

- Integrated Locate System (In-Platform)

Direct Market Access

CenterPoint Securities offers sponsored Direct Market Access (DMA) routes that give you control over your order flow.

Faster Order Executions

DMA gives traders the rapid order executions they demand. Orders skip the delays of standard retail executions.

Improved Fills

DMA gives traders control over order flow, resulting in improved execution rates, faster fills, and better fill prices.

Multiple Routing Options

Get access to over 30 routing options. Route directly to market makers and ECN’s or choose one of our smart routes.

Why Traders Choose CenterPoint

Direct Market Access Routes

Improved order executions

Short Locates

Powered by our securities lending team

Per-Share Commissions

Efficient for scaling in and out of positions

ECN Rebates

Extensive ETB Lists

Competitive Options Rates

30+ Order Routing Options

Advanced Trading Platform

Tiered Commission Structures

Pre-Market & After Hours Trading

Powerful Mobile Platform

Unparalleled Support

How Does CenterPoint Compare?

| Etrade | Ameritrade | Schwab | IBKR | |

|---|---|---|---|---|---|

| Custom Routing Options | 40+ Routes | <5 | <5 | <5 | <5 |

| Routing Rebates | |||||

| Short Locates Inventory | Extensive | Limited¹ | Limited¹ | ||

| Locate Discounts | Up to 30% | ||||

| DAS Trader Platform | |||||

| Instant Phone Support | |||||

| Direct Email Support | |||||

| Self-clearing | |||||

| Excess Account Insurace | |||||

| Primary Client Base | Active Traders | Investors | Investors | Investors | Traders/Investors |

| Free Trade Ideas Access | |||||

| Free Benzinga Pro Access | |||||

| Free TraderSync Access | |||||

| Free Dilution Tracker Access | |||||

| Free TrendSpider Access | |||||

| Free Kinfo Access | |||||

| Free TraderVue Access |

Data last updated December 16, 2024

¹ Based on 1:1 symbol comparison

Get Started Today!

FREE

Commissions for 60 Days

+ 3 Months of Free Platform Access

+ Lower Account Minimum ($30k)

Enter promo code CPFREE during the account application process.

Frequently Asked Questions

What is the account minimum?

What account types does CenterPoint offer?

Do you accept foreign accounts?

We accept most foreign accounts. Please contact us for details.

Why don’t you offer free commissions?

Do I need a specialized trading broker?

Does CenterPoint enforce the Pattern Day Trader Rule?

Is my trading account insured?

Clear Street is a member of the Securities Investor Protection Corporation (“SIPC”). In the unlikely event of a liquidation of Clear Street, losses of cash or securities in the securities account of each Clear Street customer (within the meaning of the Securities Investor Protection Act of 1970 (“SIPA”)) will be covered by SIPC and the excess SIPC insurance coverage purchased by Clear Street up to the limits described below.

SIPC Coverage. In the event of a bankruptcy of a SIPC covered firm, SIPC is obligated to cover a shortfall in customer assets, on a per customer basis for each customer (within the meaning of the SIPA), up to $500,000 (including up to $250,000 for cash). While SIPC does not protect against a decline in the market value of your securities, customers under SIPA receive preferential treatment in any liquidation and are not general creditors of a failed broker-dealer. A brochure regarding SIPC coverage is available upon request or at www.sipc.org.

Excess SIPC Coverage. In addition to the standard coverage provided by SIPC described above, Clear Street has purchased excess SIPC insurance coverage from Lloyd’s of London to provide additional protection to customer accounts that have a net equity value in excess of $500,000. Lloyd’s carries an A+ rating from S&P and an A rating from A.M. Best. The Lloyd’s excess SIPC insurance purchased by Clear Street covers up to a maximum of $1,900,000 per customer account for cash and $62,500,000 per customer account for securities (in addition to the coverage from SIPC), with an aggregate limit of $250,000,000 for all accounts.

See What CenterPoint Can Do For You

Schedule a Call With an Active Trading Specialist

Promotion Details

- Offer valid for new accounts opened after April 2025 only (cannot be combined with any other promotional offer or discount)

- Offer valid for new clients only

- Discount applies to the base commission rate

- Overnight locate discount is limited to 25,000 shares.

- 60-day promotion begins when the account number is delivered to the client

- CPGOS and LAMPFREE routes are excluded from this promotion. Clients participating in this promotion will not have access to these routes.

- Please review our pricing page to fully understand commissions and fees

- Every client is eligible for 3 months of free access to CenterPoint Edge. After 3 months, Edge benefits will be available to clients who trade over 100,000 shares/month.

- Offer may not be combined with any other promotions